Region:Asia

Author(s):Geetanshi

Product Code:KRAE5286

Pages:114

Published On:December 2025

By Flooring Type:The flooring market can be segmented into various types, including non-resilient flooring, resilient flooring, carpets and rugs, wood and laminate flooring, seamless/industrial flooring, and others. Each type caters to different consumer preferences and applications, with specific materials and installation methods influencing market dynamics, and with ceramics, vitrified (porcelain), vinyl/LVT, wood and laminate, carpets, and specialized industrial systems emerging as key product families in Indonesia.

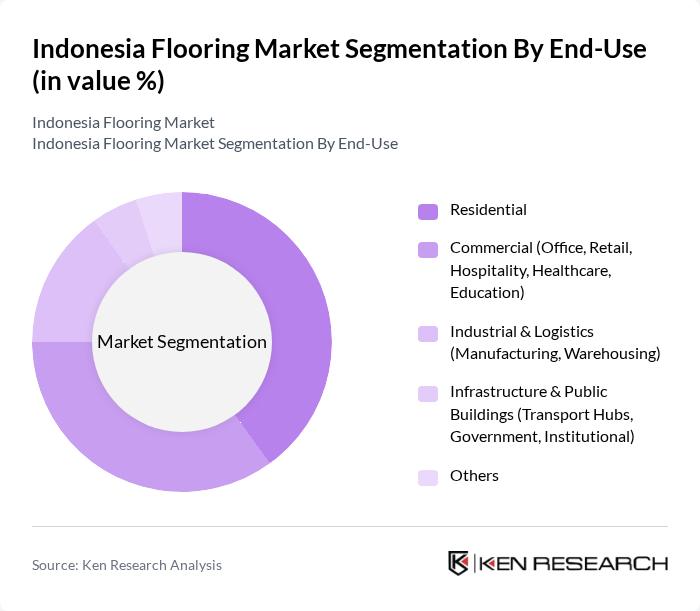

By End-Use:The flooring market is segmented by end-use into residential, commercial, industrial & logistics, infrastructure & public buildings, and others. Each segment reflects distinct performance, durability, and design requirements, with residential and commercial sectors being the primary drivers of demand, while industrial, warehousing, and institutional facilities increasingly specify high-performance resin and specialized systems to support heavy loads and hygiene or safety standards.

The Indonesia Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Keramika Indonesia Assosiasi Tbk (KIA), PT Arwana Citramulia Tbk, PT Mulia Industrindo Tbk (Mulia Ceramics), PT Granitoguna Building Ceramics (Granito), PT Roman Ceramics International, PT Indah Kiat Pulp & Paper Tbk (flooring-related laminates), PT Dharma Satya Nusantara Tbk (wood-based flooring), PT Kayu Lapis Indonesia, PT Sumber Setia Abadi (vinyl & resilient flooring distribution), PT Supreme Decors International (laminate & engineered wood), PT Trisensa Mineral Utama (stone & marble flooring), PT Indocement Tunggal Prakarsa Tbk (cement-based flooring solutions), PT Fagetti (natural stone flooring), International Players Active in Indonesia (Tarkett, Gerflor, Interface, Armstrong, Others), Selected Regional / Local Niche Players (Epoxy & Industrial Flooring Applicators) contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia flooring market is poised for significant growth, driven by urbanization, rising incomes, and a booming real estate sector. As consumers increasingly prioritize aesthetics and sustainability, the demand for eco-friendly and innovative flooring solutions is expected to rise. Additionally, advancements in technology will likely lead to the development of smart flooring options, enhancing user experience. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Flooring Type | Non-resilient Flooring (Ceramic & Porcelain Tiles, Stone, Concrete) Resilient Flooring (Vinyl, LVT, Rubber, Linoleum) Carpets & Rugs (Broadloom, Carpet Tiles) Wood & Laminate Flooring (Solid Wood, Engineered Wood, Laminate) Seamless / Industrial Flooring (Epoxy, Polyurethane, Self-levelling) Others (Bamboo, Terrazzo, Cork, Specialty) |

| By End-Use | Residential Commercial (Office, Retail, Hospitality, Healthcare, Education) Industrial & Logistics (Manufacturing, Warehousing) Infrastructure & Public Buildings (Transport Hubs, Government, Institutional) Others |

| By Application | New Construction Renovation & Retrofits Repair & Maintenance Overlay Others |

| By Material Chemistry | Ceramic & Mineral-based Polymer-based (PVC/Vinyl, Epoxy, PU, Acrylic) Wood-based & Laminates Natural & Bio-based (Bamboo, Cork, Rubber) Others |

| By Price Band | Economy Mid-range Premium Luxury |

| By Installation Method | Glue-down / Adhered Floating / Click-lock Mechanical Fixing / Nailed Trowel-applied / Poured Others |

| By Region | Java (incl. Jakarta, West Java, Central Java, East Java, Banten, DIY) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Maluku & Papua |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Preferences | 120 | Homeowners, Interior Designers |

| Commercial Flooring Solutions | 100 | Facility Managers, Architects |

| Retail Flooring Trends | 80 | Retail Managers, Merchandisers |

| Construction Industry Insights | 100 | Contractors, Builders |

| Eco-friendly Flooring Demand | 70 | Sustainability Officers, Product Managers |

The Indonesia Flooring Market is valued at approximately USD 3.3 billion, driven by urbanization, rising disposable incomes, and a growing construction sector across commercial, residential, and industrial projects.