Region:Middle East

Author(s):Shubham

Product Code:KRAC4317

Pages:84

Published On:October 2025

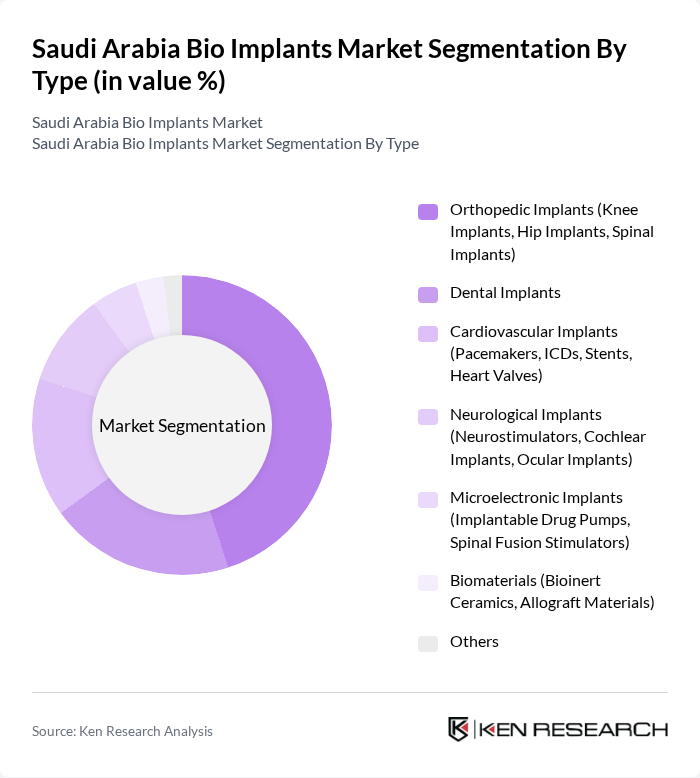

By Type:

The bio implants market can be segmented into various types, including orthopedic implants, dental implants, cardiovascular implants, neurological implants, microelectronic implants, biomaterials, and others. Among these, orthopedic implants, particularly knee and hip implants, dominate the market due to the rising incidence of orthopedic disorders, an aging population, and increased rates of trauma and sports injuries. The increasing preference for minimally invasive surgeries and advancements in implant technology—such as the use of biocompatible materials and 3D printing—further bolster the demand for orthopedic solutions .

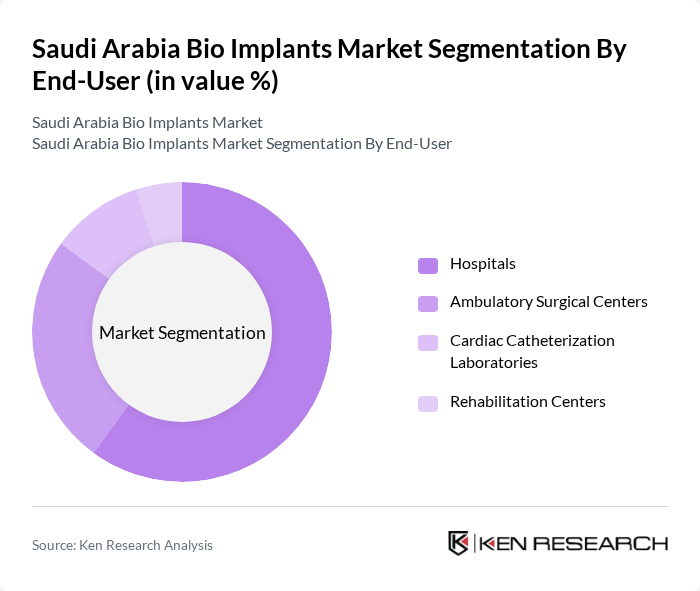

By End-User:

The end-user segmentation includes hospitals, ambulatory surgical centers, cardiac catheterization laboratories, and rehabilitation centers. Hospitals are the leading end-users, driven by the increasing number of surgical procedures, the availability of advanced medical technologies, and the presence of specialized implant centers. The growing trend of outpatient surgeries in ambulatory surgical centers also contributes to the market's expansion, as these facilities offer cost-effective and efficient care. Cardiac catheterization laboratories and rehabilitation centers play a supporting role, particularly for post-operative care and specialized interventions .

The Saudi Arabia Bio Implants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet Holdings Inc., Boston Scientific Corporation, Smith & Nephew PLC, Abbott Laboratories (St. Jude Medical), NuVasive Inc., B. Braun Melsungen AG, Medline Industries LP, Orthofix Medical Inc., ConMed Corporation, Aesculap AG (B. Braun subsidiary), Exactech Inc., Organogenesis Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio implants market in Saudi Arabia appears promising, driven by technological advancements and an increasing focus on personalized medicine. As healthcare infrastructure continues to expand, the integration of artificial intelligence in surgical procedures is expected to enhance precision and outcomes. Furthermore, the growing trend towards outpatient surgeries will likely increase the demand for bio implants, as patients seek less invasive options that facilitate quicker recovery times and reduced hospital stays.

| Segment | Sub-Segments |

|---|---|

| By Type | Orthopedic Implants (Knee Implants, Hip Implants, Spinal Implants) Dental Implants Cardiovascular Implants (Pacemakers, ICDs, Stents, Heart Valves) Neurological Implants (Neurostimulators, Cochlear Implants, Ocular Implants) Microelectronic Implants (Implantable Drug Pumps, Spinal Fusion Stimulators) Biomaterials (Bioinert Ceramics, Allograft Materials) Others |

| By End-User | Hospitals Ambulatory Surgical Centers Cardiac Catheterization Laboratories Rehabilitation Centers |

| By Application | Orthopedic Surgery (Total Knee Replacement, Partial Knee Replacement, Revision Knee Replacement) Dental Surgery Cardiovascular Surgery (Arrhythmias, Myocardial Ischemia, Acute Myocardial Infarction, Heart Failure) Neurological Surgery |

| By Distribution Channel | Direct Sales Authorized Distributors Online Sales |

| By Material Type | Metal Implants (Titanium, Stainless Steel) Polymer Implants Ceramic Implants (Alumina, Zirconia) |

| By Price Range | Low Price Mid Price High Price |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Bio Implants | 120 | Orthopedic Surgeons, Hospital Administrators |

| Dental Bio Implants | 80 | Dentists, Dental Clinic Managers |

| Cardiovascular Bio Implants | 60 | Cardiologists, Cardiac Surgeons |

| Regulatory Compliance in Bio Implants | 50 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Market Trends in Bio Implants | 70 | Healthcare Analysts, Medical Device Researchers |

The Saudi Arabia Bio Implants Market is valued at approximately USD 1.3 billion, driven by factors such as the increasing prevalence of chronic diseases, advancements in medical technology, and a growing aging population.