Region:Middle East

Author(s):Shubham

Product Code:KRAC4330

Pages:87

Published On:October 2025

Market.png)

By Type:The market is segmented into various types, including Financial Management, Human Resource Management, Supply Chain Management, Customer Relationship Management, Project Management, Manufacturing Management, Analytics & Business Intelligence, and Others. Among these,Financial ManagementandHuman Resource Managementremain the leading subsegments due to their essential role in streamlining financial operations, ensuring regulatory compliance, and managing workforce efficiency. The growing demand for real-time financial reporting, payroll automation, and advanced analytics continues to drive the dominance of these modules in the Saudi market .

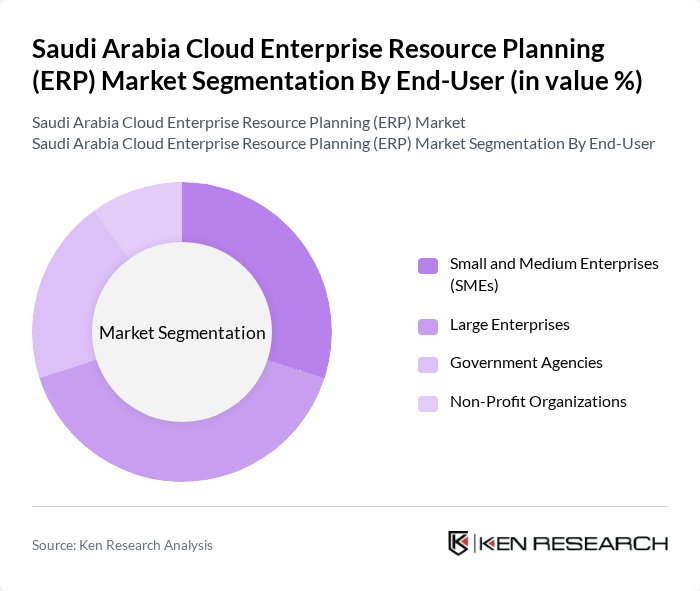

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Non-Profit Organizations.Large Enterprisesdominate the market due to their complex operational requirements and higher budgets for comprehensive ERP solutions. SMEs are increasingly adopting cloud ERP systems to enhance operational efficiency, reduce IT overhead, and remain competitive, supported by the availability of modular, scalable, and industry-specific solutions .

The Saudi Arabia Cloud Enterprise Resource Planning (ERP) Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Corporation, Infor, Inc., Sage Group plc, NetSuite Inc., Epicor Software Corporation, Odoo S.A., Zoho Corporation, Workday, Inc., IFS AB, Acumatica, Inc., Unit4 Business Software, Syspro, Freshworks Inc., Saudi Business Machines (SBM), Ejada Systems Ltd., STC Solutions, Cloud4C (CtrlS Datacenters Ltd.), Seidor MENA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud ERP market in Saudi Arabia appears promising, driven by ongoing digital transformation efforts and government support. As organizations increasingly recognize the importance of operational efficiency, the demand for cloud-based solutions is expected to rise. Additionally, advancements in artificial intelligence and machine learning will likely enhance ERP functionalities, making them more appealing to businesses. The market is poised for growth as companies seek innovative ways to leverage technology for competitive advantage while navigating regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Financial Management Human Resource Management Supply Chain Management Customer Relationship Management Project Management Manufacturing Management Analytics & Business Intelligence Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Industry Vertical | Manufacturing Retail & E-commerce Healthcare Education Financial Services Government & Public Sector Oil & Gas Others |

| By Functionality | Core ERP Advanced ERP (AI/ML, IoT Integration) ERP Add-ons (Localization, Compliance, Mobile Access) |

| By Sales Channel | Direct Sales Value-Added Resellers (VARs) Online Sales |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cloud ERP Adoption | 100 | IT Managers, CFOs, Digital Transformation Leads |

| Healthcare Sector ERP Implementation | 80 | Healthcare Administrators, IT Directors, Compliance Officers |

| Manufacturing Industry ERP Solutions | 90 | Operations Managers, Supply Chain Directors, IT Specialists |

| Retail Sector Cloud ERP Usage | 60 | Retail Managers, E-commerce Directors, IT Consultants |

| Telecommunications ERP Integration | 50 | Network Operations Managers, IT Project Managers, Business Analysts |

The Saudi Arabia Cloud Enterprise Resource Planning (ERP) Market is valued at approximately USD 170 million, reflecting significant growth driven by the adoption of cloud technologies and digital transformation initiatives across various sectors.