Vietnam Digital Advertising and Retail Media Market Overview

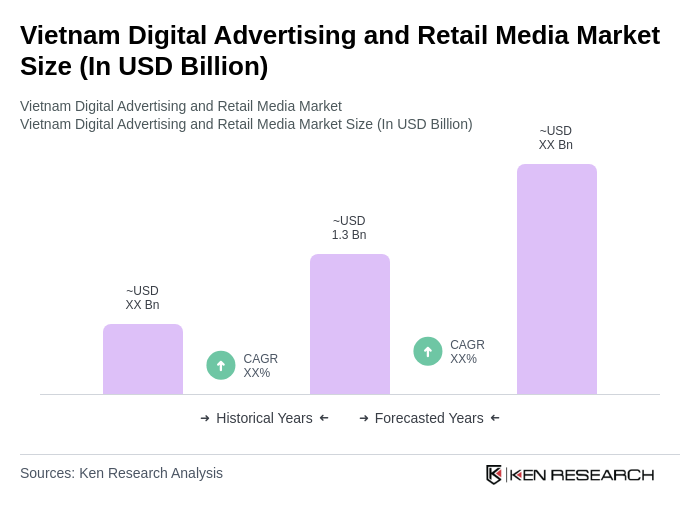

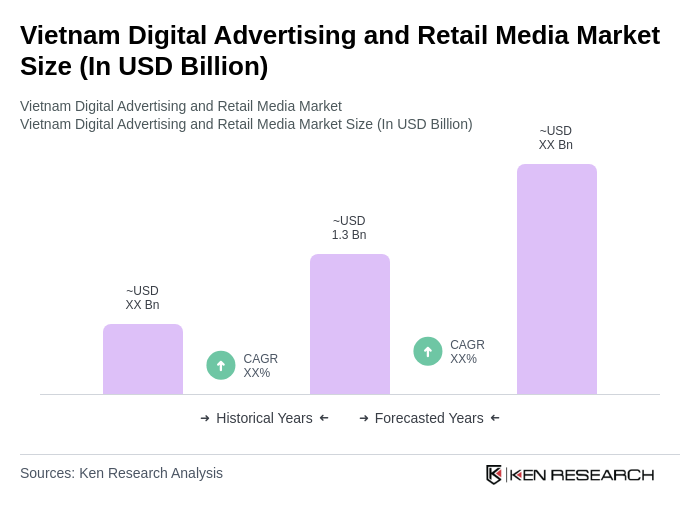

- The Vietnam Digital Advertising and Retail Media Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid increase in internet penetration—now exceeding 70%—widespread smartphone adoption, and the accelerated shift of traditional advertising budgets to digital platforms. The expansion of e-commerce, the dominance of social media, and the rising popularity of video content are further propelling demand for digital advertising solutions, with brands increasingly leveraging short-form and interactive video formats to engage Vietnam’s young, tech-savvy population .

- Key cities dominating the market include Ho Chi Minh City and Hanoi, which serve as the economic and cultural hubs of Vietnam. These cities have a high concentration of businesses and consumers, making them attractive for digital advertising investments. The urban population's increasing digital engagement and the presence of major technology companies contribute to the market's growth in these regions .

- The Ministry of Information and Communications issued Decree No. 13/2023/ND-CP on the Protection of Personal Data, which took effect in 2023. This regulation requires all digital advertising platforms operating in Vietnam to disclose their pricing models and performance metrics to advertisers, and to ensure compliance with data protection standards, thereby enhancing transparency, fair competition, and accountability in the market .

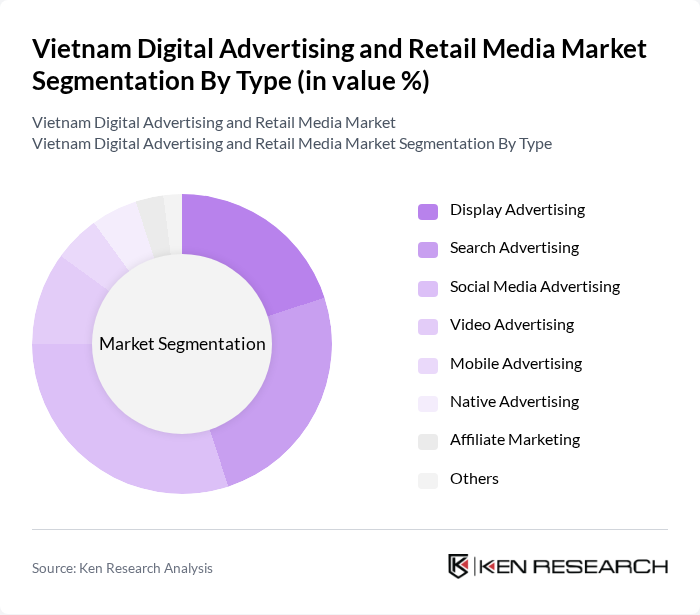

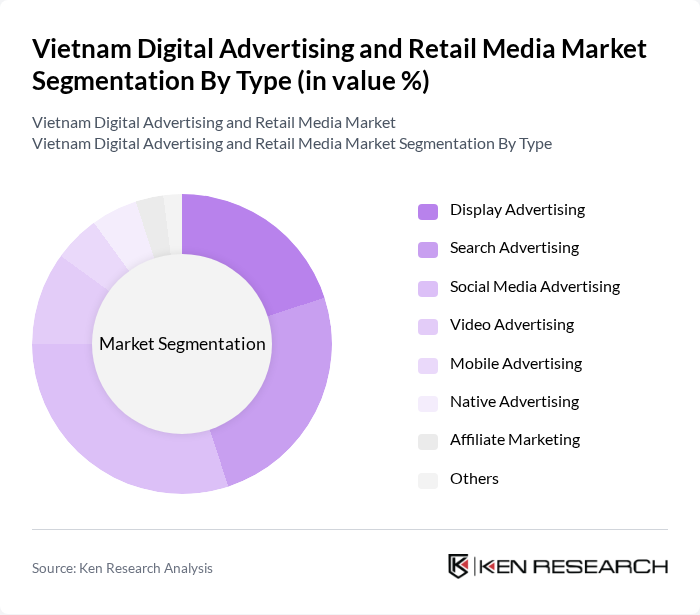

Vietnam Digital Advertising and Retail Media Market Segmentation

By Type:The digital advertising market in Vietnam is segmented into Display Advertising, Search Advertising, Social Media Advertising, Video Advertising, Mobile Advertising, Native Advertising, Affiliate Marketing, and Others. Each segment addresses distinct advertising objectives and consumer behaviors, with platforms such as Facebook, TikTok, YouTube, and Google being central to campaign strategies. Social media and video advertising are particularly prominent, driven by high engagement among younger demographics and the growing influence of short-form video content .

By End-User:The end-user segmentation of the digital advertising market includes Retail, Automotive, Travel and Tourism, Education, Healthcare, Technology, Financial Services, Consumer Goods, and Others. Each sector utilizes digital advertising to target specific audiences, with retail and technology sectors leading digital ad spend, followed by automotive and travel, as brands seek to maximize reach and conversion through data-driven, omnichannel strategies .

Vietnam Digital Advertising and Retail Media Market Competitive Landscape

The Vietnam Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as VNG Corporation, FPT Corporation, MobiFone, Viettel Media, Admicro, Yeah1 Network, Zalo, Tiki Corporation, Shopee Vietnam, Lazada Vietnam, MoMo, Sendo, VCCorp, Adtima, C?c C?c, Webrand Company Limited, Golden Communication Group, Mindshare Media Ltd, GroupM Vietnam, PMAX Corp., Appota Group, Dentsu Creative Vietnam, VTV Digital, Feedforce Vietnam contribute to innovation, geographic expansion, and service delivery in this space .

Vietnam Digital Advertising and Retail Media Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Vietnam's internet penetration rate reached approximately78 million usersin future, representing about78%of the population. This growth is driven by affordable mobile data plans and expanding broadband infrastructure. The World Bank reported that Vietnam's internet users increased by10 millionfrom 2022 to 2023, facilitating greater access to digital advertising platforms. As more consumers go online, businesses are increasingly investing in digital advertising to reach this expanding audience, enhancing market growth.

- Rise of E-commerce Platforms:The e-commerce sector in Vietnam is projected to generate around$20.5 billionin revenue by future, reflecting a significant increase from$16 billionin 2022. This surge is attributed to the growing number of online shoppers, which reached57-60 millionin recent periods. The Vietnam E-commerce Association indicates thatabout 75%of internet users have made online purchases, prompting brands to allocate more resources to digital advertising strategies that target these consumers effectively, thus driving market expansion.

- Growing Mobile Usage:Mobile devices accounted for over90%of internet traffic in Vietnam in future, with smartphone penetration exceeding74%. The International Telecommunication Union reported that mobile subscriptions reachedover 130 million, indicating a strong preference for mobile browsing and shopping. This trend encourages advertisers to optimize their campaigns for mobile platforms, leading to increased investments in mobile advertising solutions. As mobile usage continues to rise, it significantly contributes to the growth of the digital advertising market.

Market Challenges

- Regulatory Compliance Issues:The digital advertising landscape in Vietnam faces stringent regulatory compliance challenges, particularly concerning advertising standards and consumer protection laws. The Ministry of Information and Communications has implemented new regulations that require advertisers to adhere to specific guidelines, which can complicate campaign execution. Non-compliance can result in fines or bans, creating a challenging environment for businesses looking to navigate the evolving regulatory landscape effectively.

- Data Privacy Concerns:With the implementation of data protection laws, such as the Personal Data Protection Act, businesses in Vietnam must prioritize consumer privacy. The government reported thatabout 60%of consumers are concerned about how their data is used in advertising. This growing awareness can lead to hesitance in sharing personal information, limiting the effectiveness of targeted advertising campaigns. Companies must balance effective marketing strategies with compliance to maintain consumer trust and avoid legal repercussions.

Vietnam Digital Advertising and Retail Media Market Future Outlook

The Vietnam digital advertising and retail media market is poised for significant transformation as technological advancements and consumer behaviors evolve. The integration of artificial intelligence and machine learning will enhance targeting capabilities, allowing advertisers to deliver personalized content. Additionally, the increasing focus on sustainability in advertising practices will shape brand strategies. As the market adapts to these trends, businesses that leverage innovative technologies and prioritize consumer engagement will likely thrive in this dynamic environment, fostering long-term growth.

Market Opportunities

- Expansion of Social Media Advertising:Withabout 75 million active social media usersin Vietnam, brands have a unique opportunity to engage consumers through targeted advertising. The rapid growth of platforms like Facebook and TikTok allows businesses to reach diverse demographics effectively. Investing in social media advertising can enhance brand visibility and drive sales, capitalizing on the increasing time users spend on these platforms.

- Growth in Video Advertising:Video content consumption in Vietnam is projected to reachover 1 billion views per dayin future. This trend presents a lucrative opportunity for advertisers to create engaging video campaigns that resonate with audiences. As platforms like YouTube and TikTok continue to dominate, businesses can leverage video advertising to enhance brand storytelling and connect with consumers on a deeper level, driving higher engagement rates.