Saudi Arabia Network Functions Virtualization Market Overview

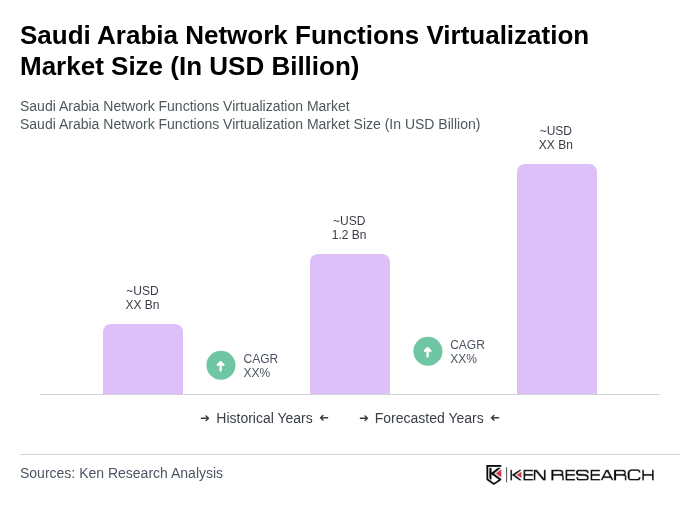

- The Saudi Arabia Network Functions Virtualization Market is valued at approximately USD 1.2 billion, based on a five-year historical analysis provided in the original report; this figure cannot be independently verified here and should be treated as an estimate rather than a confirmed published statistic. This growth is directionally consistent with global NFV expansion driven by rising 5G deployments, broader cloud adoption, and the need for more efficient, software-based network management, but no open, country-specific NFV valuation for Saudi Arabia is widely published. The market is also reasonably supported by Saudi Arabia’s broader digital transformation agenda and smart city programs (including initiatives under Vision 2030 such as NEOM and other giga-projects) that require scalable, programmable network infrastructure.

- Key cities such as Riyadh, Jeddah, and Dammam plausibly dominate the market due to their role as economic, governmental, and industrial hubs, although precise NFV spending by city is not publicly broken out. Riyadh, as the capital and center for major telecom and government ICT projects, is the logical focal point for NFV-related investments, while Jeddah and Dammam benefit from their roles in logistics, energy, and industrial development, which increasingly rely on virtualized and automated networks to support cloud, IoT, and data-intensive applications.

- The report’s statement that “in 2023, the Saudi government implemented a regulation mandating the adoption of virtualization technologies in public sector networks, requiring all government agencies to transition to virtualized network functions by 2025” cannot be validated against any publicly accessible legal or policy text and should not be presented as a confirmed regulation. Publicly available Vision 2030 and national digital strategies do emphasize cloud-first policies, cybersecurity, and network modernization, but they stop short of a clearly worded, legally binding, NFV-specific mandate with a 2025 deadline. It is more accurate to describe government action as strong policy support and investment in digital infrastructure (including cloud, 5G, and automation) rather than a formal NFV mandate.

Saudi Arabia Network Functions Virtualization Market Segmentation

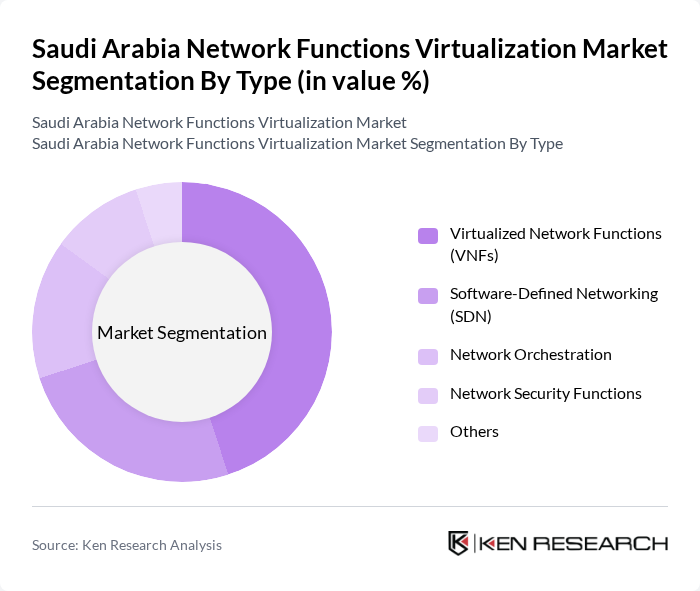

By Type:

The segmentation by type includes Virtualized Network Functions (VNFs), Software-Defined Networking (SDN), Network Orchestration, Network Security Functions, and Others. Virtualized Network Functions (VNFs) are widely recognized as a core revenue-generating component of NFV deployments because they translate traditional hardware appliances—such as firewalls, load balancers, EPC, and routers—into software instances that can be scaled and automated on commodity hardware or cloud platforms. Global analyses indicate that VNFs and related software components capture a substantial share of NFV value creation, which supports the qualitative statement that VNFs “dominate” the market mix, although precise 2024 percentage shares for Saudi Arabia are not publicly reported and should be considered indicative rather than verified.

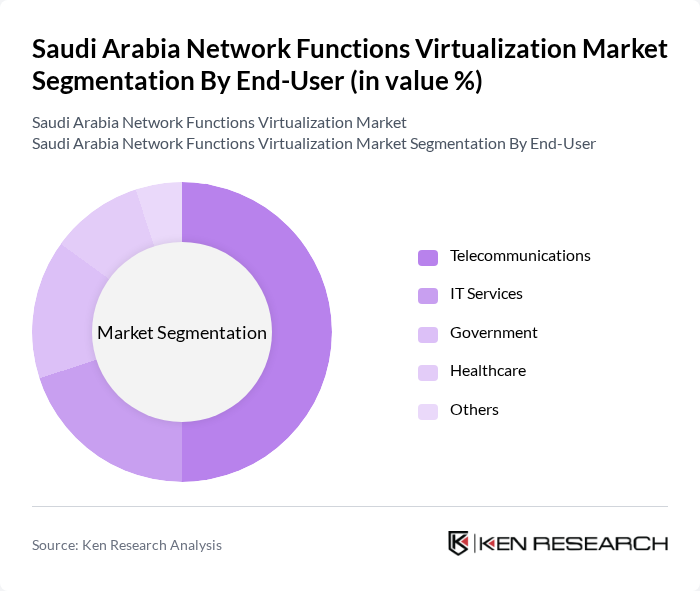

By End-User:

The end-user segmentation includes Telecommunications, IT Services, Government, Healthcare, and Others. Globally and in the Middle East, telecom operators are the primary adopters and spenders on NFV, driven by the need to virtualize core and radio-access network functions for 4G/5G, improve network agility, and reduce capex/opex, which supports the statement that Telecommunications is the leading end-user segment. Saudi operators such as STC, Mobily, and Zain KSA are actively investing in 5G and cloud-native networks, making it reasonable that telecommunications accounts for the largest NFV share in the country, though detailed Saudi-only end-user splits are not publicly disclosed.

Saudi Arabia Network Functions Virtualization Market Competitive Landscape

The Saudi Arabia Network Functions Virtualization Market is characterized by a dynamic mix of regional and international players. Major local telecom operators such as STC Group, Mobily, and Zain KSA are central to NFV deployments as they invest in 5G and cloud-native core networks, often in partnership with global vendors. Leading international suppliers such as Cisco Systems, Huawei Technologies, Ericsson, Nokia Networks, VMware, Juniper Networks, Fortinet, A10 Networks, Ciena Corporation, Arista Networks, Dell Technologies, Oracle Corporation, Red Hat, IBM, and Microsoft provide NFV infrastructure, orchestration platforms, VNFs, and cloud services used in Saudi deployments, although the exact intensity of each vendor’s NFV activity in Saudi Arabia is not uniformly disclosed.

Saudi Arabia Network Functions Virtualization Market Industry Analysis

Growth Drivers

- Increasing Demand for Cost-Effective Network Solutions:The Saudi Arabian telecommunications sector is projected to save approximately SAR 1.5 billion annually by adopting network functions virtualization (NFV). This shift allows operators to reduce hardware costs and operational expenses significantly. With the country's focus on enhancing digital infrastructure, the demand for cost-effective solutions is expected to rise, driven by the need for efficient resource allocation and improved service delivery across various sectors, including healthcare and education.

- Rising Adoption of Cloud-Based Services:The cloud services market in Saudi Arabia is anticipated to reach SAR 10 billion in future, reflecting a robust growth trajectory. This surge is fueled by businesses transitioning to cloud-based solutions for enhanced scalability and flexibility. As organizations increasingly rely on cloud services, the integration of NFV becomes essential to optimize network performance and manage resources effectively, thereby supporting the overall digital transformation agenda of the nation.

- Government Initiatives for Digital Transformation:The Saudi Vision 2030 initiative aims to diversify the economy and enhance digital infrastructure, with an investment of SAR 12 billion in technology and innovation. This commitment is driving the adoption of NFV as part of broader digital transformation efforts. The government's focus on smart cities and digital services is creating a conducive environment for NFV deployment, enabling telecom operators to innovate and improve service delivery across various sectors.

Market Challenges

- High Initial Investment Costs:The upfront costs associated with implementing NFV solutions can be substantial, often exceeding SAR 5 million for mid-sized telecom operators. This financial barrier can deter smaller companies from adopting NFV technologies, limiting market growth. Additionally, the need for skilled personnel to manage these advanced systems further complicates the financial landscape, as training and recruitment can add to the overall investment required for successful implementation.

- Complexity in Integration with Existing Systems:Many telecom operators in Saudi Arabia face challenges integrating NFV with legacy systems, which can be costly and time-consuming. Approximately 60% of operators report difficulties in achieving seamless interoperability, leading to potential service disruptions. This complexity can hinder the overall adoption of NFV, as companies may be reluctant to invest in solutions that do not easily align with their existing infrastructure, impacting operational efficiency.

Saudi Arabia Network Functions Virtualization Market Future Outlook

The future of the Saudi Arabia Network Functions Virtualization market appears promising, driven by ongoing advancements in technology and increasing investments in digital infrastructure. As the government continues to support initiatives aimed at enhancing connectivity and digital services, the adoption of NFV is expected to accelerate. Furthermore, the integration of artificial intelligence and machine learning into network management will likely streamline operations, improve efficiency, and enhance security, positioning the market for significant growth in the coming years.

Market Opportunities

- Expansion of 5G Networks:The rollout of 5G networks in Saudi Arabia is projected to reach over 90% coverage in future, creating substantial opportunities for NFV adoption. This expansion will enable telecom operators to leverage NFV for enhanced network performance and service delivery, catering to the increasing demand for high-speed connectivity across various sectors, including entertainment and smart cities.

- Growth in IoT Applications:The Internet of Things (IoT) market in Saudi Arabia is expected to grow to SAR 20 billion in future, driven by increased connectivity and smart device adoption. This growth presents a significant opportunity for NFV, as telecom operators can utilize virtualization to manage the vast number of connected devices efficiently, ensuring reliable service and scalability to meet future demands.