Japan Air Cargo Market Overview

- The Japan Air Cargo Market is valued at approximately USD 18.9 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for e-commerce, globalization of trade, and advancements in logistics technology. The rise in international trade and the need for faster delivery services have significantly contributed to the market's expansion. Cross-border e-commerce purchases in Japan reached USD 3.2 billion in 2023, reflecting a 6.4% increase year-over-year, further accelerating demand for reliable air cargo solutions.

- Tokyo, Osaka, and Nagoya are the dominant cities in the Japan Air Cargo Market due to their strategic locations, well-developed infrastructure, and proximity to major manufacturing hubs. These cities serve as critical logistics centers, facilitating efficient air cargo operations and connecting Japan to global markets. Tokyo Narita, Haneda, and Kansai airports function as primary hubs, with Kansai and Kyushu airports investing heavily in temperature-controlled cargo bays to support high-value semiconductor, biotech, and pharmaceutical exports.

- Japan's air cargo operations are governed by international security standards and compliance frameworks established through bilateral and multilateral aviation agreements. Air cargo operators must adhere to advanced screening technologies and international security protocols, ensuring the safety and reliability of air freight services. These requirements align with IATA standards and Japanese civil aviation regulations, supporting secure and efficient cargo handling across domestic and international routes.

Japan Air Cargo Market Segmentation

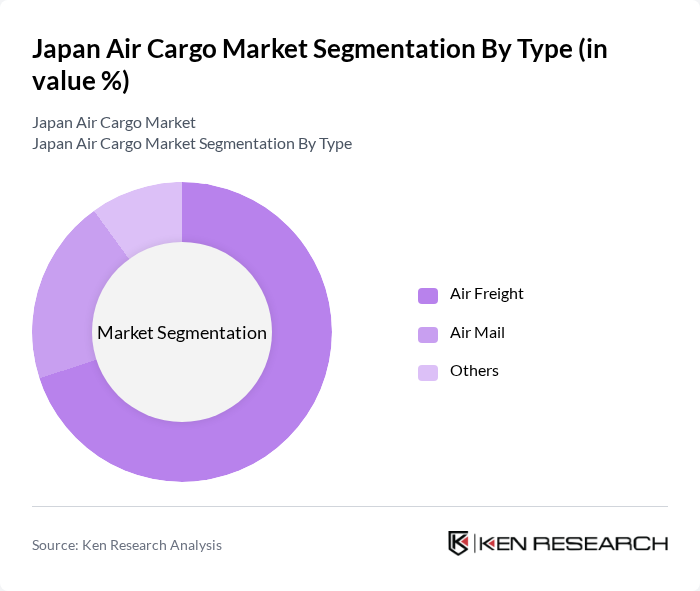

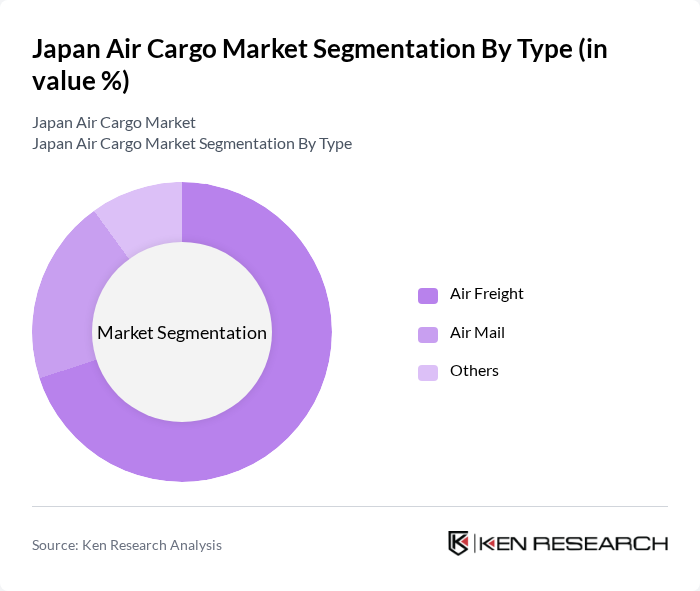

By Type:The air cargo market is segmented into Air Freight, Air Mail, and Others. Air Freight dominates the market due to its broad applicability across multiple industries, including retail, manufacturing, electronics, and automotive sectors. The increasing demand for quick and reliable shipping solutions for high-value goods, semiconductors, and e-commerce products has led to a surge in air freight shipments, making it the critical segment in the air cargo landscape.

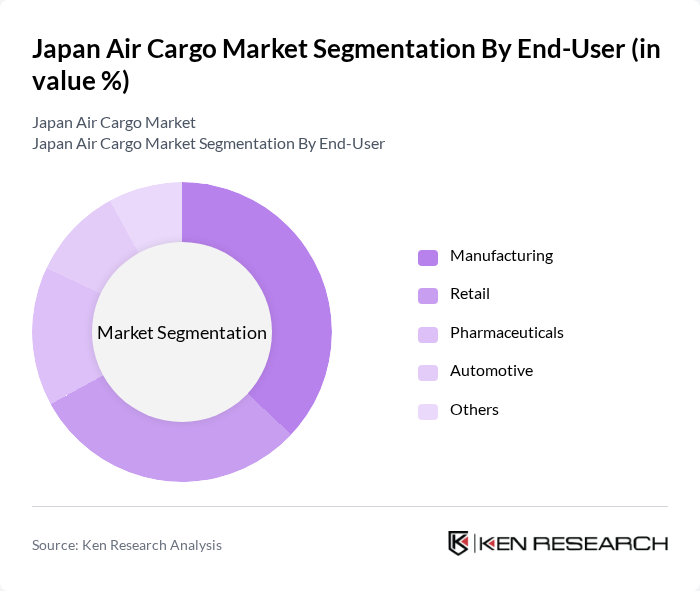

By End-User:The air cargo market is also segmented by end-user industries, including Manufacturing, Retail, Pharmaceuticals, Automotive, and Others. Manufacturing accounted for 37.41% of Japan's freight and logistics market in 2025, reflecting the country's export-oriented automotive, electronics, and precision machinery complexes. The sector relies on synchronized parts-sequencing and vendor-managed inventory programs to meet tight production cycles. Retail remains a significant segment, driven by rapid e-commerce growth and consumer demand for fast delivery services, with retailers increasingly relying on air cargo to ensure timely product delivery.

Japan Air Cargo Market Competitive Landscape

The Japan Air Cargo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Cargo Airlines, Japan Airlines Cargo, All Nippon Airways Cargo, Yamato Transport Co., Ltd., Sagawa Express Co., Ltd., DHL Aviation, FedEx Express, UPS Airlines, Kintetsu World Express, Japan Post Co., Ltd., ANA Cargo, JAL Cargo, Nippon Express, Seino Transportation, Tohoku Express contribute to innovation, geographic expansion, and service delivery in this space. ANA Cargo and Nippon Cargo Airlines lead in electronics, automotive, and precision machinery transport, while cold chain logistics support seafood and pharmaceutical shipments.

Japan Air Cargo Market Industry Analysis

Growth Drivers

- Increasing E-commerce Demand:The Japanese e-commerce market is projected to reach ¥20 trillion (approximately $180 billion) in future, driven by a surge in online shopping. This growth is expected to increase air cargo volumes significantly, as e-commerce relies heavily on fast and reliable delivery services. The demand for air freight is further supported by the need for quick delivery of high-value goods, which is essential for maintaining customer satisfaction in the competitive e-commerce landscape.

- Expansion of Global Trade:Japan's exports are anticipated to grow by 3.5% in future, reaching ¥80 trillion (around $720 billion). This expansion in global trade necessitates efficient logistics solutions, with air cargo playing a crucial role in transporting goods quickly across international borders. The increasing demand for Japanese products, particularly in Asia and North America, is expected to further boost air cargo volumes, enhancing the overall market dynamics.

- Technological Advancements in Logistics:The logistics sector in Japan is investing heavily in technology, with an estimated ¥1.5 trillion ($13.5 billion) allocated for digital transformation in future. Innovations such as automated sorting systems and real-time tracking are enhancing operational efficiency and reducing transit times. These advancements are critical for air cargo operators, as they improve service reliability and customer satisfaction, ultimately driving market growth in the air cargo sector.

Market Challenges

- High Operational Costs:The air cargo industry in Japan faces significant operational costs, with fuel prices projected to average ¥150 per liter ($1.35) in future. Additionally, labor costs are rising, with an average salary for logistics workers expected to reach ¥4 million ($36,000) annually. These high costs can erode profit margins for air cargo operators, making it challenging to remain competitive in a price-sensitive market.

- Regulatory Compliance Issues:The air cargo sector in Japan is subject to stringent regulations, including security and safety standards. Compliance with these regulations often requires substantial investment, estimated at ¥200 billion ($1.8 billion) annually. The complexity of navigating these regulations can pose challenges for air cargo operators, particularly smaller companies that may lack the resources to ensure compliance, potentially limiting their market participation.

Japan Air Cargo Market Future Outlook

The Japan air cargo market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As e-commerce continues to thrive, air cargo operators will increasingly adopt automation and AI to enhance efficiency and reduce costs. Furthermore, the focus on sustainability will likely lead to the adoption of greener practices, such as the use of biofuels and electric vehicles, aligning with global environmental goals. These trends will shape the future landscape of the air cargo industry in Japan.

Market Opportunities

- Growth in Cold Chain Logistics:The cold chain logistics market in Japan is expected to grow to ¥1 trillion ($9 billion) in future, driven by increasing demand for perishable goods. This growth presents a significant opportunity for air cargo operators to expand their services, catering to sectors such as pharmaceuticals and food, which require temperature-controlled transportation.

- Partnerships with E-commerce Platforms:Collaborations with major e-commerce platforms can enhance air cargo operators' market reach. With Japan's e-commerce sales projected to grow by 10% annually, strategic partnerships can facilitate faster delivery options and improve service offerings, positioning air cargo companies to capitalize on the booming online retail market.