Region:Europe

Author(s):Rebecca

Product Code:KRAB5257

Pages:87

Published On:October 2025

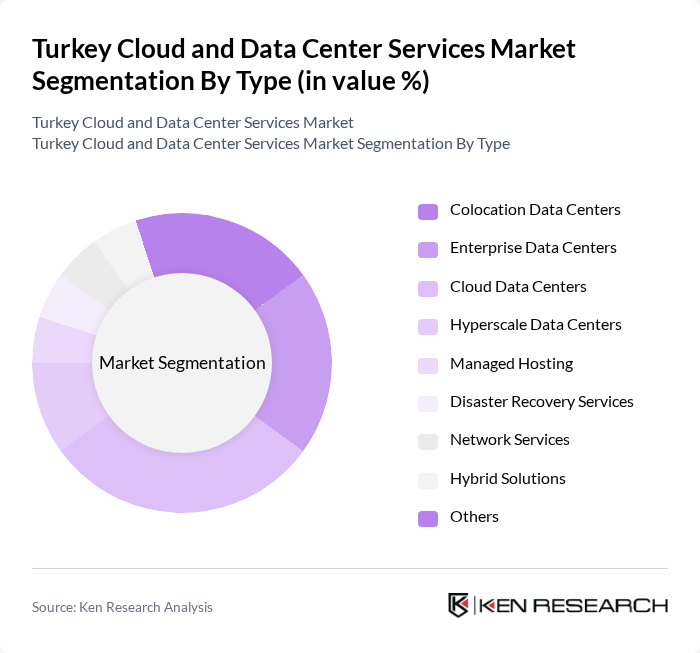

By Type:

The market is segmented into various types, including Colocation Data Centers, Enterprise Data Centers, Cloud Data Centers, Hyperscale Data Centers, Managed Hosting, Disaster Recovery Services, Network Services, Hybrid Solutions, and Others. Among these, Cloud Data Centers are currently dominating the market due to the increasing adoption of cloud computing solutions by businesses seeking flexibility and scalability. The shift towards remote work and digital services has further accelerated the demand for cloud-based solutions, with Turkey having about 31 operational colocation data centers, most developed according to Tier III standards.

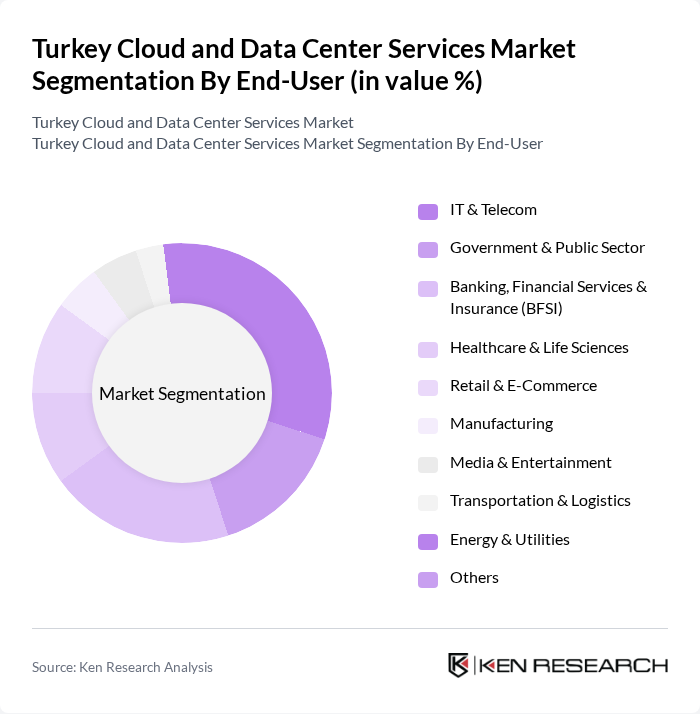

By End-User:

The end-user segmentation includes IT & Telecom, Government & Public Sector, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Media & Entertainment, Transportation & Logistics, Energy & Utilities, and Others. The IT & Telecom sector is the leading end-user, driven by the need for robust data management and storage solutions. The rapid digitalization and the increasing reliance on cloud services for operational efficiency have made this sector a significant contributor to market growth, with the government and public sectors' shift towards a cloud-first strategy expected to drive further cloud adoption.

The Turkey Cloud and Data Center Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turkcell, Vodafone Türkiye, Türk Telekom, NTT Global Data Centers Turkey, Amazon Web Services (AWS) Turkey, Microsoft Türkiye (Azure), Alibaba Cloud Turkey, KoçSistem, ?nnova Bili?im Çözümleri, Netinternet, Radore Veri Merkezi, SadeceHosting, Veriteknik, Equinix Turkey, Data Center Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Turkey cloud and data center services market appears promising, driven by increasing digitalization and government support. As businesses continue to embrace digital transformation, the demand for cloud solutions is expected to rise significantly. Additionally, advancements in technology, such as AI and edge computing, will likely enhance service offerings. However, addressing data security concerns and investment barriers will be crucial for sustained growth, ensuring that all sectors can benefit from cloud innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Enterprise Data Centers Cloud Data Centers Hyperscale Data Centers Managed Hosting Disaster Recovery Services Network Services Hybrid Solutions Others |

| By End-User | IT & Telecom Government & Public Sector Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Retail & E-Commerce Manufacturing Media & Entertainment Transportation & Logistics Energy & Utilities Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Industry Vertical | Education Media & Entertainment Transportation & Logistics Energy & Utilities Others |

| By Geographic Presence | Istanbul Ankara Izmir Bursa Denizli Tekirda? Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Wholesale Colocation (per kW) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 60 | IT Managers, CTOs, CIOs |

| Data Center Operations | 50 | Data Center Managers, Operations Directors |

| Cloud Service Providers | 40 | Business Development Managers, Sales Directors |

| SME Cloud Utilization | 45 | Small Business Owners, IT Consultants |

| Regulatory Compliance in Cloud Services | 40 | Compliance Officers, Legal Advisors |

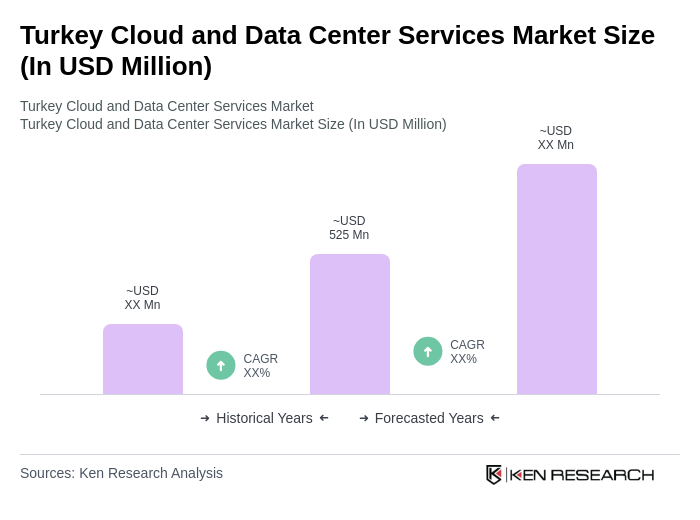

The Turkey Cloud and Data Center Services Market is valued at approximately USD 525 million, driven by the increasing demand for digital transformation, e-commerce growth, and data storage solutions.