Region:North America

Author(s):Rebecca

Product Code:KRAB5863

Pages:99

Published On:October 2025

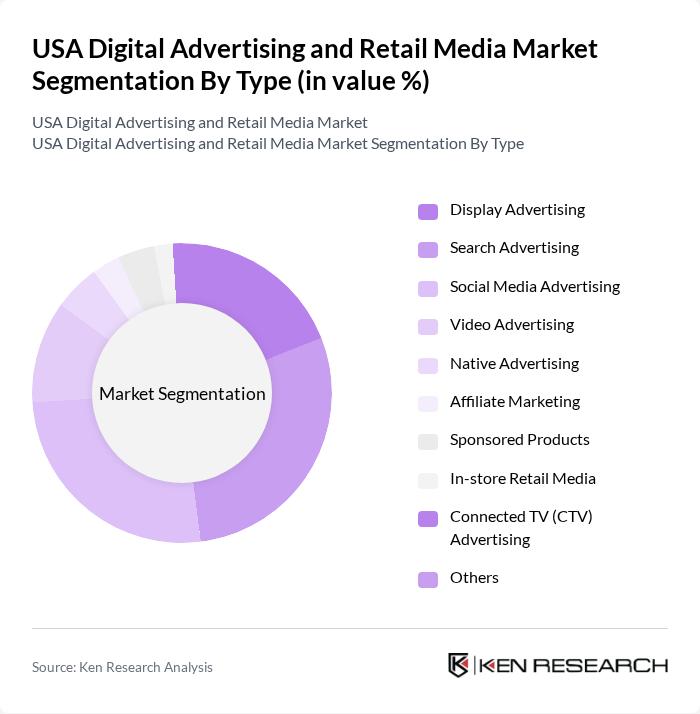

By Type:The digital advertising landscape is diverse, encompassing a wide range of advertising formats. Display advertising remains a core segment, utilizing visual content to capture user attention across websites and apps. Search advertising continues to lead in effectiveness, leveraging intent-based queries to reach consumers at critical decision moments. Social media advertising has surged, driven by high engagement on platforms such as Facebook, Instagram, and TikTok. Video advertising is rapidly expanding, with dynamic content appealing to audiences on streaming and social platforms. Native advertising integrates promotional content seamlessly within editorial environments, while affiliate marketing leverages strategic partnerships for performance-driven campaigns. Sponsored products and in-store retail media are essential for driving sales in both e-commerce and physical retail settings. Connected TV (CTV) advertising is emerging as a high-growth segment, enabling brands to reach audiences through streaming services and smart TVs. Additional formats, including audio and digital out-of-home, contribute to the market’s ongoing growth .

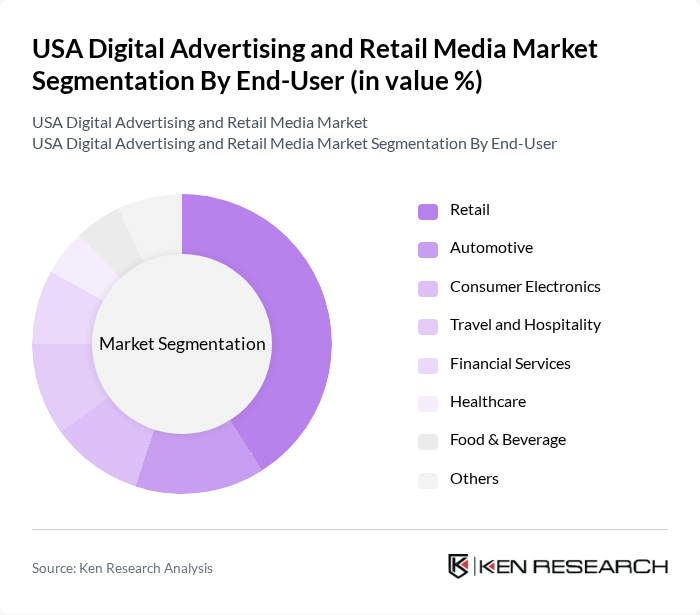

By End-User:The end-user segmentation of digital advertising highlights a broad spectrum of industries leveraging these platforms. Retail is the largest segment, driven by the need for brands to engage consumers directly and enhance their shopping experiences through omnichannel strategies. Automotive brands utilize digital advertising for model launches and feature promotions, while consumer electronics companies focus on product innovation and targeted campaigns. Travel and hospitality firms employ digital channels to attract and retain customers with personalized offers. Financial services increasingly use digital advertising to build trust and educate consumers about products. Healthcare organizations are adopting digital strategies to reach patients and promote services, especially in telemedicine and wellness. The food and beverage industry leverages targeted advertising to drive sales and foster brand loyalty. Other sectors, including education and entertainment, are also expanding their digital advertising investments .

The USA Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook), Amazon.com, Inc., Walmart Inc., The Trade Desk, Inc., Instacart, Target Corporation, Kroger Co., Albertsons Companies, Inc., Best Buy Co., Inc., CVS Health Corporation, Walgreens Boots Alliance, Inc., Criteo S.A., Pinterest, Inc., Snap Inc., Taboola.com Ltd., Outbrain Inc., MediaMath, Inc., AdRoll, Inc., Quantcast Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The USA digital advertising and retail media market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt artificial intelligence and machine learning, the efficiency of ad targeting will improve, enhancing customer engagement. Additionally, the shift towards video and interactive content will redefine advertising strategies, making them more immersive. With a focus on sustainability and ethical advertising practices, companies will likely adapt to meet consumer expectations, ensuring a dynamic and responsive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Native Advertising Affiliate Marketing Sponsored Products In-store Retail Media Connected TV (CTV) Advertising Others |

| By End-User | Retail Automotive Consumer Electronics Travel and Hospitality Financial Services Healthcare Food & Beverage Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Programmatic Buying Off-site Retail Media In-store Digital Signage Others |

| By Advertising Format | Banner Ads Sponsored Content Pop-up Ads Interstitial Ads Video Ads Shoppable Ads Others |

| By Device Type | Mobile Devices Desktop Computers Tablets Smart TVs In-store Screens Others |

| By Geographic Focus | National Campaigns Regional Campaigns Local Campaigns Others |

| By Customer Segment | B2B B2C C2C D2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Strategies | 100 | Marketing Directors, Brand Managers |

| Retail Media Effectiveness | 70 | Media Buyers, Advertising Analysts |

| Consumer Engagement with Digital Ads | 50 | Digital Marketing Specialists, UX Researchers |

| Trends in E-commerce Advertising | 80 | E-commerce Managers, Digital Strategists |

| Impact of Social Media Advertising | 60 | Social Media Managers, Content Creators |

The USA Digital Advertising and Retail Media Market is valued at approximately USD 210 billion, reflecting significant growth driven by the expansion of retail media networks and the increasing dominance of digital channels in advertising expenditures.