Region:Middle East

Author(s):Rebecca

Product Code:KRAC0250

Pages:87

Published On:August 2025

By Type:The foodservice market is segmented into Full-Service Restaurants, Quick Service Restaurants (QSR), Cafés, Coffee Shops & Juice Bars, Cloud Kitchens (Virtual Kitchens), Catering Services, Food Trucks, Institutional Foodservice, and Others. Full-Service Restaurants offer table service and a diverse menu, catering to families and premium diners. Quick Service Restaurants focus on speed and convenience, appealing to younger and working consumers. Cafés, Coffee Shops & Juice Bars provide casual environments for beverages and light meals. Cloud Kitchens operate delivery-only models, leveraging digital platforms. Catering Services serve events and institutions, while Food Trucks offer mobile, on-the-go options. Institutional Foodservice addresses the needs of corporates, schools, and healthcare facilities.

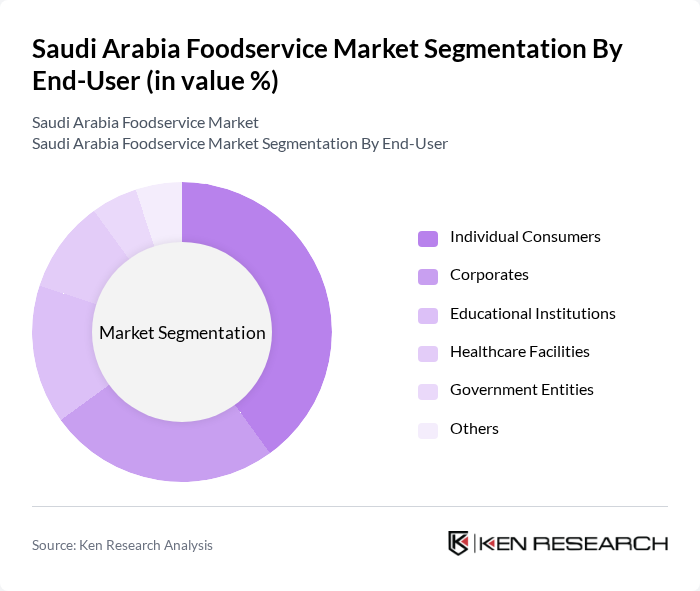

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Educational Institutions, Healthcare Facilities, Government Entities, and Others. Individual Consumers represent the largest share, driven by rising urbanization and changing lifestyles. Corporates and institutions increasingly rely on foodservice providers for employee and student meals, while healthcare and government entities ensure food provision in specialized settings.

The Saudi Arabia Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Baik, Kudu, Herfy, McDonald's Saudi Arabia (Reza Food Services Co. Ltd.), Domino's Pizza Saudi Arabia (Alamar Foods), Pizza Hut Saudi Arabia (M.H. Alshaya Co.), Subway Saudi Arabia (Shahia Food Limited Company), Starbucks Saudi Arabia (Alshaya Group), Taza, Shawarmer, Al Tazaj, Chili's Saudi Arabia (Alshaya Group), Texas Roadhouse Saudi Arabia (Alshaya Group), Piatto (Food & Entertainment Co.), and Fuddruckers Saudi Arabia (Food & Entertainment Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia foodservice market is poised for dynamic growth, driven by urbanization, rising incomes, and a burgeoning tourism sector. As consumer preferences shift towards health-conscious and sustainable dining options, foodservice providers must adapt to these trends. The integration of technology in service delivery, such as mobile ordering and contactless payments, will enhance customer experiences. Additionally, the expansion of food delivery services will continue to reshape the market landscape, providing new avenues for growth and innovation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants Quick Service Restaurants (QSR) Cafés, Coffee Shops & Juice Bars Cloud Kitchens (Virtual Kitchens) Catering Services Food Trucks Institutional Foodservice Others |

| By End-User | Individual Consumers Corporates Educational Institutions Healthcare Facilities Government Entities Others |

| By Sales Channel | Online Delivery Platforms Direct Sales (On-Premise) Third-Party Distributors Retail Outlets Others |

| By Cuisine Type | Middle Eastern (Saudi, Levantine, etc.) Asian (Indian, Chinese, Japanese, etc.) Western (European, North American, etc.) Fast Food (Burgers, Pizza, Fried Chicken, etc.) Others |

| By Service Style | Dine-In Takeaway Delivery Drive-Thru Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Location | Urban Areas Suburban Areas Rural Areas Tourist Destinations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Quick Service Restaurants | 100 | Franchise Owners, Store Managers |

| Full Service Restaurants | 80 | Restaurant Owners, Head Chefs |

| Catering Services | 50 | Catering Managers, Event Planners |

| Food Delivery Services | 70 | Operations Managers, Marketing Directors |

| Food Trucks and Street Vendors | 40 | Owner-Operators, Local Entrepreneurs |

The Saudi Arabia Foodservice Market is valued at approximately USD 31.7 billion, driven by factors such as population growth, urbanization, and increasing disposable incomes, alongside a shift in consumer preferences towards dining out and food delivery services.