Region:Middle East

Author(s):Rebecca

Product Code:KRAC9751

Pages:82

Published On:November 2025

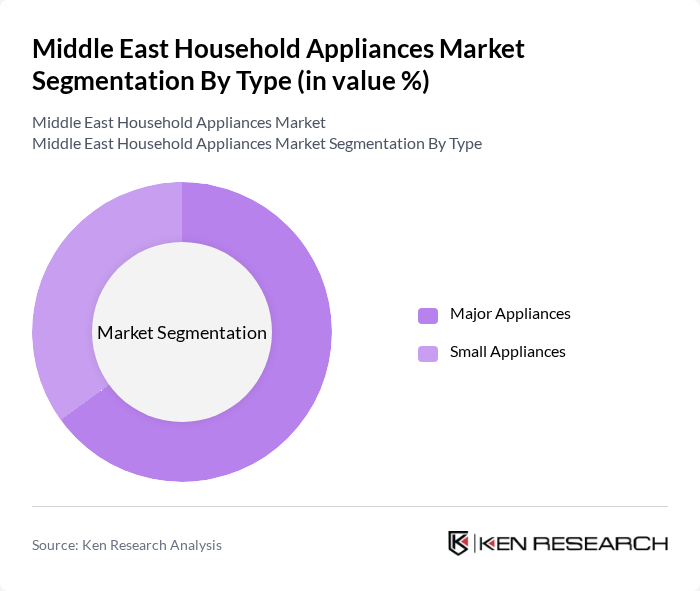

By Type:

The market is segmented into Major Appliances and Small Appliances. Major Appliances, which include large items like refrigerators, washing machines, and air conditioners, dominate the market due to their essential role in daily household activities and the region’s climate-driven demand for cooling solutions. The increasing adoption of home automation and smart technology integration has led to a surge in demand for these appliances. Small Appliances, such as coffee makers, vacuum cleaners, and food processors, are gaining traction as consumers seek convenience, efficiency, and multifunctionality in their daily routines. The expanding urban population and evolving lifestyles further support the growth of both segments.

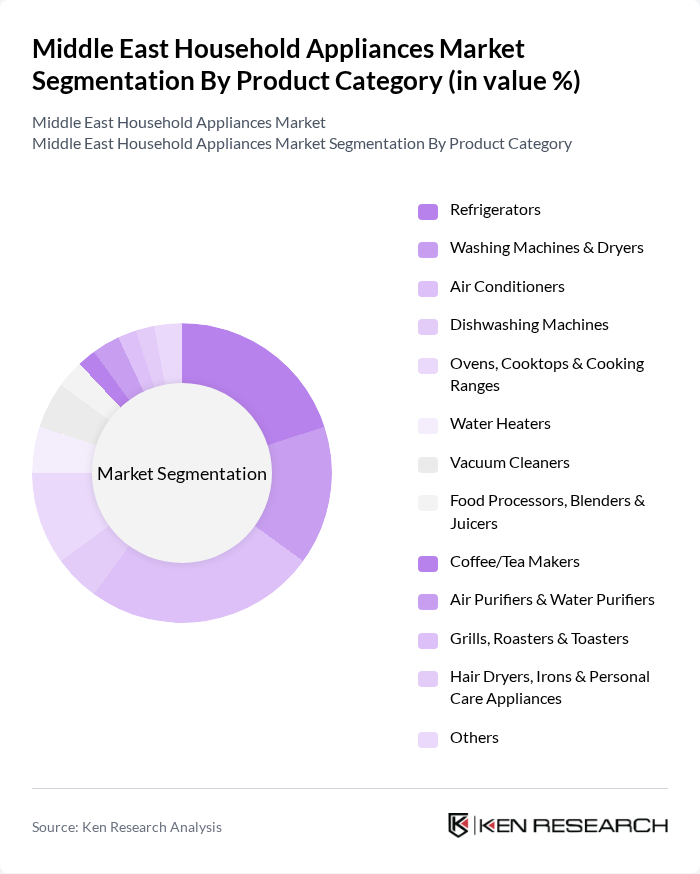

By Product Category:

The product category segmentation includes Refrigerators, Washing Machines & Dryers, Air Conditioners, Dishwashing Machines, Ovens, Cooktops & Cooking Ranges, Water Heaters, Vacuum Cleaners, Food Processors, Blenders & Juicers, Coffee/Tea Makers, Air Purifiers & Water Purifiers, Grills, Roasters & Toasters, Hair Dryers, Irons & Personal Care Appliances, and Others. Refrigerators and Air Conditioners are the leading products due to their necessity in hot climates and high penetration rates in urban households. The demand for smart and energy-efficient appliances is rising, driven by regulatory standards and consumer awareness. Multifunctional appliances and those with connectivity features are shaping consumer preferences, supporting growth across all categories.

The Middle East Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics, Samsung Electronics, Whirlpool Corporation, Bosch Home Appliances (Robert Bosch GmbH), Electrolux, Panasonic, Haier Group, Midea Group, Sharp Corporation, Gree Electric Appliances, Arçelik A.?., Beko, Hisense, TCL Technology, Hitachi Ltd., Nikai Group, Daewoo Electronics, Super General Company, Siemens Home Appliances, Philips (Koninklijke Philips N.V.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East household appliances market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for modern appliances will likely increase, particularly in smart home technologies. Additionally, government initiatives aimed at promoting energy efficiency will further stimulate market growth. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture emerging opportunities in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Major Appliances Small Appliances |

| By Product Category | Refrigerators Washing Machines & Dryers Air Conditioners Dishwashing Machines Ovens, Cooktops & Cooking Ranges Water Heaters Vacuum Cleaners Food Processors, Blenders & Juicers Coffee/Tea Makers Air Purifiers & Water Purifiers Grills, Roasters & Toasters Hair Dryers, Irons & Personal Care Appliances Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya, Sudan) |

| By Technology | Energy-Efficient Technologies Smart Technologies Traditional Technologies |

| By Application | Kitchen Appliances Laundry Appliances Climate Control Appliances Others |

| By Distribution Channel | Online Offline (Supermarkets & Hypermarkets, Specialty Stores, Others) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Credits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refrigerators | 120 | Homeowners, Renters |

| Market Insights on Washing Machines | 100 | Families, Single Professionals |

| Air Conditioner Purchase Behavior | 80 | Homeowners, Property Managers |

| Trends in Kitchen Appliances | 60 | Home Cooks |

| Consumer Attitudes towards Smart Appliances | 70 | Tech-savvy Consumers, Early Adopters |

The Middle East Household Appliances Market is valued at approximately USD 34 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for energy-efficient and smart appliances.