Region:Asia

Author(s):Shubham

Product Code:KRAB1129

Pages:90

Published On:October 2025

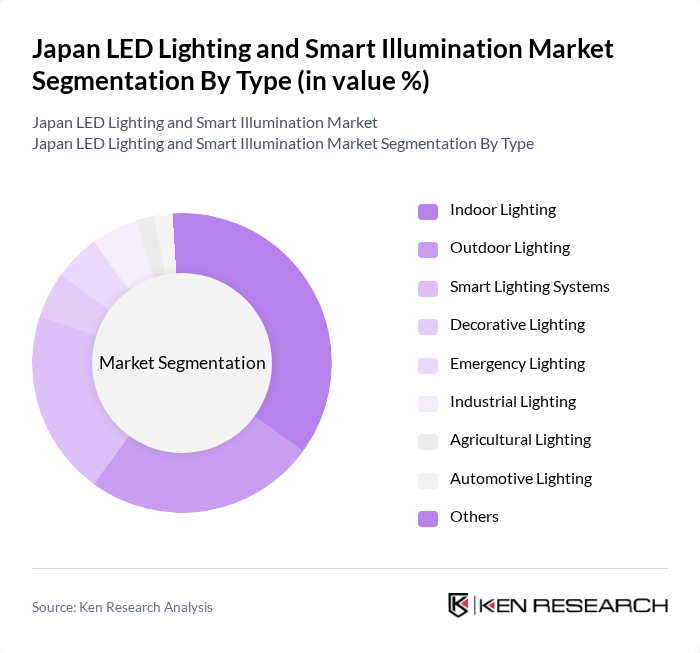

By Type:

The market is segmented into various types, including Indoor Lighting, Outdoor Lighting, Smart Lighting Systems, Decorative Lighting, Emergency Lighting, Industrial Lighting, Agricultural Lighting, Automotive Lighting, and Others. Among these, Indoor Lighting is the leading sub-segment, driven by the growing trend of smart homes and the increasing adoption of energy-efficient solutions in residential and commercial spaces. The demand for smart lighting systems is also on the rise, as consumers seek enhanced control and customization of their lighting environments.

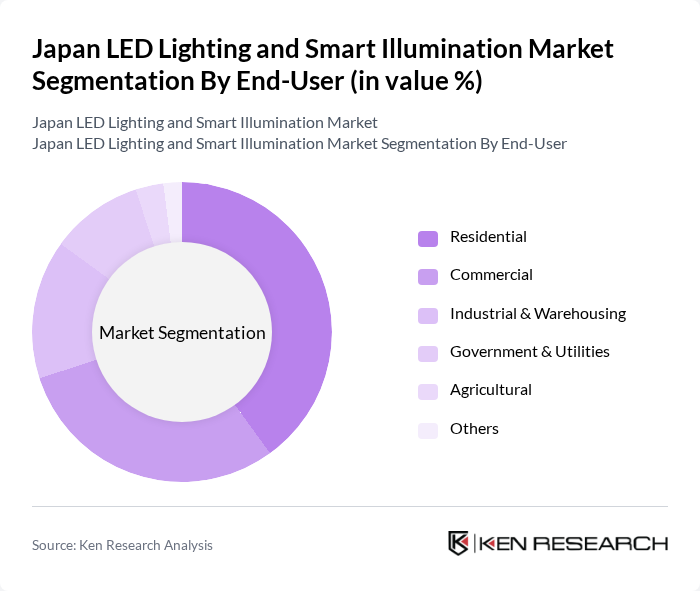

By End-User:

The market is segmented by end-users into Residential, Commercial, Industrial & Warehousing, Government & Utilities, Agricultural, and Others. The Residential segment is the dominant sub-segment, fueled by the increasing consumer preference for energy-efficient lighting solutions and smart home technologies. The Commercial sector is also growing rapidly, as businesses seek to reduce operational costs and enhance the aesthetic appeal of their spaces through innovative lighting solutions.

The Japan LED Lighting and Smart Illumination Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Holdings Corporation, Toshiba Lighting & Technology Corporation, Nichia Corporation, Sharp Corporation, Mitsubishi Electric Corporation, Hitachi, Ltd., Koizumi Lighting Technology Corporation, Iwasaki Electric Co., Ltd., Stanley Electric Co., Ltd., Citizen Electronics Co., Ltd., Ushio Inc., Osram Opto Semiconductors GmbH, Signify Holdings (Philips Lighting), Cree Lighting, LG Innotek, Samsung Electronics Co., Ltd., Everlight Electronics Co., Ltd., Seoul Semiconductor Co., Ltd., Bridgelux, Inc., Dialight plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan LED lighting and smart illumination market appears promising, driven by increasing urbanization and a growing emphasis on sustainability. As cities expand, the demand for efficient lighting solutions will rise, particularly in smart city initiatives. Furthermore, advancements in IoT and AI technologies will enhance the functionality of lighting systems, making them more appealing to consumers. The integration of these technologies is expected to create a more connected and energy-efficient urban environment, fostering further market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Indoor Lighting Outdoor Lighting Smart Lighting Systems Decorative Lighting Emergency Lighting Industrial Lighting Agricultural Lighting Automotive Lighting Others |

| By End-User | Residential Commercial Industrial & Warehousing Government & Utilities Agricultural Others |

| By Application | Street Lighting Architectural Lighting Retail Lighting Landscape Lighting Automotive Lighting Warehouse Lighting Vertical Farming & Grow Lights Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Discount Pricing |

| By Region | Kanto (Tokyo, Yokohama, etc.) Kansai (Osaka, Kyoto, Kobe, etc.) Chubu (Nagoya, Shizuoka, etc.) Kyushu Hokkaido Shikoku Tohoku Others |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential LED Lighting Users | 100 | Homeowners, Renters |

| Commercial Lighting Decision Makers | 80 | Facility Managers, Procurement Officers |

| Industrial LED Solutions Implementers | 60 | Operations Managers, Plant Engineers |

| Smart City Project Stakeholders | 50 | Urban Planners, Government Officials |

| Retail Sector Lighting Managers | 40 | Store Managers, Visual Merchandisers |

The Japan LED Lighting and Smart Illumination Market is valued at approximately USD 3.4 billion, reflecting a significant shift towards energy-efficient lighting solutions and advancements in smart technology, driven by urbanization and government initiatives promoting sustainability.