Region:Africa

Author(s):Dev

Product Code:KRAA6386

Pages:95

Published On:September 2025

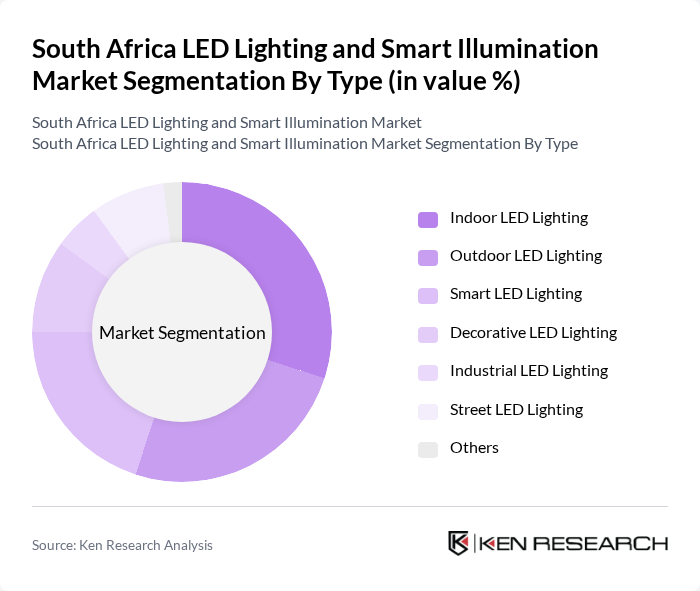

By Type:The market is segmented into various types of LED lighting solutions, including Indoor LED Lighting, Outdoor LED Lighting, Smart LED Lighting, Decorative LED Lighting, Industrial LED Lighting, Street LED Lighting, and Others. Each sub-segment caters to specific consumer needs and preferences, with Indoor and Outdoor LED Lighting being the most widely adopted due to their versatility and energy efficiency.

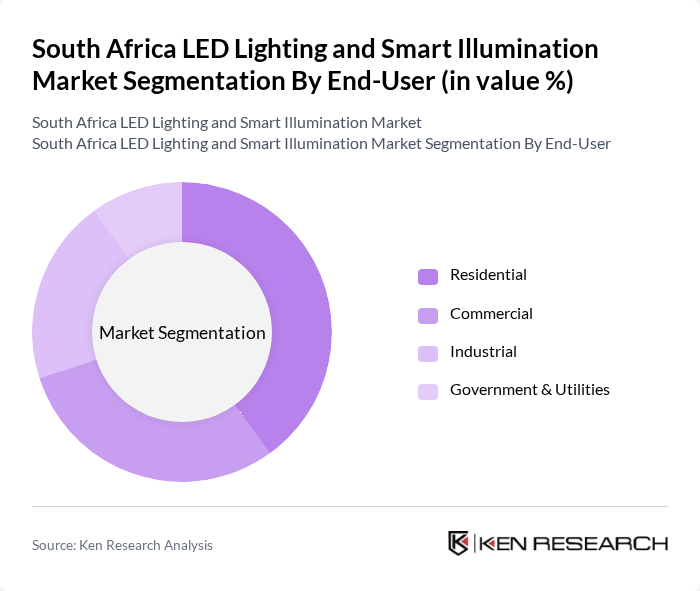

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is currently leading the market due to the growing trend of energy-efficient home solutions and the increasing awareness of sustainable living among consumers.

The South Africa LED Lighting and Smart Illumination Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Lighting South Africa, Osram South Africa, General Electric South Africa, Cree South Africa, Zumtobel Group, Acuity Brands, Signify South Africa, Thorn Lighting, Tridonic, Dialight, Sylvania Lighting, LEDVANCE, FSL Lighting, Eveready South Africa, Luminus Devices contribute to innovation, geographic expansion, and service delivery in this space.

The South African LED lighting and smart illumination market is poised for significant growth, driven by increasing energy efficiency awareness and government support. As urbanization accelerates, the demand for sustainable lighting solutions will rise, particularly in smart city initiatives. The integration of IoT technologies will further enhance the appeal of LED systems, making them more attractive to consumers. In the near future, the market is expected to witness a shift towards energy-as-a-service models, promoting long-term sustainability and efficiency in lighting solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Indoor LED Lighting Outdoor LED Lighting Smart LED Lighting Decorative LED Lighting Industrial LED Lighting Street LED Lighting Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | General Lighting Task Lighting Ambient Lighting Emergency Lighting |

| By Distribution Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Component | LED Chips Drivers Fixtures |

| By Policy Support | Subsidies Tax Exemptions RECs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial LED Lighting Adoption | 150 | Facility Managers, Energy Efficiency Consultants |

| Smart Illumination Projects in Urban Areas | 100 | City Planners, Municipal Engineers |

| Residential LED Lighting Preferences | 120 | Homeowners, Interior Designers |

| Public Infrastructure Lighting Solutions | 80 | Government Officials, Project Managers |

| Retail Sector LED Implementation | 90 | Store Managers, Retail Operations Directors |

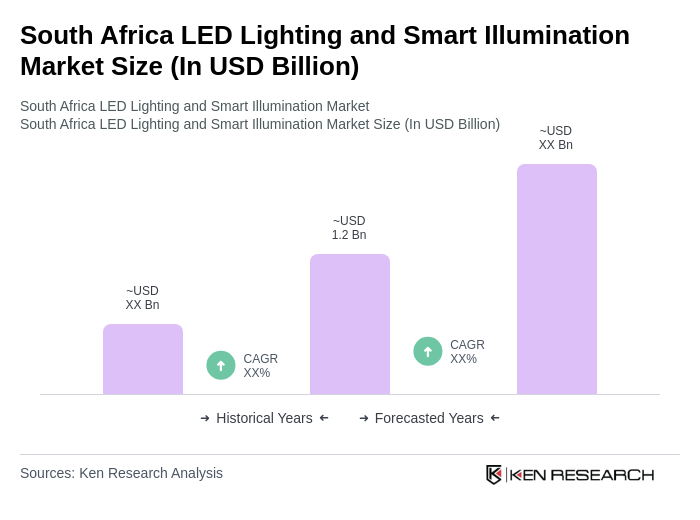

The South Africa LED Lighting and Smart Illumination Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by urbanization, government initiatives for energy efficiency, and increasing demand for smart lighting solutions in residential and commercial sectors.