Philippines Flooring Market Overview

- The Philippines Flooring Market is valued at USD 1.1 billion, based on a five-year historical analysis of key segments including resilient flooring and wood & laminate flooring, and considering their combined share within the broader flooring space. This growth is primarily driven by the booming construction sector, increased urbanization, and rising disposable incomes, which have led to a surge in demand for various flooring solutions across residential, commercial, and industrial applications. The Philippine construction industry has recorded strong growth, with the construction market expanding at a robust pace and expected to reach around PHP 1.94 trillion, underpinned by infrastructure and real estate investments, which directly support demand for flooring materials and services.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines Flooring Market. Metro Manila, as the capital region, has a high concentration of commercial, office, and high-density residential developments, while Cebu and Davao are emerging as key urban centers with significant infrastructure, tourism-related, and mixed-use development projects, driving the demand for flooring products across retail, hospitality, residential, and institutional buildings.

- The Philippine government’s flagship infrastructure program widely known as “Build, Build, Build,” initiated under the previous administration, has been continued and evolved under the current “Build Better More” agenda, which aims to accelerate infrastructure development across the country through large-scale investments in transport, public works, and housing projects; this sustained pipeline of projects is boosting demand for flooring materials and installation services in both public and private construction. Key policy frameworks such as the Republic Act No. 11201 (Department of Human Settlements and Urban Development Act of 2019), which created the Department of Human Settlements and Urban Development (DHSUD), and the National Building Code of the Philippines (Presidential Decree No. 1096, 1977) set requirements for building design, materials, and safety standards that govern construction and, by extension, specifications for floor assemblies and finishes in residential, commercial, and institutional buildings.

Philippines Flooring Market Segmentation

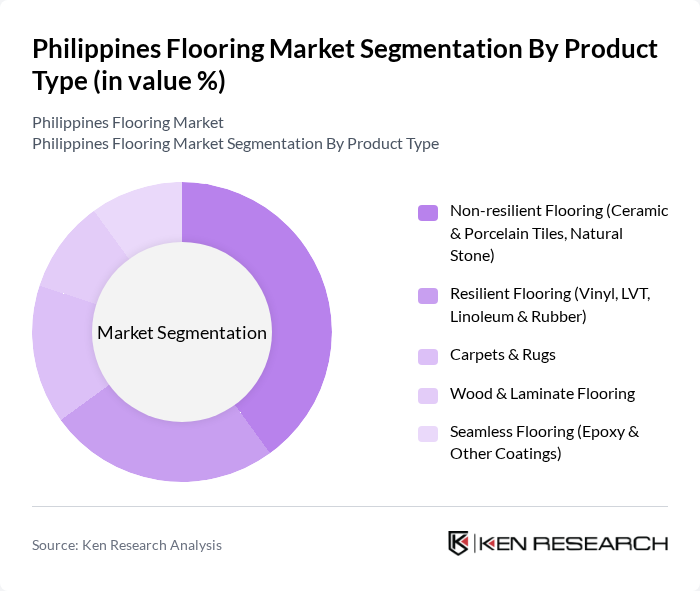

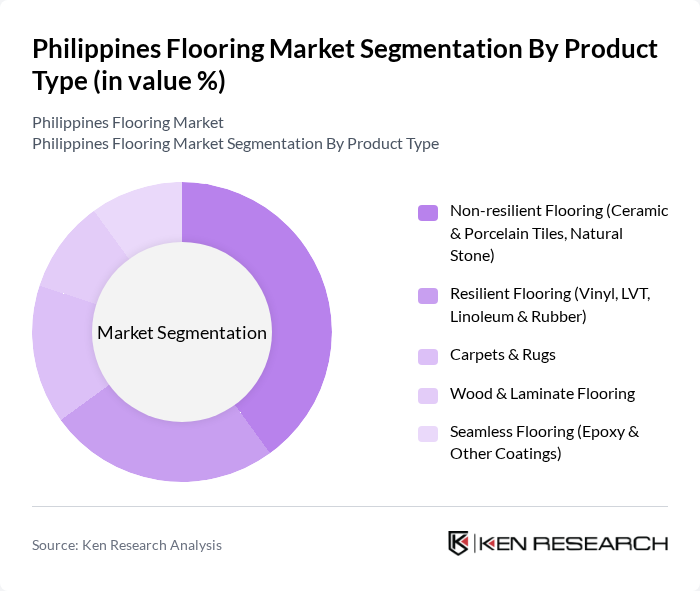

By Product Type:The product type segmentation includes various flooring materials that cater to different consumer preferences and applications. The subsegments are Non-resilient Flooring (Ceramic & Porcelain Tiles, Natural Stone), Resilient Flooring (Vinyl, LVT, Linoleum & Rubber), Carpets & Rugs, Wood & Laminate Flooring, and Seamless Flooring (Epoxy & Other Coatings). Among these, Non-resilient Flooring is currently dominating the market due to its durability, ease of maintenance, and aesthetic appeal, making it a preferred choice for both residential and commercial spaces. Ceramic and porcelain tiles represent a sizable and growing share of floor finishes in the country, supported by rising middle-class housing demand and renovation activities, while resilient flooring (including vinyl and LVT) and wood & laminate flooring are also expanding as consumers increasingly seek modern designs, moisture resistance, and cost-effective alternatives.

By Application:The application segmentation encompasses the various sectors where flooring products are utilized, including Residential, Commercial, and Industrial applications. The Residential segment is currently leading the market, supported by strong demand for new housing, vertical condominiums, and subdivision developments, as well as increasing home renovations among middle-income households. The growing trend of interior design, home improvement, and preference for easy-to-clean, durable surfaces has significantly influenced consumer preferences towards high-quality flooring solutions, while commercial projects such as offices, retail, hospitality, and institutional buildings also represent a substantial and growing user base for resilient, tile, and wood-based flooring.

Philippines Flooring Market Competitive Landscape

The Philippines Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Floor Center, Wilcon Depot, FC Tile Depot, CW Home Depot, Mapei Philippines Inc., Mariwasa Siam Ceramics Inc., Apo Floors, Nexent Coatings Inc., ABC Phil., Inc. (ABC Adhesives & Coatings), Pride Asia Marketing (Vinyl & LVT), Kaufman, Inc., Matimco, Inc., Kent Floors, Armstrong Flooring (Regional Presence), Interface, Inc. (Modular Carpet Tiles) contribute to innovation, geographic expansion, and service delivery in this space. Many of these companies are strengthening portfolios in ceramic tiles, resilient flooring, and engineered wood, while also promoting eco-friendlier options such as low-VOC adhesives and coatings, reflecting a broader regional shift toward sustainable building materials.

Philippines Flooring Market Industry Analysis

Growth Drivers

- Increasing Urbanization:The Philippines is experiencing rapid urbanization, with urban areas projected to house 58% of the population in future, up from 54% in the recent past. This shift is driving demand for residential and commercial flooring solutions, as new constructions and renovations become more prevalent. The urban population is expected to reach approximately 63 million, leading to a significant increase in flooring requirements across various sectors, including residential, commercial, and industrial.

- Rising Disposable Income:The average disposable income in the Philippines is projected to rise to approximately PHP 350,000 per capita in future, reflecting a growing middle class. This increase in disposable income is encouraging consumers to invest in home improvements, including flooring upgrades. As households prioritize aesthetics and quality, the demand for premium flooring options, such as hardwood and luxury vinyl tiles, is expected to surge, further stimulating market growth.

- Demand for Sustainable Flooring Solutions:With environmental awareness on the rise, the demand for sustainable flooring solutions is increasing. The market for eco-friendly flooring materials, such as bamboo and recycled products, is expected to grow significantly, with a projected increase of 25% in future. This trend is supported by government initiatives promoting sustainability and consumer preferences shifting towards environmentally responsible products, creating a robust market for sustainable flooring options.

Market Challenges

- High Competition:The Philippines flooring market is characterized by intense competition, with over 250 local and international players vying for market share. This saturation leads to price wars and reduced profit margins, making it challenging for new entrants to establish themselves. Companies must differentiate their offerings through innovation and quality to survive in this competitive landscape, which can strain resources and limit growth potential.

- Fluctuating Raw Material Prices:The flooring industry is heavily reliant on raw materials such as wood, vinyl, and ceramics, which are subject to price volatility. In future, the price of wood is expected to increase by 20% due to supply chain disruptions and increased demand. This fluctuation can significantly impact production costs and profit margins for flooring manufacturers, forcing them to adapt their pricing strategies and potentially pass costs onto consumers.

Philippines Flooring Market Future Outlook

The Philippines flooring market is poised for significant growth driven by urbanization, rising disposable incomes, and a shift towards sustainable products. As the construction sector expands, particularly in urban areas, the demand for innovative flooring solutions will increase. Companies that invest in technology and eco-friendly materials will likely gain a competitive edge. Additionally, the rise of e-commerce platforms will facilitate greater access to diverse flooring options, enhancing consumer choice and market dynamics in the coming years.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in the Philippines presents a significant opportunity for flooring companies. With online retail sales projected to reach approximately PHP 250 billion in future, businesses can leverage digital platforms to reach a broader audience, streamline sales processes, and enhance customer engagement, ultimately driving sales growth in the flooring sector.

- Innovations in Flooring Technology:Advancements in flooring technology, such as smart flooring solutions that integrate IoT capabilities, are gaining traction. The market for smart flooring is expected to grow by 30% in future, driven by consumer interest in home automation and energy efficiency. Companies that embrace these innovations can capture new market segments and enhance their product offerings.