Region:Asia

Author(s):Geetanshi

Product Code:KRAE6468

Pages:81

Published On:December 2025

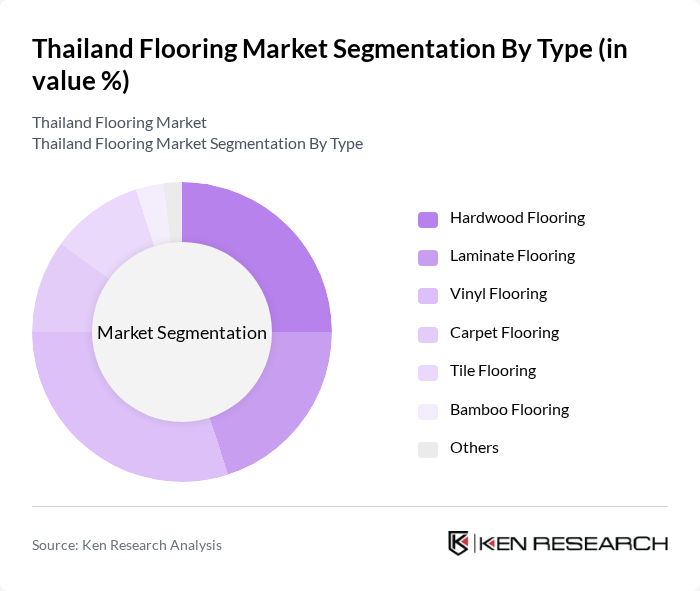

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, tile flooring, bamboo flooring, and others. Each type caters to different consumer preferences and applications, with specific characteristics that appeal to various market segments.

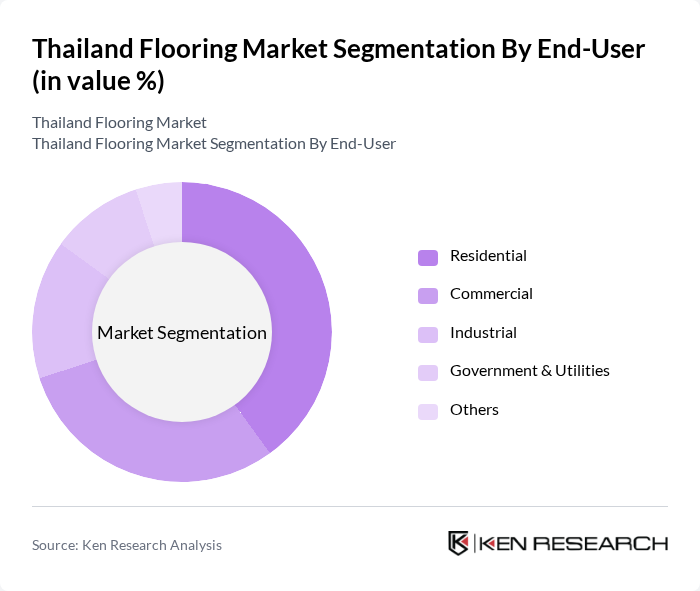

By End-User:The flooring market is segmented based on end-users, which include residential, commercial, industrial, government & utilities, and others. Each segment has distinct requirements and preferences, influencing the types of flooring products that are in demand.

The Thailand Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Building Materials, Thai Union Group, Floor & Decor Holdings, Inc., TPI Polene Public Company Limited, Siam Cement Group, KCC Corporation, Kenzai Co., Ltd., Boral Limited, Kito Corporation, Kwangsang Co., Ltd., AICA Kogyo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand flooring market is poised for significant growth, driven by urbanization, rising incomes, and a shift towards sustainable products. As consumers increasingly prioritize aesthetics and functionality, manufacturers are expected to innovate with smart flooring solutions and eco-friendly materials. Additionally, government initiatives aimed at infrastructure development will likely bolster demand for flooring in both residential and commercial sectors. The market's adaptability to changing consumer preferences will be crucial for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardwood Flooring Laminate Flooring Vinyl Flooring Carpet Flooring Tile Flooring Bamboo Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | New Construction Renovation Maintenance Others |

| By Material | Natural Wood Engineered Wood Composite Materials Others |

| By Design | Traditional Modern Rustic Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand Eastern Thailand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Purchases | 120 | Homeowners, Interior Designers |

| Commercial Flooring Installations | 110 | Facility Managers, Architects |

| Retail Flooring Trends | 90 | Store Owners, Retail Managers |

| Construction Sector Flooring Needs | 130 | Contractors, Builders |

| Eco-friendly Flooring Preferences | 60 | Sustainability Advocates, Green Building Consultants |

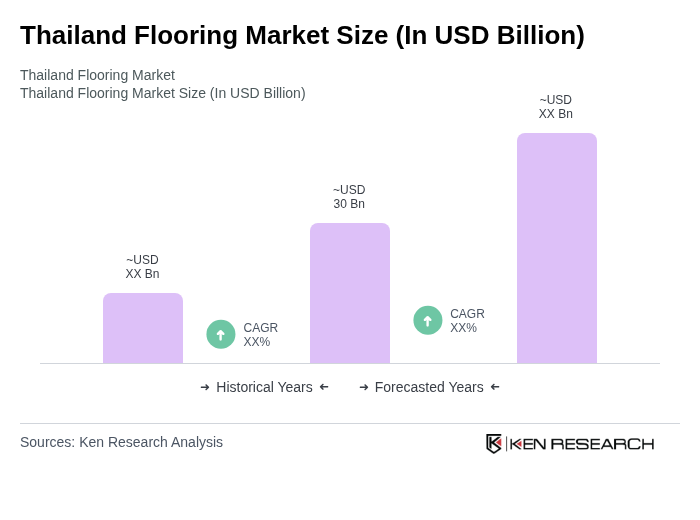

The Thailand Flooring Market is valued at approximately USD 30 billion, driven by increasing demand for residential and commercial spaces, urbanization, and a growing manufacturing sector. This valuation reflects a five-year historical analysis of market trends and consumer preferences.