Region:Middle East

Author(s):Shubham

Product Code:KRAD5473

Pages:93

Published On:December 2025

Market.png)

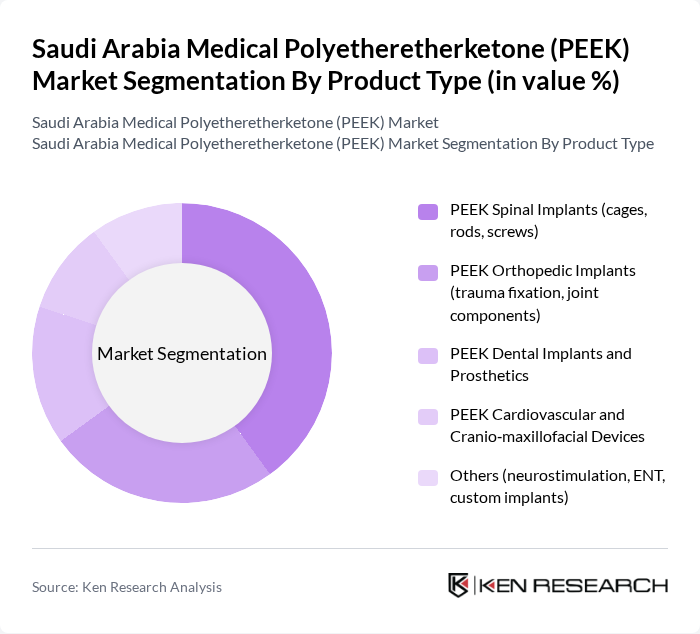

By Product Type:The product type segmentation includes various categories of PEEK-based medical devices. The leading sub-segment is PEEK Spinal Implants, which are widely used due to their excellent mechanical properties and biocompatibility. The demand for PEEK Orthopedic Implants is also significant, driven by the increasing incidence of orthopedic surgeries. PEEK Dental Implants and Prosthetics are gaining traction as dental professionals seek durable and aesthetic solutions for patients. The market for PEEK Cardiovascular and Cranio-maxillofacial Devices is growing, reflecting advancements in surgical techniques and materials. Other applications, including neurostimulation and custom implants, are also emerging.

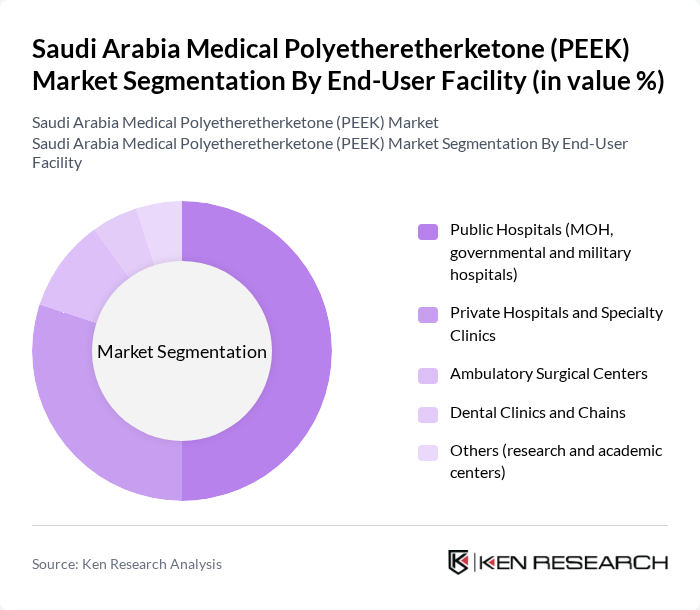

By End-User Facility:The end-user facility segmentation highlights the various healthcare settings utilizing PEEK products. Public hospitals, including those operated by the Ministry of Health, are the largest consumers due to their extensive surgical departments and patient volumes. Private hospitals and specialty clinics are also significant players, often adopting advanced technologies to attract patients. Ambulatory surgical centers are increasingly using PEEK devices for outpatient procedures, while dental clinics are expanding their offerings with PEEK dental implants. Research and academic centers contribute to the market by exploring innovative applications of PEEK in medical research.

The Saudi Arabia Medical Polyetheretherketone (PEEK) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Victrex plc (Invibio Biomaterial Solutions), Solvay S.A., Evonik Industries AG, Evonik Röhm GmbH – VESTAKEEP Medical, RTP Company, Ensinger GmbH, Jilin Joinature Polymer Co., Ltd., Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., B. Braun Melsungen AG (Aesculap), Smith & Nephew plc, NuVasive, Inc. (now part of Globus Medical), Johnson & Johnson MedTech (DePuy Synthes), Saudi Enayah Medical Company (local medical device distributor) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PEEK market in Saudi Arabia appears promising, driven by ongoing advancements in medical technology and increasing healthcare investments. As the healthcare infrastructure expands, particularly in rural areas, the demand for innovative medical solutions will rise. Furthermore, the integration of PEEK in minimally invasive surgical techniques is expected to enhance patient recovery times, making it a preferred choice among surgeons. The focus on biocompatibility and patient safety will further solidify PEEK's position in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | PEEK Spinal Implants (cages, rods, screws) PEEK Orthopedic Implants (trauma fixation, joint components) PEEK Dental Implants and Prosthetics PEEK Cardiovascular and Cranio?maxillofacial Devices Others (neurostimulation, ENT, custom implants) |

| By End-User Facility | Public Hospitals (MOH, governmental and military hospitals) Private Hospitals and Specialty Clinics Ambulatory Surgical Centers Dental Clinics and Chains Others (research and academic centers) |

| By Clinical Application | Spine Surgery Orthopedic Trauma and Joint Reconstruction Dental Restoration and Implantology Cardiovascular and Thoracic Surgery Others (CMF, neurosurgery, sports medicine) |

| By Distribution Channel | Direct Sales to Hospitals and Group Purchasing Bodies Local Medical Device Distributors/Importers OEM/Contract Manufacturing Supply E?procurement and Online Tender Platforms |

| By Region | Riyadh Region Makkah Region Madinah & Qassim Regions Eastern Province Other Regions (Northern & Southern provinces) |

| By Material Form | PEEK Granules/Compounds PEEK Rods and Bars PEEK Plates, Sheets and Films D?Printing Grade PEEK Filaments and Powders |

| By Procedure Setting | Inpatient Surgical Procedures Day?care / Outpatient Surgical Procedures Dental Chair?side Procedures Others (revision and follow?up interventions) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 100 | Surgeons specializing in joint replacement and trauma |

| Hospital Procurement Managers | 80 | Managers responsible for medical device purchasing decisions |

| Medical Device Manufacturers | 70 | Executives from companies producing PEEK-based products |

| Healthcare Policy Makers | 50 | Government officials involved in healthcare regulations |

| Clinical Researchers | 60 | Researchers focused on biomaterials and their applications in medicine |

The Saudi Arabia Medical Polyetheretherketone (PEEK) Market is valued at approximately USD 15 million, reflecting a growing demand for advanced medical implants and devices, particularly in orthopedic and spinal surgeries.