Region:Middle East

Author(s):Shubham

Product Code:KRAD3059

Pages:91

Published On:January 2026

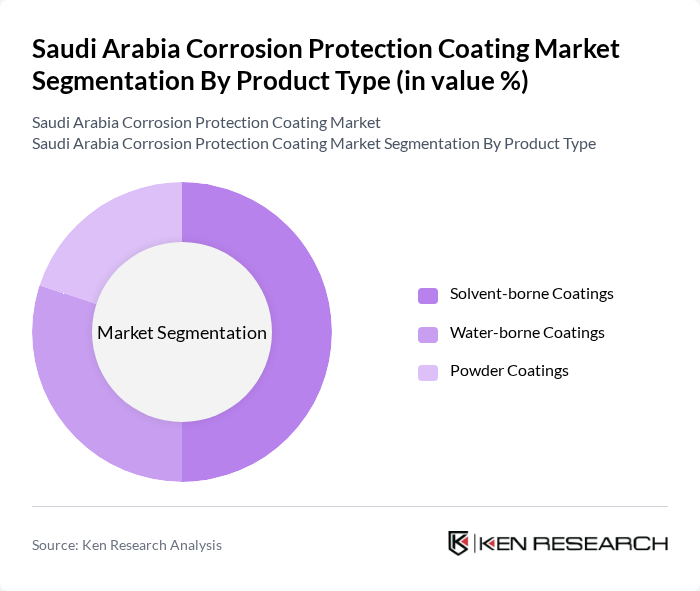

By Product Type:

The product type segmentation includes solvent-borne coatings, water-borne coatings, and powder coatings. Among these, solvent-borne coatings dominate the market due to their excellent adhesion properties and durability, making them suitable for harsh environments. The increasing industrial activities and infrastructure projects in Saudi Arabia have further propelled the demand for these coatings. Water-borne coatings are gaining traction due to their eco-friendliness and lower VOC emissions, while powder coatings are preferred for their efficiency and finish quality in various applications.

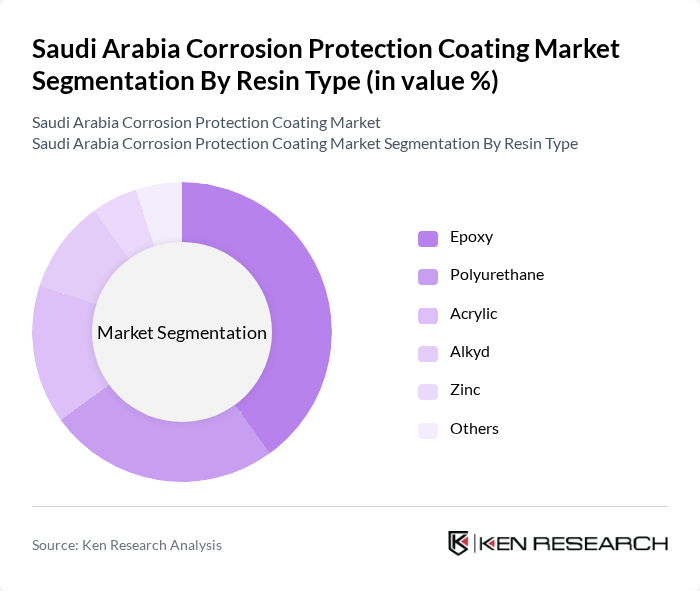

By Resin Type:

The resin type segmentation includes epoxy, polyurethane, acrylic, alkyd, zinc, and others. Epoxy resins lead the market due to their superior adhesion, chemical resistance, and durability, making them ideal for industrial applications. Polyurethane resins are also popular for their flexibility and weather resistance, while acrylic resins are favored for their aesthetic appeal and quick-drying properties. Zinc-based coatings are essential for corrosion protection in steel structures, contributing to their significant market presence.

The Saudi Arabia Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Saudi Arabia, PPG Industries, AkzoNobel, Hempel, BASF, Sherwin-Williams, RPM International, Tnemec Company, Carboline Company, Rust-Oleum, International Paints, Sika AG, DuPont, Sherwin-Williams Protective & Marine Coatings, Valspar Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corrosion protection coating market in Saudi Arabia appears promising, driven by ongoing industrialization and a strong focus on sustainability. As the government continues to invest in infrastructure and industrial projects, the demand for advanced coatings is expected to rise. Additionally, the shift towards eco-friendly materials and smart coatings technology will likely shape the market landscape, fostering innovation and attracting investments in research and development to enhance product offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Solvent-borne Coatings Water-borne Coatings Powder Coatings |

| By Resin Type | Epoxy Polyurethane Acrylic Alkyd Zinc Others |

| By End-User Industry | Oil & Gas Marine Construction Industrial Automotive Others |

| By Region | Northern and Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Coating Applications | 100 | Procurement Managers, Technical Directors |

| Construction Industry Coating Solutions | 80 | Project Managers, Site Engineers |

| Marine Coating Requirements | 60 | Marine Engineers, Fleet Managers |

| Infrastructure Development Coatings | 70 | Urban Planners, Civil Engineers |

| Automotive Coating Applications | 50 | Product Development Managers, Quality Assurance Officers |

The Saudi Arabia Corrosion Protection Coating Market is valued at approximately USD 725 million, driven by increasing demand across various industries such as oil and gas, construction, and automotive, along with heightened awareness of corrosion prevention.