Region:Middle East

Author(s):Rebecca

Product Code:KRAC9767

Pages:85

Published On:November 2025

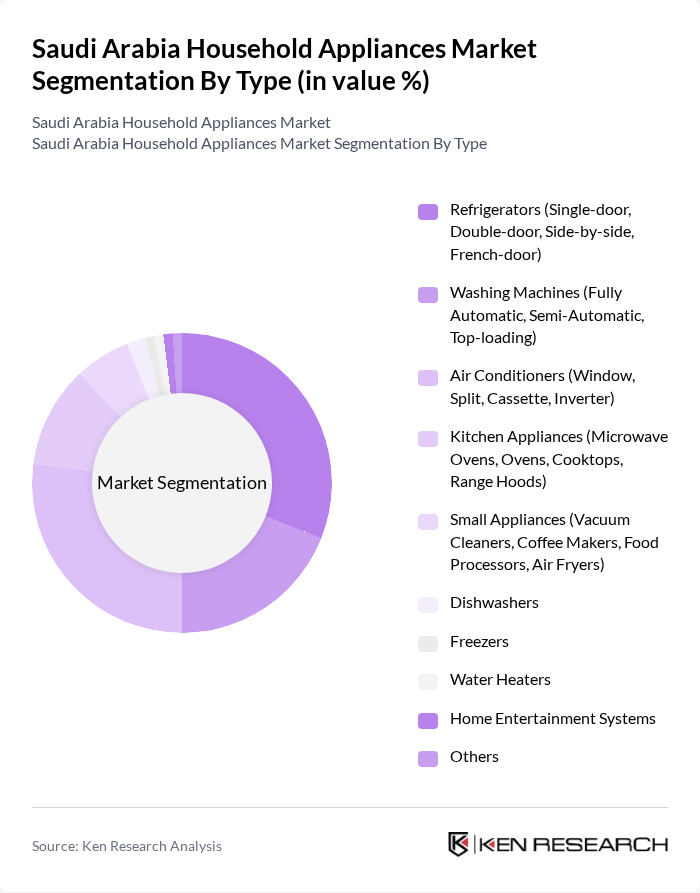

By Type:The market is segmented into various types of household appliances, including refrigerators, washing machines, air conditioners, kitchen appliances, small appliances, dishwashers, freezers, water heaters, home entertainment systems, and others. Among these, refrigerators and air conditioners are particularly dominant due to the extreme climate conditions in Saudi Arabia, which necessitate effective cooling solutions. The trend towards smart appliances is also gaining traction, with consumers increasingly seeking connectivity, automation, and energy efficiency in their purchases.

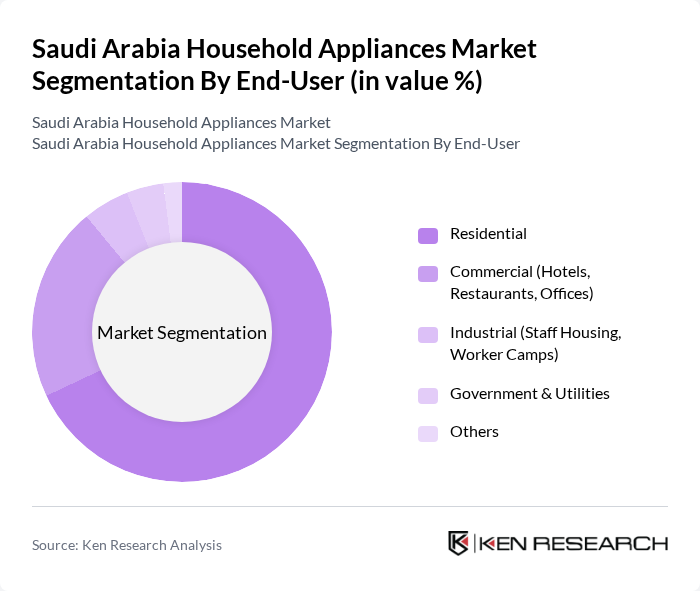

By End-User:The household appliances market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment holds the largest share, driven by the increasing number of households, rising urban migration, and the growing trend of home renovations and smart home adoption. Commercial establishments, including hotels, restaurants, and offices, also contribute significantly to the demand for appliances, particularly in urban areas where hospitality and dining experiences are expanding.

The Saudi Arabia Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Haier Electronics Group Co Ltd, Electrolux AB, Bosch Siemens Hausgeräte GmbH (BSH), Midea Group, Sharp Corporation, Arçelik A.?., Gree Electric Appliances Inc., TCL Technology, Hisense Group, Beko, Frigidaire, Al-Jabr Electronics, National Appliances Company, Al-Falak Electronic Appliances contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia household appliances market appears promising, driven by increasing urbanization and rising disposable incomes. As consumers become more tech-savvy, the demand for smart and energy-efficient appliances is expected to grow. Additionally, government initiatives aimed at promoting energy efficiency will likely enhance market dynamics. Companies that adapt to these trends and invest in innovative technologies will be well-positioned to capture emerging opportunities in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators (Single-door, Double-door, Side-by-side, French-door) Washing Machines (Fully Automatic, Semi-Automatic, Top-loading) Air Conditioners (Window, Split, Cassette, Inverter) Kitchen Appliances (Microwave Ovens, Ovens, Cooktops, Range Hoods) Small Appliances (Vacuum Cleaners, Coffee Makers, Food Processors, Air Fryers) Dishwashers Freezers Water Heaters Home Entertainment Systems Others |

| By End-User | Residential Commercial (Hotels, Restaurants, Offices) Industrial (Staff Housing, Worker Camps) Government & Utilities Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Distribution Channel | Supermarkets & Hypermarkets Convenience Stores Specialty Stores Online Retail/E-commerce Platforms Direct Sales Others |

| By Brand | Local Brands (e.g., Al-Jabr, Al-Falak, National Appliances) International Brands Private Labels Others |

| By Energy Efficiency Rating | A++ A+ B Others |

| By Material | Plastic Metal Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refrigerators | 100 | Homeowners, Renters |

| Market Insights on Washing Machines | 90 | Families, Single Professionals |

| Trends in Kitchen Appliances | 60 | Home Chefs, Culinary Enthusiasts |

| Consumer Attitudes towards Energy Efficiency | 50 | Environmentally Conscious Consumers |

| Impact of E-commerce on Appliance Purchases | 40 | Online Shoppers, Tech-Savvy Consumers |

The Saudi Arabia Household Appliances Market is valued at approximately USD 4.3 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for energy-efficient and smart appliances.