Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4477

Pages:81

Published On:October 2025

By Type:The market is segmented into various types of emergency lighting solutions, including LED Emergency Lights, Fluorescent Emergency Lights, Halogen Emergency Lights, Solar Emergency Lights, Rechargeable Emergency Lights, Exit Signs, Self-Contained Emergency Lighting Systems, Central Battery Emergency Lighting Systems, Hybrid Emergency Lighting Systems, and Others. Among these, LED Emergency Lights are gaining significant traction due to their energy efficiency, longer lifespan, and compliance with modern energy standards, making them the preferred choice for both residential and commercial applications .

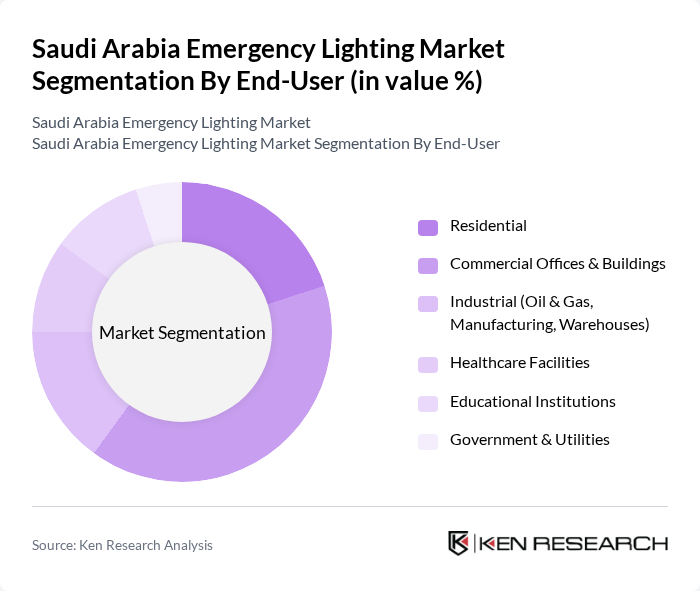

By End-User:The emergency lighting market is segmented by end-user into Residential, Commercial Offices & Buildings, Industrial (Oil & Gas, Manufacturing, Warehouses), Healthcare Facilities, Educational Institutions, and Government & Utilities. The commercial sector is the largest end-user, driven by stringent safety regulations and the need for reliable emergency lighting solutions in office buildings and public spaces. The healthcare sector also shows significant demand due to the critical nature of emergency preparedness in hospitals and clinics. Increasing adoption of smart and energy-efficient lighting solutions is also observed in industrial and government facilities .

The Saudi Arabia Emergency Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (formerly Philips Lighting), Schneider Electric Saudi Arabia, Eaton Corporation, General Electric, Osram Licht AG, Acuity Brands, Hubbell Lighting, Legrand Saudi Arabia, NVC Lighting Technology Corporation, Beghelli S.p.A., Zumtobel Group, ABB Saudi Arabia, MSL Lighting (Middle East Specialized Lighting Co.), Al Nasser Group, and Alfanar contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia emergency lighting market is poised for significant growth as urbanization accelerates and safety regulations tighten. In future, the integration of smart technologies and energy-efficient solutions will likely reshape the landscape, enhancing the functionality and appeal of emergency lighting systems. As awareness increases and government initiatives promote safety standards, the market will attract investments, particularly in commercial sectors. The focus on sustainability will further drive innovation, positioning the market for robust expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Emergency Lights Fluorescent Emergency Lights Halogen Emergency Lights Solar Emergency Lights Rechargeable Emergency Lights Exit Signs Self-Contained Emergency Lighting Systems Central Battery Emergency Lighting Systems Hybrid Emergency Lighting Systems Others |

| By End-User | Residential Commercial Offices & Buildings Industrial (Oil & Gas, Manufacturing, Warehouses) Healthcare Facilities Educational Institutions Government & Utilities |

| By Application | Indoor Lighting Outdoor Lighting Emergency Exit Lighting Signage Lighting High-Risk Area Lighting (e.g., Oil & Gas, Hospitals) |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets) Direct Sales (B2B, Project-Based) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Compliance Support |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Facilities | 60 | Facility Managers, Safety Compliance Officers |

| Commercial Real Estate | 50 | Property Managers, Building Engineers |

| Hospitality Sector | 40 | Operations Managers, Safety Coordinators |

| Industrial Applications | 40 | Safety Managers, Operations Directors |

| Government Buildings | 40 | Facility Directors, Compliance Officers |

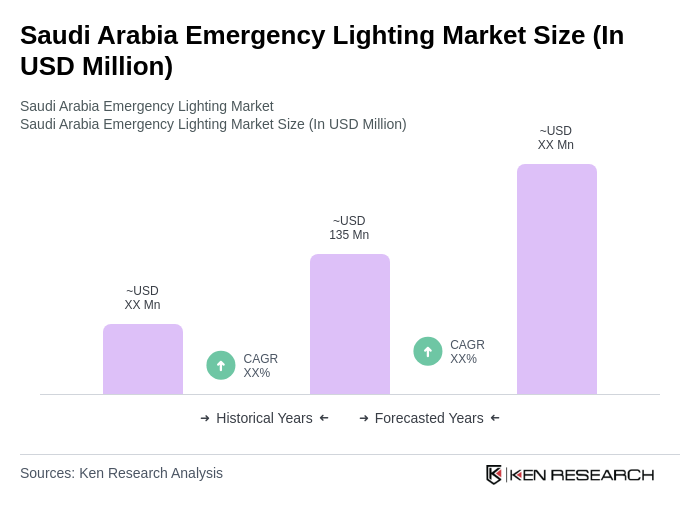

The Saudi Arabia Emergency Lighting Market is valued at approximately USD 135 million, driven by urbanization, infrastructure development, and safety regulations in both commercial and residential sectors.