Region:Africa

Author(s):Geetanshi

Product Code:KRAB5177

Pages:98

Published On:October 2025

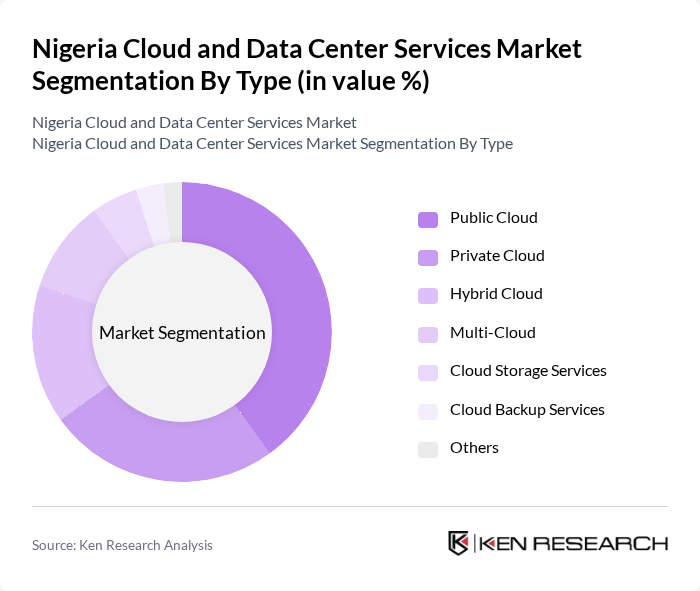

By Type:The market is segmented into Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, Cloud Storage Services, Cloud Backup Services, and Others. Among these, the Public Cloud segment is currently leading the market due to its cost-effectiveness, scalability, and rapid deployment capabilities. The increasing demand for flexible IT solutions, accelerated digitalization, and the growing trend of remote and hybrid work have further propelled the adoption of Public Cloud services across Nigeria’s business landscape .

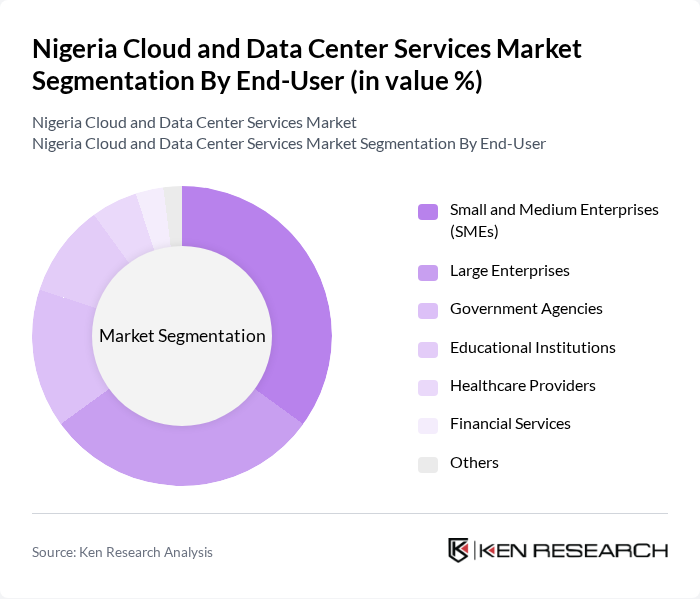

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Services, and Others. The SMEs segment is witnessing significant growth as these businesses increasingly adopt cloud solutions to enhance operational efficiency and reduce costs. The flexibility and scalability offered by cloud services are particularly appealing to SMEs, driving their market share. Large enterprises and government agencies are also accelerating cloud adoption to support digital transformation and regulatory compliance .

The Nigeria Cloud and Data Center Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as MainOne Cable Company, Rack Centre, Cloudflex, MTN Nigeria, GIG Cloud, AWS Nigeria, Microsoft Azure Nigeria, DigitalOcean, IBM Cloud Nigeria, Google Cloud Nigeria, VDT Communications, 21st Century Technologies, Africa Data Centres, Interswitch, Zinox Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's cloud and data center services market appears promising, driven by increasing digitalization and government support. As businesses continue to embrace digital transformation, the demand for cloud services is expected to rise significantly. Additionally, the expansion of internet infrastructure and the growing adoption of advanced technologies like AI and IoT will further enhance the market landscape. Companies that adapt to these trends will likely find new avenues for growth and innovation in the evolving digital economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Cloud Storage Services Cloud Backup Services Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Services Others |

| By Industry Vertical | IT and Telecommunications Retail Manufacturing Media and Entertainment Transportation and Logistics Energy and Utilities Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Others |

| By Deployment Model | On-Premises Off-Premises Managed Services Others |

| By Geographic Coverage | Urban Areas Rural Areas Regional Data Centers Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, CIOs |

| SME Data Center Utilization | 60 | Business Owners, IT Administrators |

| Public Sector Cloud Services | 40 | Government IT Officials, Policy Makers |

| Telecommunications Cloud Solutions | 50 | Network Engineers, Operations Managers |

| Financial Services Cloud Integration | 45 | Risk Managers, Compliance Officers |

The Nigeria Cloud and Data Center Services Market is valued at approximately USD 280 million, reflecting significant growth driven by increased cloud adoption, data generation, and digital transformation initiatives across various sectors.