Region:Middle East

Author(s):Geetanshi

Product Code:KRAE6471

Pages:112

Published On:December 2025

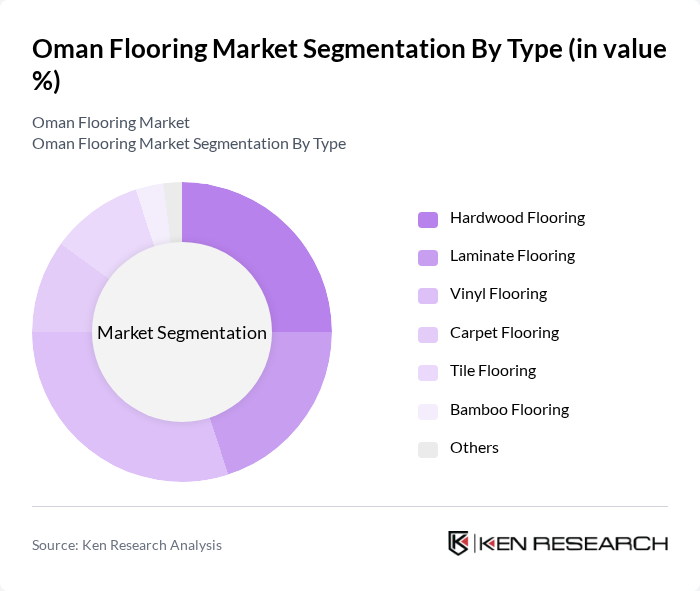

By Type:The flooring market can be segmented into various types, including Hardwood Flooring, Laminate Flooring, Vinyl Flooring, Carpet Flooring, Tile Flooring, Bamboo Flooring, and Others. Each type caters to different consumer preferences and applications, with specific characteristics that appeal to various market segments. In Oman and the wider Middle East, resilient products such as vinyl and luxury vinyl tiles, carpets, ceramic and porcelain tiles, and laminates are widely used in residential, commercial, and hospitality applications due to their durability, ease of maintenance, and suitability for high-traffic and warm-climate environments.

The Vinyl Flooring segment is currently dominating the market due to its versatility, durability, and cost-effectiveness, in line with Middle East trends where vinyl and luxury vinyl tiles are gaining share in residential, commercial, and hospitality projects. Consumers are increasingly opting for vinyl flooring as it offers a wide range of designs and finishes that mimic natural materials while being easier to maintain. The growing trend of DIY and small-scale home improvement projects, as well as demand for water-resistant and scratch-resistant surfaces in kitchens, corridors, and commercial spaces, has also contributed to the rising popularity of vinyl flooring, making it a preferred choice among homeowners, facility managers, and contractors alike.

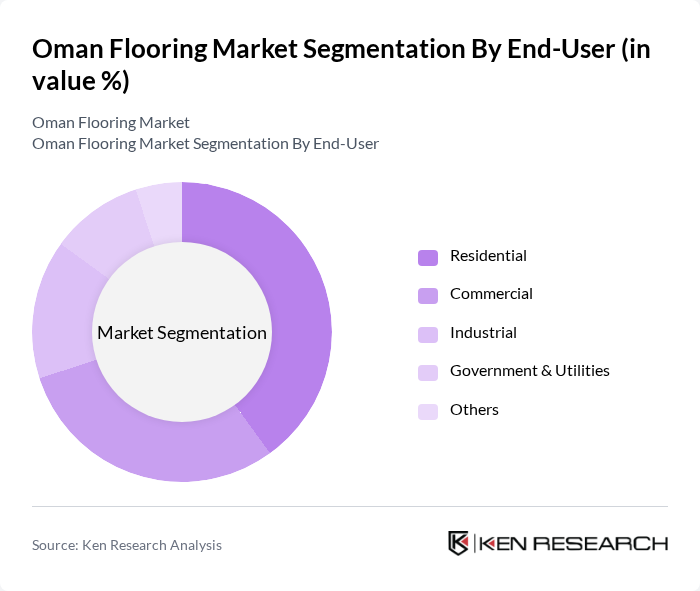

By End-User:The market can be segmented based on end-users into Residential, Commercial, Industrial, Government & Utilities, and Others. Each segment has distinct requirements and preferences, influencing the types of flooring products that are in demand. Residential and commercial real estate development, along with tourism, retail, healthcare, and education projects, are the primary demand centers in Oman and the broader Middle East flooring market.

The Residential segment leads the market, driven by increasing home renovations and new construction projects supported by urbanization and population growth in Oman’s main cities. Homeowners are investing in high-quality flooring options to enhance aesthetics and functionality, with a growing inclination toward durable, easy-to-clean, and moisture-resistant materials such as vinyl, laminates, and tiles. The trend towards open-concept living spaces, as well as the development of apartments, villas, and gated communities, has also increased the demand for versatile flooring solutions that can seamlessly integrate different areas of the home while maintaining thermal comfort and acoustic performance.

The Oman Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Flooring Company, Al Hooti Group, Muscat Flooring, Gulf Flooring Solutions, Al Jazeera Flooring, Oman Ceramics, Al Mufeed Flooring, Al Futtaim Flooring, Al Muna Flooring, Al Shanfari Group, Al Makhazen Flooring, Al Mufeed Group, Al Matar Flooring, Al Muna Group, Al Hossaini Flooring contribute to innovation, geographic expansion, and service delivery in this space.

The Oman flooring market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization accelerates, the demand for innovative flooring solutions will increase, particularly in urban centers. Companies are likely to invest in smart flooring technologies that enhance functionality and sustainability. Additionally, the trend towards eco-friendly products will continue to shape the market, encouraging manufacturers to adopt sustainable practices and materials, thus fostering a more environmentally conscious industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardwood Flooring Laminate Flooring Vinyl Flooring Carpet Flooring Tile Flooring Bamboo Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Application | Residential Buildings Commercial Spaces Industrial Facilities Hospitality Sector Others |

| By Material | Natural Materials Synthetic Materials Recycled Materials Others |

| By Installation Type | Glue-Down Floating Nail-Down Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 140 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 110 | Facility Managers, Architects |

| Retail Flooring Sales | 90 | Store Managers, Sales Representatives |

| Construction Industry Flooring Demand | 130 | Contractors, Project Managers |

| Flooring Material Suppliers | 100 | Supply Chain Managers, Product Managers |

The Oman Flooring Market is valued at approximately USD 25 million, reflecting a five-year historical analysis of flooring material sales in the country. This growth is driven by urbanization, rising disposable incomes, and a booming construction sector.