Region:Middle East

Author(s):Dev

Product Code:KRAD7735

Pages:98

Published On:December 2025

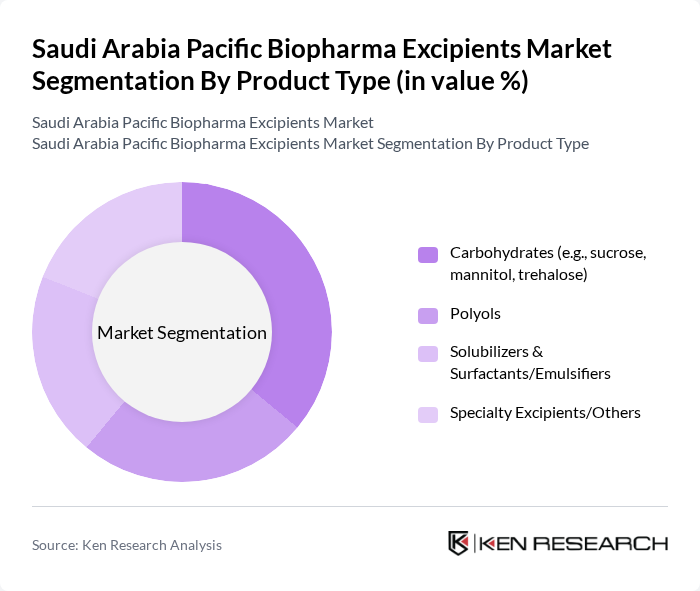

By Product Type:

The product type segmentation includes carbohydrates, polyols, solubilizers & surfactants/emulsifiers, and specialty excipients/others. Among these, carbohydrates, such as sucrose and mannitol, dominate the market due to their widespread use as stabilizers and bulking agents in biopharmaceutical formulations. The increasing demand for oral and parenteral drug delivery systems has further solidified their position. Polyols are also gaining traction, particularly in formulations requiring low-calorie sweeteners and moisture retention. The versatility of these excipients in various applications contributes to their significant market share.

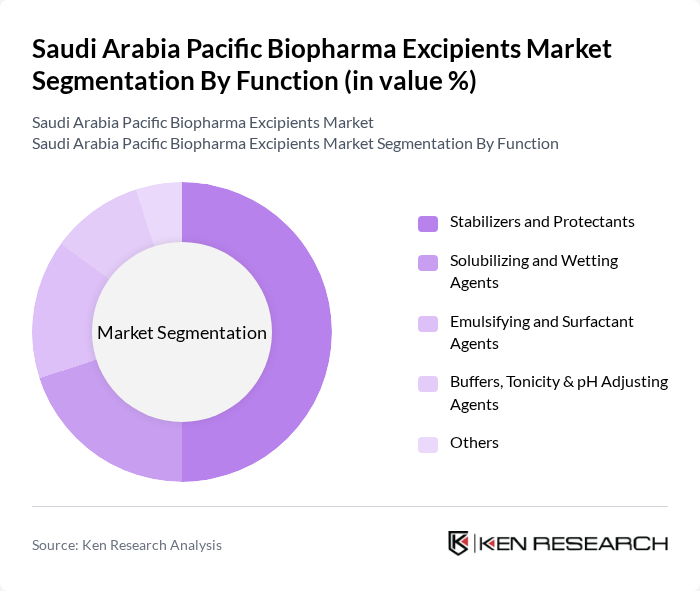

By Function:

The function segmentation encompasses stabilizers and protectants, solubilizing and wetting agents, emulsifying and surfactant agents, buffers, tonicity & pH adjusting agents, and others. Stabilizers and protectants lead the market due to their essential role in maintaining the stability and efficacy of biopharmaceutical products. The increasing complexity of biologics necessitates the use of advanced stabilizers to ensure product integrity throughout the shelf life. Emulsifying agents are also critical, particularly in formulations requiring enhanced bioavailability and improved solubility.

The Saudi Arabia Pacific Biopharma Excipients Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Evonik Industries AG, Ashland Global Holdings Inc., Croda International Plc, Merck KGaA (MilliporeSigma), JRS Pharma, Roquette Frères, Ingredion Incorporated, Colorcon, Gattefossé, Lubrizol Corporation, Kerry Group plc (Biopharma Excipients), SPI Pharma, DFE Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Pacific Biopharma Excipients Market appears promising, driven by increasing investments in biopharmaceutical R&D and a growing emphasis on personalized medicine. As the government continues to support local manufacturing and innovation, the market is likely to witness a surge in the development of novel excipients tailored for specific therapeutic applications. Additionally, the integration of digital technologies in production processes will enhance efficiency and quality, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Carbohydrates (e.g., sucrose, mannitol, trehalose) Polyols Solubilizers & Surfactants/Emulsifiers Specialty Excipients/Others |

| By Function | Stabilizers and Protectants Solubilizing and Wetting Agents Emulsifying and Surfactant Agents Buffers, Tonicity & pH Adjusting Agents Others |

| By Biologic Type | Monoclonal Antibodies Vaccines Recombinant Proteins Cell & Gene Therapies Others |

| By Formulation Type | Liquid Formulations Lyophilized (Freeze?Dried) Formulations Sustained/Controlled?Release Formulations Others |

| By Route of Administration | Parenteral (Injectable) Oral Biologics Pulmonary & Nasal Others |

| By End?User | Biopharmaceutical Manufacturers Contract Development & Manufacturing Organizations (CDMOs/CMOs) Research Institutes & Universities Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Jubail) Western Region (including Jeddah, Makkah, Madinah) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 100 | R&D Managers, Production Heads |

| Biopharma Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

| Excipient Suppliers | 80 | Sales Managers, Product Development Leads |

| Healthcare Professionals | 70 | Pharmacists, Clinical Researchers |

| Market Analysts | 60 | Industry Analysts, Market Research Consultants |

The Saudi Arabia Pacific Biopharma Excipients Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for biopharmaceuticals and advancements in drug formulation technologies.