Region:Global

Author(s):Geetanshi

Product Code:KRAB5815

Pages:98

Published On:October 2025

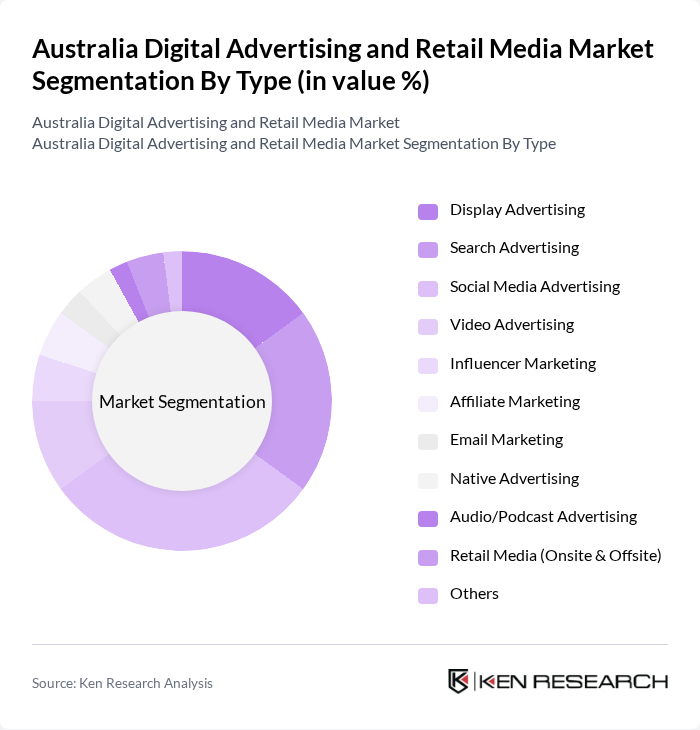

By Type:The digital advertising market in Australia is segmented into display advertising, search advertising, social media advertising, video advertising, influencer marketing, affiliate marketing, email marketing, native advertising, audio/podcast advertising, retail media, and others. Among these, social media advertising has emerged as a dominant force, driven by the increasing usage of platforms such as Facebook, Instagram, and TikTok, which enable brands to engage directly with consumers through personalized and interactive campaigns .

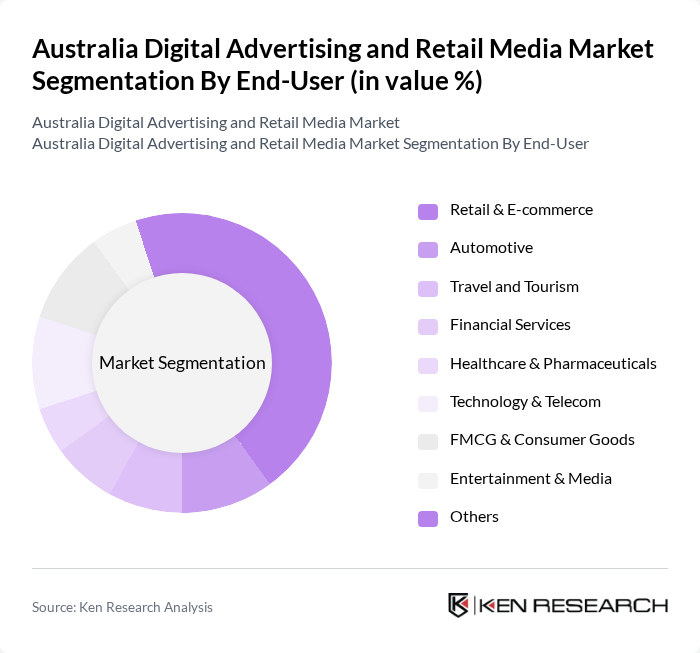

By End-User:The end-user segmentation of the digital advertising market includes retail & e-commerce, automotive, travel and tourism, financial services, healthcare & pharmaceuticals, technology & telecom, FMCG & consumer goods, entertainment & media, and others. The retail & e-commerce sector is the leading end-user, as businesses in this space increasingly leverage digital advertising to drive online sales, enhance customer engagement, and support omnichannel strategies .

The Australia Digital Advertising and Retail Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google Australia Pty Ltd, Meta Platforms, Inc. (Facebook Australia), Amazon Australia & Amazon Advertising, Woolworths Group (Cartology), Coles Group (Coles 360), Seven West Media (7RED), Nine Entertainment Co. (Nine Digital), The Trade Desk, Taboola Australia, Outbrain Australia, Criteo, Adobe Advertising Cloud, LinkedIn Marketing Solutions (Microsoft Australia), X (formerly Twitter) Australia, TikTok Australia, Pinterest Australia, Snapchat Australia, REA Group (realestate.com.au), Domain Group, Carsales.com Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia digital advertising and retail media market appears promising, driven by technological advancements and evolving consumer preferences. As brands increasingly adopt data-driven strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Furthermore, the shift towards sustainability in advertising practices is expected to resonate with environmentally conscious consumers, fostering brand loyalty. Overall, the market is poised for continued growth, adapting to emerging trends and consumer demands in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Advertising Social Media Advertising Video Advertising Influencer Marketing Affiliate Marketing Email Marketing Native Advertising Audio/Podcast Advertising Retail Media (Onsite & Offsite) Others |

| By End-User | Retail & E-commerce Automotive Travel and Tourism Financial Services Healthcare & Pharmaceuticals Technology & Telecom FMCG & Consumer Goods Entertainment & Media Others |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Networks Social Media Platforms Retailer-Owned Media Networks Others |

| By Advertising Format | Native Advertising Sponsored Content Retargeting Ads Programmatic Ads Shoppable Media Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Geographic Targeting Interest-Based Targeting Others |

| By Device Type | Mobile Devices (Smartphones) Desktop Computers Tablets Smart TVs/Connected TV (CTV) Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion App Installs Store Visits (Online/Offline) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Account Managers, Media Buyers |

| Retail Media Executives | 80 | Marketing Directors, E-commerce Managers |

| Consumer Insights Specialists | 60 | Market Researchers, Data Analysts |

| Technology Providers in Ad Tech | 70 | Product Managers, Sales Executives |

| End Consumers Engaged with Digital Ads | 100 | General Public, Online Shoppers |

The Australia Digital Advertising and Retail Media Market is valued at approximately USD 12.8 billion, reflecting significant growth driven by increased internet penetration, smartphone adoption, and the expansion of e-commerce.