Region:Middle East

Author(s):Geetanshi

Product Code:KRAB5164

Pages:94

Published On:October 2025

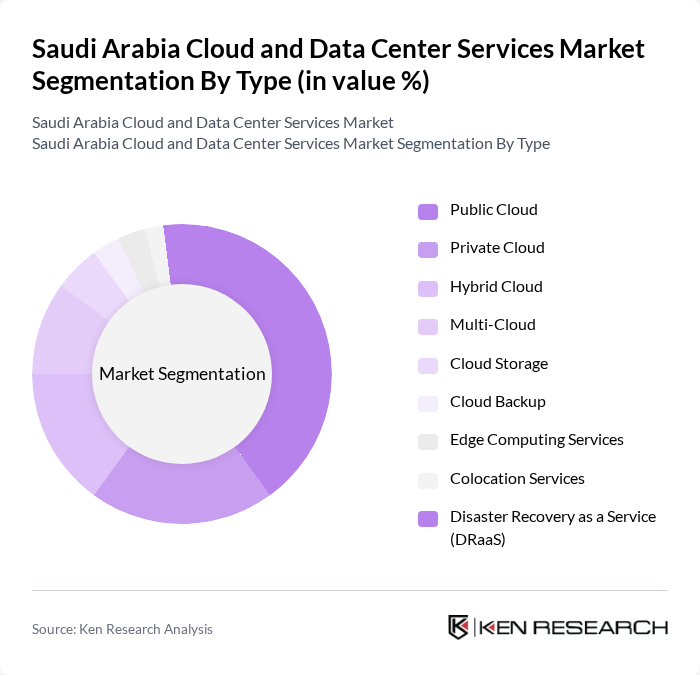

By Type:The market is segmented into various types of cloud services, including Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, Cloud Storage, Cloud Backup, Edge Computing Services, Colocation Services, and Disaster Recovery as a Service (DRaaS). Among these, thePublic Cloudsegment is currently leading the market due to its cost-effectiveness and scalability, making it a preferred choice for businesses looking to minimize IT expenditures while maximizing operational efficiency .

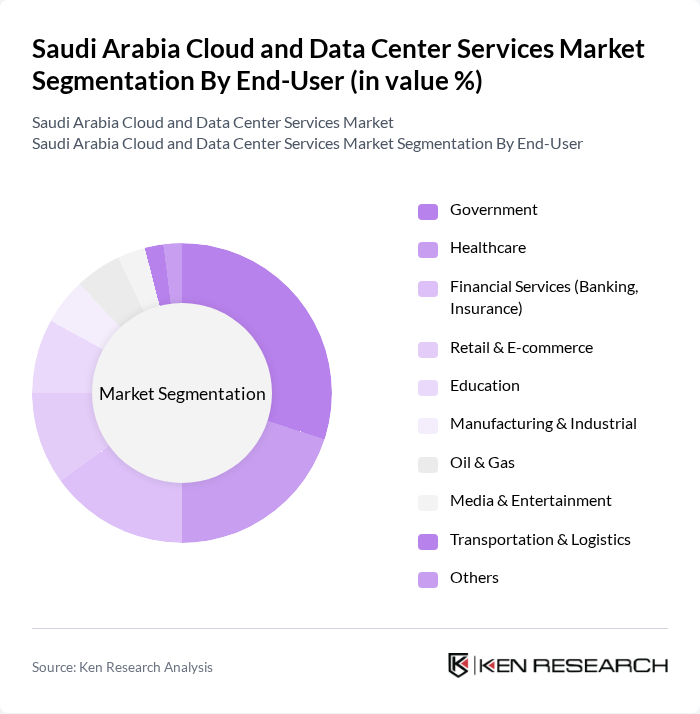

By End-User:The end-user segmentation includes Government, Healthcare, Financial Services (Banking, Insurance), Retail & E-commerce, Education, Manufacturing & Industrial, Oil & Gas, Media & Entertainment, Transportation & Logistics, and Others. TheGovernmentsector is the leading end-user, driven by significant investments in digital infrastructure and the need for secure data management solutions to support various public services .

The Saudi Arabia Cloud and Data Center Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Cloud, Mobily, Zain KSA, Oracle, Microsoft Azure, Amazon Web Services (AWS), IBM Cloud, Google Cloud, Alibaba Cloud, Ooredoo, Gulf Data Hub, NTT Communications, Equinix, Khazna Data Centers, Edgnex Data Centres by DAMAC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud and data center services market in Saudi Arabia appears promising, driven by ongoing digital transformation initiatives and government support. As businesses increasingly adopt hybrid cloud solutions, the demand for flexible and scalable services will rise. Additionally, the integration of advanced technologies such as AI and IoT will further enhance service offerings, creating a dynamic environment for innovation. The focus on sustainability will also shape future investments in green data centers, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Cloud Storage Cloud Backup Edge Computing Services Colocation Services Disaster Recovery as a Service (DRaaS) |

| By End-User | Government Healthcare Financial Services (Banking, Insurance) Retail & E-commerce Education Manufacturing & Industrial Oil & Gas Media & Entertainment Transportation & Logistics Others |

| By Industry Vertical | Telecommunications Energy & Utilities Transportation Media and Entertainment Real Estate Public Sector Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Disaster Recovery as a Service (DRaaS) Backup as a Service (BaaS) Others |

| By Deployment Model | On-Premises Off-Premises Managed Services Colocation Others |

| By Cloud Security | Identity and Access Management Data Loss Prevention Threat Intelligence Security Information and Event Management (SIEM) Encryption Services Others |

| By Pricing Model | Pay-as-you-go Subscription-based Reserved Instances Spot Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 60 | IT Managers, CTOs, CIOs |

| SME Cloud Services Utilization | 50 | Business Owners, IT Consultants |

| Data Center Infrastructure Insights | 40 | Data Center Managers, Operations Directors |

| Public Sector Cloud Initiatives | 45 | Government IT Officials, Policy Makers |

| Cloud Security and Compliance | 55 | Security Officers, Compliance Managers |

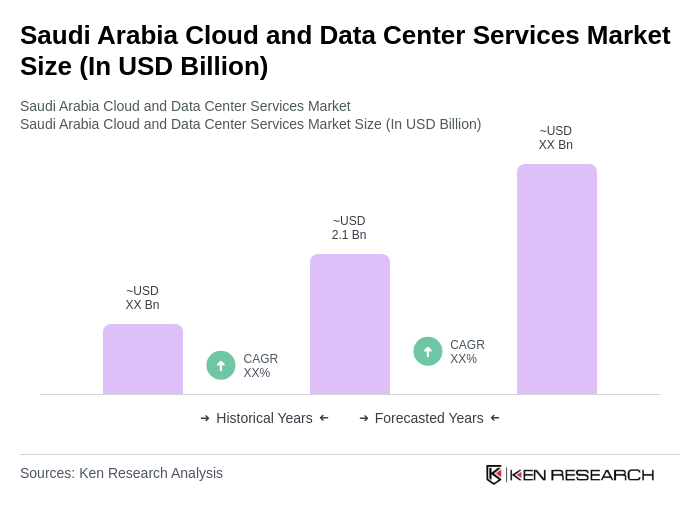

The Saudi Arabia Cloud and Data Center Services Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, including government, healthcare, and smart cities.