Region:Global

Author(s):Geetanshi

Product Code:KRAA5969

Pages:83

Published On:January 2026

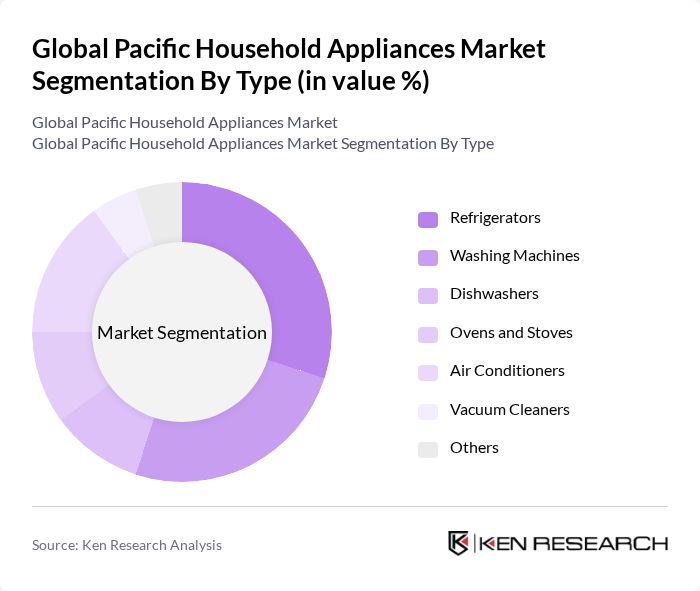

By Type:The market is segmented into various types of household appliances, including refrigerators, washing machines, dishwashers, ovens and stoves, air conditioners, small kitchen appliances, and others. Among these, refrigerators and washing machines dominate the market due to their essential nature in daily household activities. The increasing demand for energy-efficient and smart appliances is also driving growth in these segments.

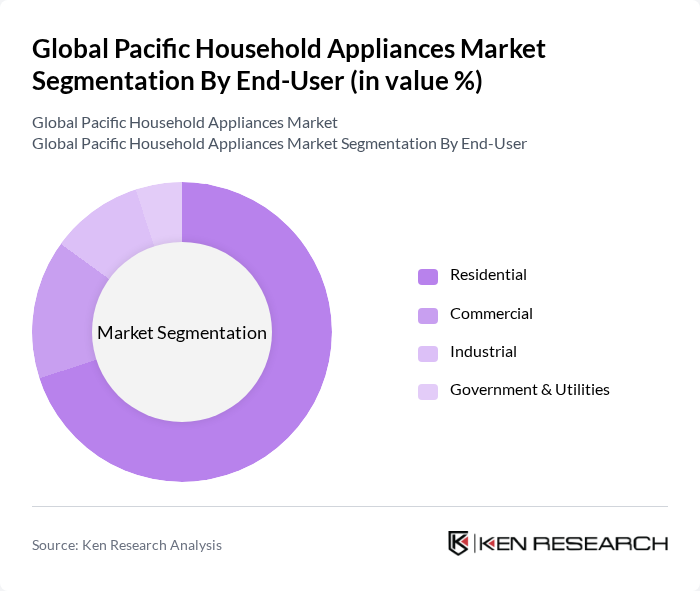

By End-User:The household appliances market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment holds the largest share, driven by increasing urbanization and the growing trend of smart homes. The demand for energy-efficient appliances in residential settings is also a significant factor contributing to the growth of this segment.

The Global Pacific Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, LG Electronics, Samsung Electronics, Electrolux, Bosch, Panasonic, Haier, GE Appliances, Miele, Sharp Corporation, Frigidaire, Siemens, TCL, Hisense, KitchenAid contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household appliances market in the Asia-Pacific region is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of smart home technologies and AI is expected to enhance product functionality and user experience, making appliances more appealing. Additionally, sustainability will play a crucial role, with consumers increasingly prioritizing energy-efficient and eco-friendly products. As urbanization continues, the demand for innovative and convenient appliances will likely rise, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators Washing Machines Dishwashers Ovens and Stoves Air Conditioners Small Kitchen Appliances Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale Others |

| By Price Range | Budget Appliances Mid-Range Appliances Premium Appliances Luxury Appliances Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers Others |

| By Technological Features | Smart Appliances Energy-Efficient Appliances Multi-Functional Appliances Others |

| By Material Used | Stainless Steel Plastic Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 150 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 120 | Home Appliance Users, Market Analysts |

| Microwave Oven Usage Trends | 100 | Kitchen Appliance Retailers, Consumer Survey Participants |

| Energy Efficiency in Household Appliances | 80 | Sustainability Experts, Regulatory Officials |

| Smart Appliance Adoption Rates | 90 | Tech-savvy Consumers, Industry Innovators |

The Global Pacific Household Appliances Market is valued at approximately USD 150 billion, driven by rising disposable incomes and urbanization in Asia-Pacific economies, alongside the growing demand for both essential and premium appliances.