Region:Europe

Author(s):Shubham

Product Code:KRAB4980

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of digital advertising, each addressing specific consumer behaviors and business objectives. The primary subsegments include Display Advertising, Search Engine Advertising, Social Media Advertising, Video Advertising, Native Advertising, Programmatic Advertising, Influencer Marketing, Affiliate Marketing, Digital Out-of-Home (DOOH) Advertising, and Others. Social Media Advertising has emerged as the leading segment, propelled by the widespread use of platforms such as Facebook, Instagram, and TikTok, which allow brands to execute highly targeted and interactive campaigns. Video and programmatic advertising are also experiencing robust growth due to increased video consumption and automation in ad buying .

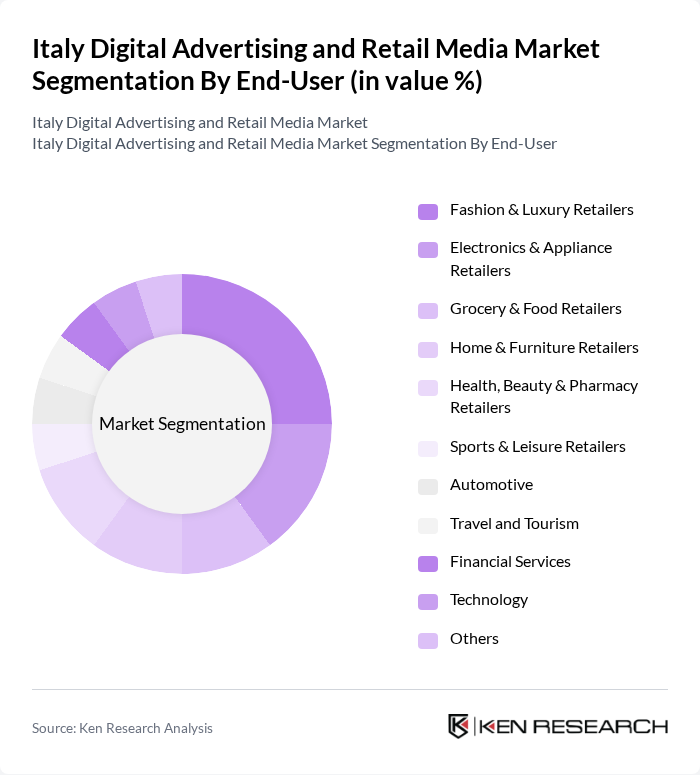

By End-User:The end-user segmentation encompasses a diverse range of industries leveraging digital advertising to reach and engage consumers. Key segments include Fashion & Luxury Retailers, Electronics & Appliance Retailers, Grocery & Food Retailers, Home & Furniture Retailers, Health, Beauty & Pharmacy Retailers, Sports & Leisure Retailers, Automotive, Travel and Tourism, Financial Services, Technology, and Others. Fashion & Luxury Retailers lead the market, driven by their strong focus on digital storytelling, influencer collaborations, and immersive online experiences. Electronics and grocery retailers are also significant contributors, reflecting the broader adoption of digital channels across retail verticals .

The Italy Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google LLC, Meta Platforms, Inc. (Facebook & Instagram), Amazon Advertising, Adform A/S, Criteo S.A., The Trade Desk, Inc., Yahoo Inc. (formerly Verizon Media), Taboola.com Ltd., Outbrain Inc., MediaMath, Inc., Sizmek by Amazon, AdRoll, Inc., Rakuten Advertising, Xandr (Microsoft Advertising), Quantcast Corporation, Italiaonline S.p.A., WebAds S.p.A., Dentsu Italia S.p.A., H-FARM S.p.A., Alkemy S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Italy's digital advertising and retail media market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt data-driven marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting and personalization. Additionally, the growing emphasis on sustainability in advertising practices will shape brand narratives, appealing to environmentally conscious consumers. These trends indicate a dynamic landscape where innovation and consumer engagement will be paramount for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Advertising Social Media Advertising Video Advertising Native Advertising Programmatic Advertising Influencer Marketing Affiliate Marketing Digital Out-of-Home (DOOH) Advertising Others |

| By End-User | Fashion & Luxury Retailers Electronics & Appliance Retailers Grocery & Food Retailers Home & Furniture Retailers Health, Beauty & Pharmacy Retailers Sports & Leisure Retailers Automotive Travel and Tourism Financial Services Technology Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Retail Media Networks Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Geo-targeting Others |

| By Format | Text Ads Image Ads Video Ads Interactive Ads Audio Ads Others |

| By Device | Mobile Devices Desktop Computers Tablets Smart TVs Digital Signage Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion App Installs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 50 | Agency Owners, Media Planners |

| Retail Brands' Marketing Teams | 40 | Marketing Directors, Brand Managers |

| Consumer Insights on Digital Ads | 120 | General Consumers, Online Shoppers |

| Technology Providers in Ad Tech | 60 | Product Managers, Sales Executives |

| Regulatory Bodies and Industry Experts | 40 | Policy Makers, Industry Analysts |

The Italy Digital Advertising and Retail Media Market is valued at approximately USD 4.5 billion, reflecting significant growth driven by increased internet penetration, e-commerce expansion, and advanced digital marketing strategies adopted by businesses.