Region:Middle East

Author(s):Rebecca

Product Code:KRAD7590

Pages:96

Published On:December 2025

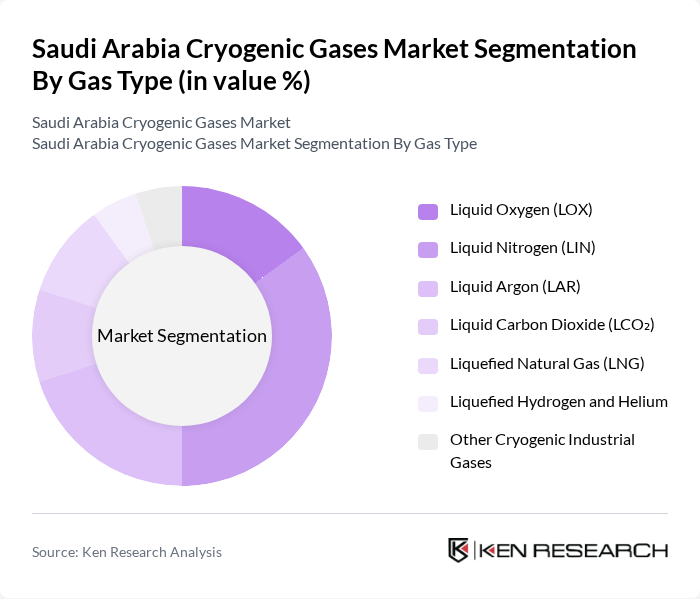

By Gas Type:The segmentation of the market by gas type includes various cryogenic gases that cater to different industrial needs. The primary subsegments are Liquid Oxygen (LOX), Liquid Nitrogen (LIN), Liquid Argon (LAR), Liquid Carbon Dioxide (LCO?), Liquefied Natural Gas (LNG), Liquefied Hydrogen and Helium, and Other Cryogenic Industrial Gases. Among these, Liquid Nitrogen (LIN) is the most dominant due to its extensive use in food preservation, medical applications, and industrial processes. The increasing demand for LIN in the healthcare sector, particularly for cryopreservation and medical gas applications, has solidified its leading position in the market.

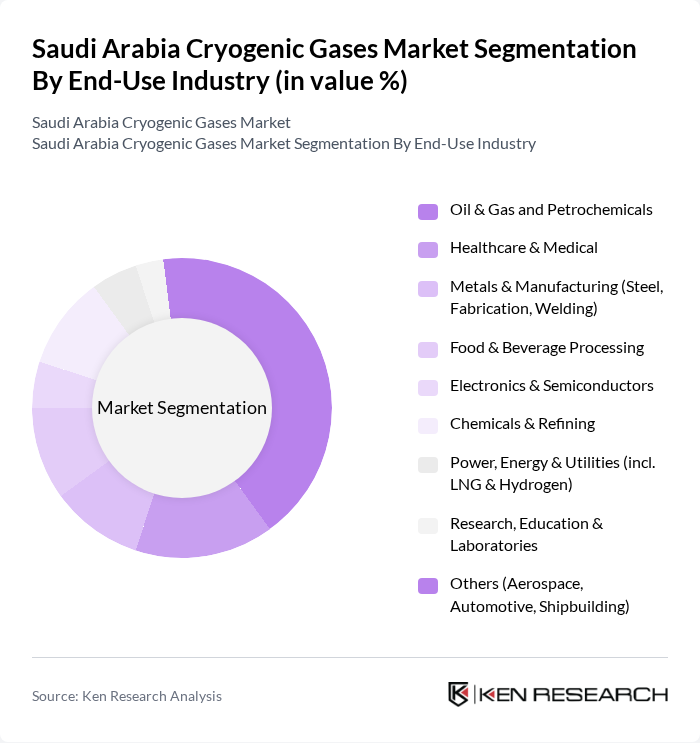

By End-Use Industry:The market is segmented by end-use industries, which include Oil & Gas and Petrochemicals, Healthcare & Medical, Metals & Manufacturing, Food & Beverage Processing, Electronics & Semiconductors, Chemicals & Refining, Power, Energy & Utilities, Research, Education & Laboratories, and Others. The Oil & Gas and Petrochemicals sector is the largest consumer of cryogenic gases, driven by the need for efficient gas processing and transportation. The increasing investments in petrochemical projects and the expansion of oil refineries in Saudi Arabia have significantly boosted the demand for cryogenic gases in this sector.

The Saudi Arabia Cryogenic Gases Market is characterized by a dynamic mix of regional and international players. Leading participants such as Linde plc (including Linde Saudi Arabia LLC), Air Products and Chemicals, Inc. (including Air Products Qudra in KSA), Air Liquide S.A. (including Air Liquide Arabia), Gulf Cryo Holding KSCC (including Gulf Cryo Saudi for Industrial & Medical Gases), National Industrial Gases Company (GASCO) – SABIC Affiliate, Jubail Industrial Gases Company (JIGPC), Saudi Industrial Gas Co. (SIGAS), Emirates Industrial Gases Co. LLC (regional supplier active in KSA), Buzwair Industrial Gases Factories (GCC supplier with KSA presence), INOX Air Products Private Limited (regional project and equipment supplier), Messer Group GmbH / Messer Middle East, Air Water Inc., Universal Industrial Gases, Inc., Other Emerging Local Industrial & Medical Gas Producers in Saudi Arabia, Key LNG & Hydrogen Project Developers Using Cryogenic Gases in KSA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cryogenic gases market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt cryogenic technology for efficiency, the market is likely to witness innovations that enhance production processes. Additionally, the government's commitment to promoting clean energy initiatives will further stimulate demand for cryogenic gases, particularly in renewable energy applications, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Gas Type | Liquid Oxygen (LOX) Liquid Nitrogen (LIN) Liquid Argon (LAR) Liquid Carbon Dioxide (LCO?) Liquefied Natural Gas (LNG) Liquefied Hydrogen and Helium Other Cryogenic Industrial Gases |

| By End-Use Industry | Oil & Gas and Petrochemicals Healthcare & Medical Metals & Manufacturing (Steel, Fabrication, Welding) Food & Beverage Processing Electronics & Semiconductors Chemicals & Refining Power, Energy & Utilities (incl. LNG & Hydrogen) Research, Education & Laboratories Others (Aerospace, Automotive, Shipbuilding) |

| By Application | Storage and Bulk Supply (On-site & Off-site) Transportation & Distribution (Bulk and Micro-bulk) Cooling, Freezing & Refrigeration Inerting, Purging & Blanketing Cutting, Welding & Metal Processing Medical & Laboratory Uses Others |

| By Mode of Supply | On-site Generation (ASU / Dedicated Plants) Bulk Liquid (Tankers & Storage Tanks) Packaged Cylinders & Micro-bulk Pipeline Supply |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam, Jubail) Western Region (incl. Jeddah, Makkah, Madinah) Southern & Northern Regions |

| By Customer Type | Large Industrial Customers (Integrated Plants) Medium Enterprises Small & Specialty Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications of Cryogenic Gases | 110 | Medical Equipment Suppliers, Hospital Administrators |

| Industrial Gas Usage in Manufacturing | 90 | Production Managers, Quality Control Supervisors |

| Food Preservation and Processing | 80 | Food Technologists, Supply Chain Managers |

| Aerospace and Defense Applications | 70 | Engineering Managers, Procurement Specialists |

| Research and Development in Cryogenics | 60 | Research Scientists, Laboratory Managers |

The Saudi Arabia Cryogenic Gases Market is valued at approximately USD 1.0 billion, driven by increasing demand across various sectors such as oil and gas, healthcare, and manufacturing, along with infrastructure expansion and energy-efficient solutions.