Region:Middle East

Author(s):Rebecca

Product Code:KRAA9350

Pages:94

Published On:November 2025

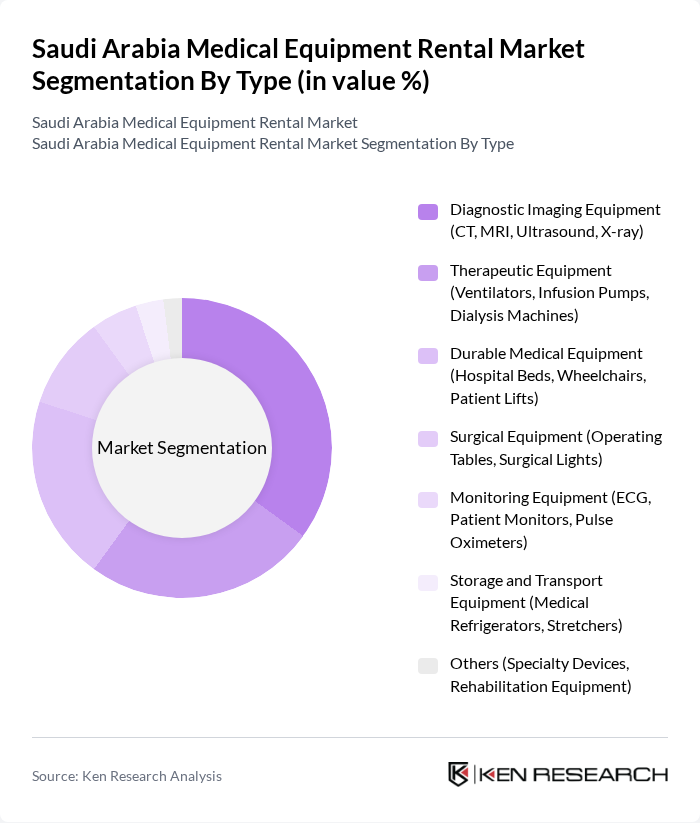

By Type:The market is segmented into various types of medical equipment, including diagnostic imaging equipment, therapeutic equipment, durable medical equipment, surgical equipment, monitoring equipment, storage and transport equipment, and others.Diagnostic imaging equipmentis currently the leading segment, driven by the rising demand for accurate diagnostics and the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions. The trend toward outpatient care and home healthcare services is also fueling demand fordurable medical equipment, including hospital beds, wheelchairs, and patient lifts .

By End-User:The end-user segmentation includes hospitals, clinics, home care providers, rehabilitation centers, diagnostic centers, long-term care facilities, and others.Hospitalsare the dominant end-user segment, supported by the increasing number of patient admissions and the need for high-quality medical equipment. The growing trend of home healthcare services is also contributing to the rise ofhome care providersas a significant segment, reflecting the shift toward outpatient and remote care models .

The Saudi Arabia Medical Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Faisaliah Medical Systems, Gulf Medical Company, Al Nahdi Medical Company, United Medical Supplies, Al-Dawaa Pharmacies, Mediserv Medical Supplies, Al-Jazeera Medical Equipment, Siemens Healthineers Saudi Arabia, GE Healthcare Saudi Arabia, Philips Healthcare Saudi Arabia, Johnson & Johnson Medical Saudi Arabia, B. Braun Medical Saudi Arabia, Fresenius Medical Care Saudi Arabia, Stryker Saudi Arabia, Baxter Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia medical equipment rental market is poised for significant transformation, driven by technological advancements and evolving patient needs. The integration of telemedicine and IoT technologies is expected to enhance service delivery, allowing for real-time monitoring and improved patient outcomes. Additionally, as the healthcare landscape shifts towards outpatient care, rental services will become increasingly vital, providing flexible solutions that cater to the growing demand for home healthcare and chronic disease management.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Imaging Equipment (CT, MRI, Ultrasound, X-ray) Therapeutic Equipment (Ventilators, Infusion Pumps, Dialysis Machines) Durable Medical Equipment (Hospital Beds, Wheelchairs, Patient Lifts) Surgical Equipment (Operating Tables, Surgical Lights) Monitoring Equipment (ECG, Patient Monitors, Pulse Oximeters) Storage and Transport Equipment (Medical Refrigerators, Stretchers) Others (Specialty Devices, Rehabilitation Equipment) |

| By End-User | Hospitals Clinics Home Care Providers Rehabilitation Centers Diagnostic Centers Long-term Care Facilities Others |

| By Equipment Condition | New Equipment Refurbished Equipment Others |

| By Rental Duration | Short-term Rentals Long-term Rentals Others |

| By Geographic Distribution | Central Region Eastern Region Western Region Southern Region Others |

| By Payment Model | Subscription-based Pay-per-use Lease-to-own Others |

| By Application Area | Emergency Services Surgical Procedures Diagnostic Testing Rehabilitation Chronic Disease Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Equipment Rental | 120 | Procurement Managers, Facility Administrators |

| Home Healthcare Equipment | 85 | Home Care Coordinators, Patient Care Managers |

| Rehabilitation Equipment Rental | 65 | Rehabilitation Specialists, Physical Therapists |

| Diagnostic Equipment Rental | 55 | Radiology Managers, Equipment Technicians |

| Long-term Care Facilities | 50 | Facility Managers, Nursing Home Administrators |

The Saudi Arabia Medical Equipment Rental Market is valued at approximately USD 0.8 billion, reflecting a five-year historical analysis. This growth is driven by increasing healthcare demands, chronic disease prevalence, and expanding healthcare infrastructure across the country.