Region:Global

Author(s):Geetanshi

Product Code:KRAC9405

Pages:88

Published On:November 2025

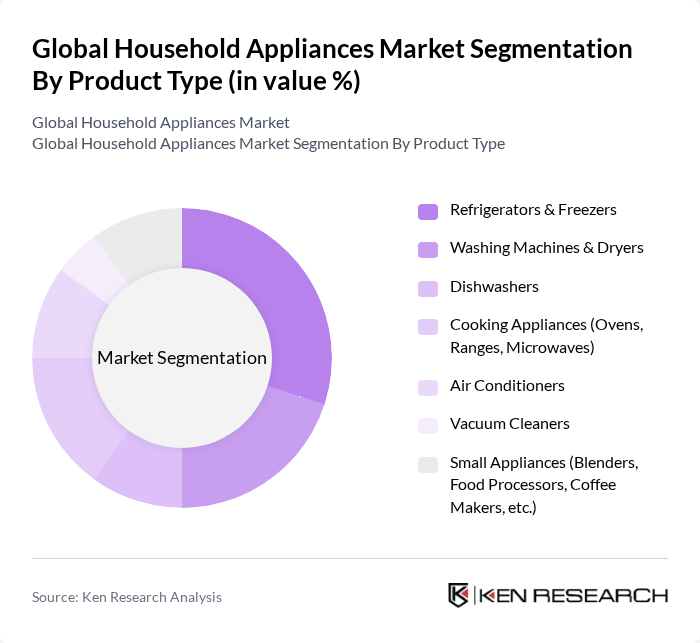

By Product Type:The product type segmentation includes various categories of household appliances that cater to different consumer needs. The major subsegments are Refrigerators & Freezers, Washing Machines & Dryers, Dishwashers, Cooking Appliances (Ovens, Ranges, Microwaves), Air Conditioners, Vacuum Cleaners, and Small Appliances (Blenders, Food Processors, Coffee Makers, etc.). Among these, Refrigerators & Freezers hold the largest share due to their essential role in food preservation, the growing demand for energy-efficient models, and the increasing adoption of smart, connected appliances. The trend towards smart appliances and built-in models is also influencing consumer preferences, leading to increased sales in this category .

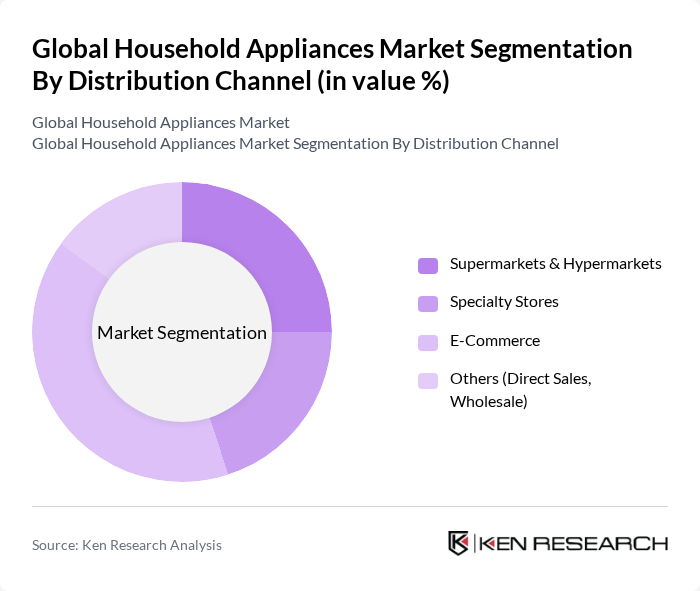

By Distribution Channel:The distribution channel segmentation encompasses various methods through which household appliances reach consumers. This includes Supermarkets & Hypermarkets, Specialty Stores, E-Commerce, and Others (Direct Sales, Wholesale). E-Commerce has emerged as a leading channel due to the convenience it offers consumers, the growing trend of online shopping, and the expansion of digital retail infrastructure. The COVID-19 pandemic accelerated this shift, resulting in a significant increase in online sales of household appliances. E-Commerce now accounts for the largest share among distribution channels, reflecting changing consumer purchasing behaviors .

The Global Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics Co., Ltd., LG Electronics Inc., BSH Hausgeräte GmbH (Bosch & Siemens Home Appliances), Electrolux AB, Panasonic Corporation, Haier Smart Home Co., Ltd., Miele & Cie. KG, GE Appliances (a Haier company), Frigidaire (Electrolux brand), Sharp Corporation, Toshiba Corporation, Kenmore (Sears brand), Beko (Arçelik A.?.), Hisense Group, Midea Group Co., Ltd., Gorenje Group, Hitachi, Ltd., Glen Dimplex Group, Breville Group Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the household appliances market in None appears promising, driven by technological innovations and changing consumer preferences. As smart home technology continues to evolve, manufacturers are expected to invest heavily in IoT-enabled appliances, enhancing connectivity and user experience. Additionally, the increasing focus on sustainability will likely lead to a rise in demand for energy-efficient products, aligning with global environmental goals. These trends indicate a dynamic market landscape poised for growth and transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Refrigerators & Freezers Washing Machines & Dryers Dishwashers Cooking Appliances (Ovens, Ranges, Microwaves) Air Conditioners Vacuum Cleaners Small Appliances (Blenders, Food Processors, Coffee Makers, etc.) |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores E-Commerce Others (Direct Sales, Wholesale) |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Technology | Smart Appliances Energy-Efficient Appliances IoT-Enabled Appliances Automation Technology |

| By Application | Kitchen Appliances Laundry Appliances Cleaning Appliances Climate Control Appliances |

| By End-User | Residential Commercial Industrial |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits (RECs) Grants and Funding Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refrigerator Market Insights | 100 | Product Managers, Retail Buyers |

| Washing Machine Consumer Preferences | 80 | Home Appliance Users, Market Analysts |

| Smart Appliance Adoption Trends | 60 | Tech-Savvy Consumers, Industry Experts |

| Energy Efficiency in Appliances | 50 | Sustainability Officers, Energy Consultants |

| Market Entry Strategies for New Brands | 40 | Entrepreneurs, Business Development Managers |

The Global Household Appliances Market is valued at approximately USD 705 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, urbanization, and technological advancements in home automation.