Region:Middle East

Author(s):Rebecca

Product Code:KRAB5356

Pages:91

Published On:October 2025

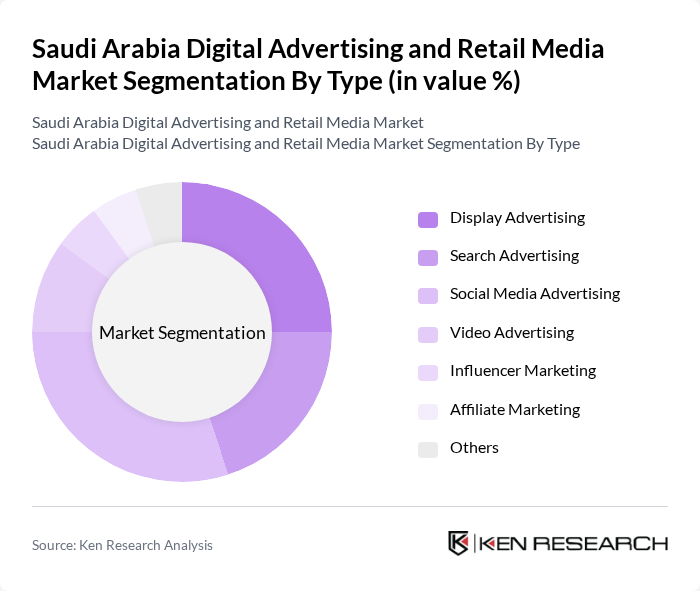

By Type:The digital advertising market can be segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Influencer Marketing, Affiliate Marketing, and Others. Each of these segments plays a crucial role in shaping the overall market dynamics, driven by consumer preferences and technological advancements.

The Social Media Advertising segment is currently dominating the market, driven by the increasing number of users on platforms like Instagram, Facebook, and Twitter. Brands are leveraging these platforms to engage with their target audiences through targeted ads and influencer partnerships. The shift towards mobile usage and the effectiveness of social media campaigns in driving consumer engagement have further solidified this segment's leadership.

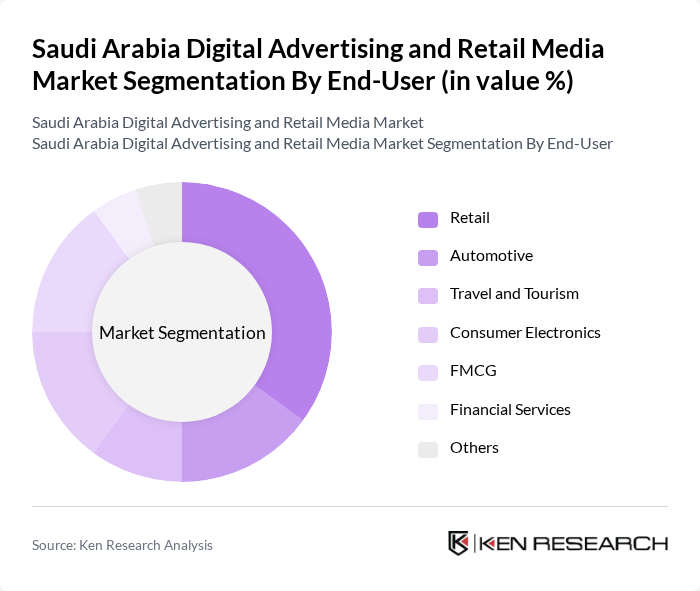

By End-User:The market can also be segmented by end-user industries, including Retail, Automotive, Travel and Tourism, Consumer Electronics, FMCG, Financial Services, and Others. Each sector utilizes digital advertising differently, reflecting their unique marketing strategies and consumer engagement approaches.

The Retail sector is the leading end-user in the digital advertising market, driven by the need for brands to reach consumers directly through online channels. The rise of e-commerce and the increasing trend of online shopping have compelled retailers to invest heavily in digital advertising to attract and retain customers, making it a critical component of their marketing strategies.

The Saudi Arabia Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group, Al Arabiya, Mobily, Al Jazeera Media Network, Saudi Telecom Company, OMD Saudi Arabia, Publicis Groupe, WPP plc, Dentsu Aegis Network, GroupM, Havas Media, Zenith Media, Initiative, IPG Mediabrands, Omnicom Media Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital advertising and retail media market in Saudi Arabia appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt programmatic advertising and personalized marketing strategies, the demand for innovative digital solutions will rise. Additionally, the integration of augmented reality and immersive experiences is expected to enhance consumer engagement, creating new avenues for advertisers. The market is poised for growth as businesses adapt to these trends and leverage emerging technologies to optimize their advertising efforts.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Influencer Marketing Affiliate Marketing Others |

| By End-User | Retail Automotive Travel and Tourism Consumer Electronics FMCG Financial Services Others |

| By Sales Channel | Direct Sales Online Marketplaces Social Media Platforms Affiliate Networks Others |

| By Advertising Format | Native Advertising Sponsored Content Banner Ads Pop-up Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Engagement Sales Conversion Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| Retail Brand Marketing Teams | 80 | Marketing Directors, Brand Managers |

| Consumer Insights and Analytics | 70 | Data Analysts, Market Researchers |

| E-commerce Platforms | 90 | Product Managers, Digital Marketing Specialists |

| Media Buying Agencies | 60 | Media Planners, Buying Executives |

The Saudi Arabia Digital Advertising and Retail Media Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital transformation, increased internet penetration, and the rising popularity of social media among consumers.