Region:Middle East

Author(s):Dev

Product Code:KRAA3547

Pages:84

Published On:September 2025

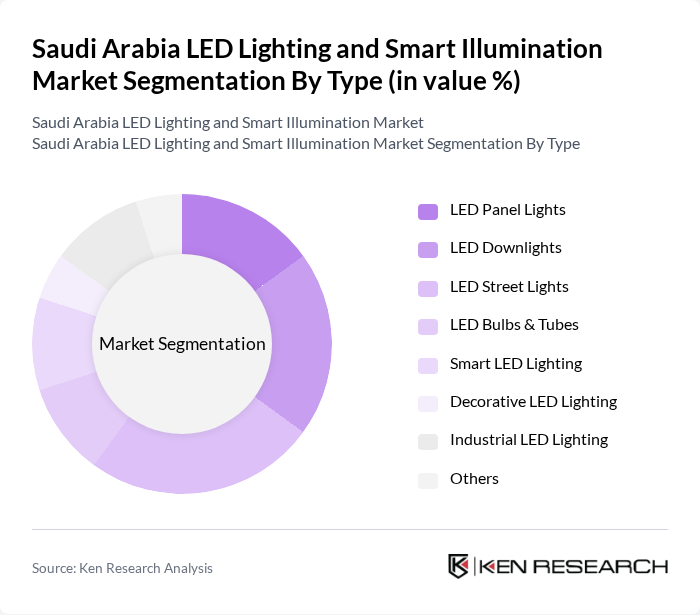

By Type:The market is segmented into various types of LED lighting solutions, including LED Panel Lights, LED Downlights, LED Street Lights, LED Bulbs & Tubes, Smart LED Lighting, Decorative LED Lighting, Industrial LED Lighting, and Others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall market dynamics.

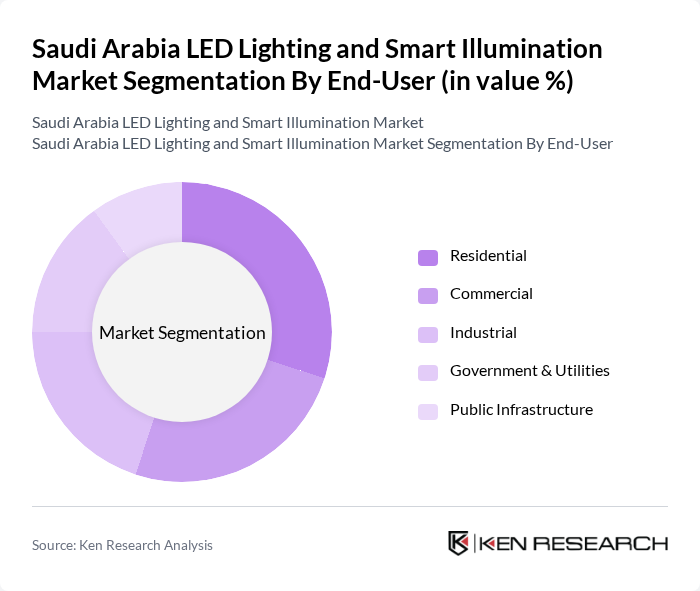

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Public Infrastructure. Each segment has unique requirements and preferences, influencing the types of LED lighting solutions adopted in various applications.

The Saudi Arabia LED Lighting and Smart Illumination Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Lighting Company, Philips Lighting Saudi Arabia Company (Signify), Osram Middle East, General Electric Company (GE Saudi Arabia), Al Nasser Group, Zumtobel Lighting Saudi Arabia, Alfanar, Cinmar Lighting Systems, Huda Lighting, Al AbdulKarim Trading Company, Zubair Electric Group, Cooper Lighting (Eaton Corporation), Tridonic, Legrand, Lutron Electronics, Panasonic Corporation, Toshiba Lighting contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia LED lighting and smart illumination market appears promising, driven by technological advancements and government support. As urbanization accelerates, the demand for smart lighting solutions is expected to rise, particularly in newly developed commercial and residential areas. Additionally, the integration of IoT technologies will enhance user experience and energy management, making smart illumination systems more appealing. Continued investment in renewable energy sources will further bolster the market, aligning with national sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Panel Lights LED Downlights LED Street Lights LED Bulbs & Tubes Smart LED Lighting Decorative LED Lighting Industrial LED Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities Public Infrastructure |

| By Application | General Lighting Architectural Lighting Landscape Lighting Automotive Lighting Street & Highway Lighting |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors E-Commerce |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Component | LED Chips Drivers Fixtures Sensors & Controls |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LED Lighting Adoption | 120 | Homeowners, Property Managers |

| Commercial Lighting Solutions | 90 | Facility Managers, Business Owners |

| Public Infrastructure Projects | 60 | City Planners, Government Officials |

| Smart Illumination Technologies | 50 | Technology Integrators, Urban Developers |

| Energy Efficiency Initiatives | 55 | Energy Auditors, Sustainability Consultants |

The Saudi Arabia LED Lighting and Smart Illumination Market is valued at approximately USD 1.5 billion, driven by the demand for energy-efficient lighting solutions and government initiatives promoting sustainable practices.