Region:Europe

Author(s):Geetanshi

Product Code:KRAB5147

Pages:86

Published On:October 2025

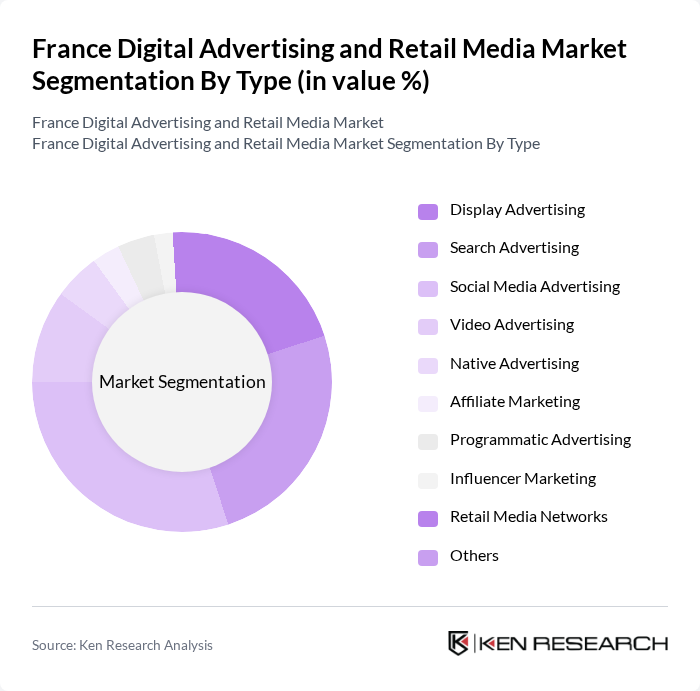

By Type:The digital advertising market in France is segmented into various types, including Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Native Advertising, Affiliate Marketing, Programmatic Advertising, Influencer Marketing, Retail Media Networks, and Others. Each of these segments caters to different advertising needs and consumer preferences, with programmatic advertising gaining significant traction due to its efficiency in real-time ad buying and audience targeting capabilities. Video content continues to experience impressive growth due to high engagement rates, while influencer marketing shows particular strength in fashion, beauty, and lifestyle sectors.

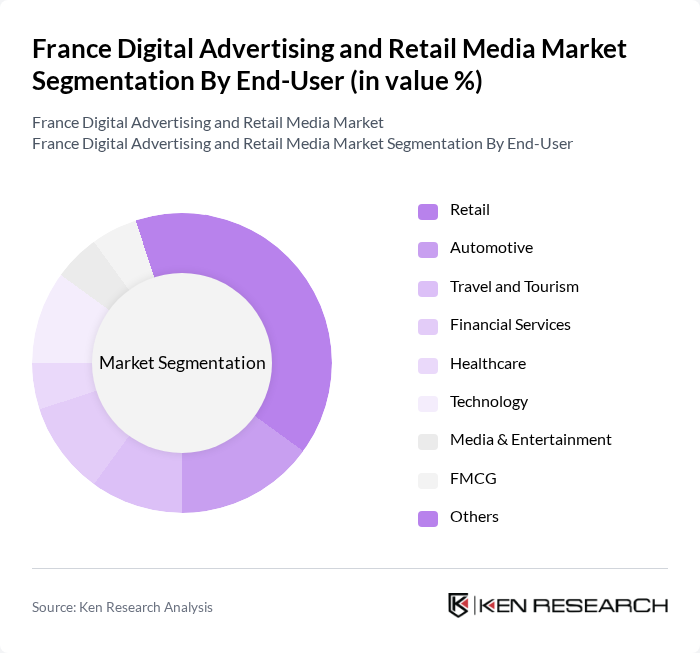

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Travel and Tourism, Financial Services, Healthcare, Technology, Media & Entertainment, FMCG, and Others. Each sector utilizes digital advertising to reach its target audience effectively, adapting strategies based on consumer behavior and market trends. The retail sector maintains its dominance driven by the continued growth of e-commerce and mobile-first shopping behaviors among French consumers.

The France Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook & Instagram), Amazon Advertising, Criteo S.A., Publicis Groupe S.A., Havas Group, Adform A/S, Taboola.com Ltd., Outbrain Inc., Artefact S.A., SLAP digital, TikTok (ByteDance Ltd.), LinkedIn Corporation (Microsoft), IBM Corporation, The Trade Desk, Inc., WIDIGIX, BSTAFF SAS, Ludobros – SARL, SAS Institute Inc., Adobe Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital advertising landscape in France appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly embrace artificial intelligence and machine learning, personalized advertising will become more prevalent, enhancing user engagement. Furthermore, the integration of sustainability into marketing strategies is expected to resonate with environmentally conscious consumers, influencing purchasing decisions. These trends will shape the market, fostering innovation and creating new avenues for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Programmatic Advertising Influencer Marketing Retail Media Networks Others |

| By End-User | Retail Automotive Travel and Tourism Financial Services Healthcare Technology Media & Entertainment FMCG Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Retail Media Platforms Others |

| By Advertising Format | Banner Ads Sponsored Content Email Marketing Mobile Ads Video Ads Audio Ads Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Geo-targeting Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Acquisition Customer Retention Sales Conversion Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 60 | Account Managers, Media Planners |

| Retail Brands Utilizing Digital Media | 50 | Marketing Directors, E-commerce Managers |

| Consumer Insights on Digital Ads | 100 | General Consumers, Online Shoppers |

| Technology Providers in Advertising | 40 | Product Managers, Sales Executives |

| Market Analysts and Consultants | 40 | Industry Analysts, Research Directors |

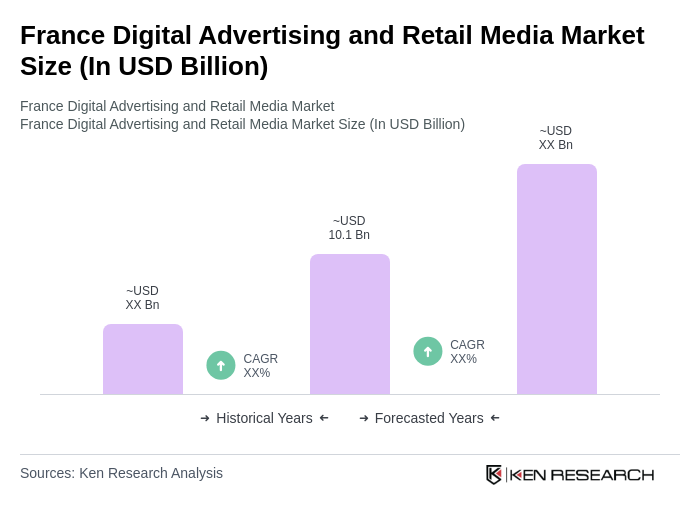

The France Digital Advertising and Retail Media Market is valued at approximately USD 10.1 billion, reflecting significant growth driven by increased internet penetration, the rise of e-commerce, and the adoption of data-driven marketing strategies.