Region:Middle East

Author(s):Dev

Product Code:KRAC8744

Pages:91

Published On:November 2025

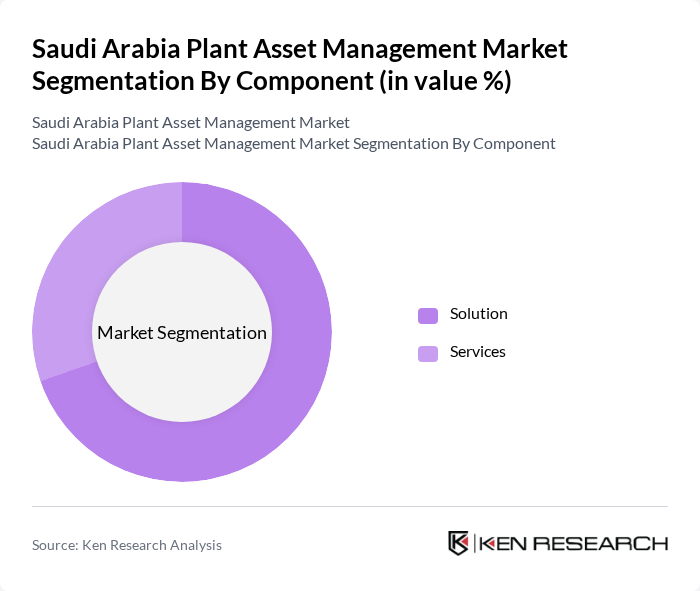

By Component:The market is segmented into solutions and services. The solutions segment includes software and tools designed for asset management, while the services segment encompasses consulting, implementation, and support services. The solutions segment is currently leading the market due to the increasing demand for advanced software solutions that enhance asset visibility and performance.

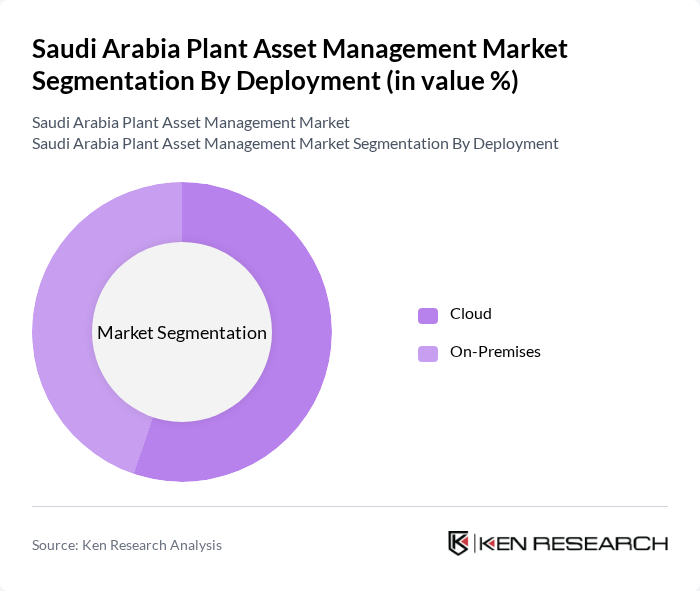

By Deployment:The market is divided into cloud and on-premises deployment models. The cloud segment is gaining traction due to its scalability, cost-effectiveness, and ease of access. On-premises solutions, while still relevant, are gradually being overshadowed by the growing preference for cloud-based systems, especially among small to medium enterprises.

The Saudi Arabia Plant Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., General Electric, Yokogawa Electric Corporation, Rockwell Automation, Inc., International Business Machines Corporation (IBM), Bentley Systems, Incorporated, SAP SE, Oracle Corporation, AVEVA Group plc, PTC Inc., Infor Global Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia plant asset management market appears promising, driven by technological advancements and government support. As industries increasingly adopt predictive maintenance and automation, the demand for sophisticated asset management solutions will rise. Furthermore, the integration of AI and machine learning is expected to enhance decision-making processes, leading to improved operational efficiency. The focus on sustainability will also drive innovation, as companies seek to comply with environmental regulations while optimizing asset performance.

| Segment | Sub-Segments |

|---|---|

| By Component | Solution Services |

| By Deployment | Cloud On-Premises |

| By Asset Type | Production Assets Automation Assets |

| By End-User Industry | Oil & Gas Petrochemicals Power Generation Manufacturing Mining & Metals Chemicals Others |

| By Region | Eastern Central Western Southern |

| By Maintenance Type | Equipment Maintenance Turnaround & Shutdown Services Pipeline Maintenance Corrosion & Integrity Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Asset Management | 100 | Asset Managers, Operations Directors |

| Manufacturing Plant Maintenance | 80 | Maintenance Managers, Production Supervisors |

| Utilities Asset Optimization | 70 | Utility Managers, Reliability Engineers |

| Technology Adoption in Asset Management | 60 | IT Managers, Digital Transformation Leads |

| Regulatory Compliance in Asset Management | 90 | Compliance Officers, Risk Management Executives |

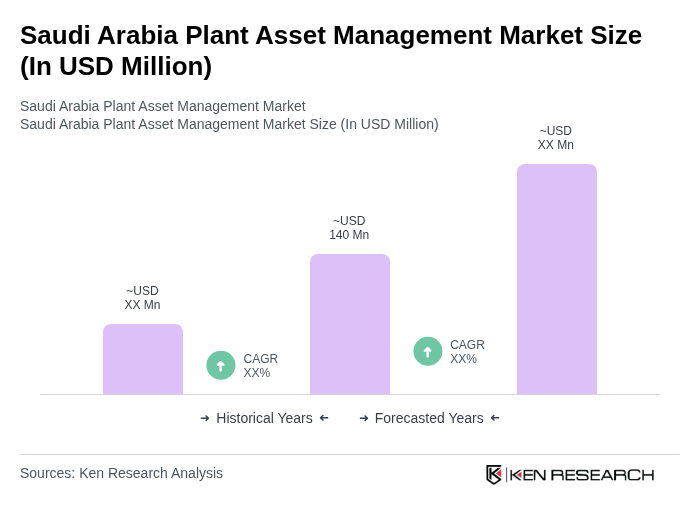

The Saudi Arabia Plant Asset Management Market is valued at approximately USD 140 million, driven by the need for operational efficiency, asset optimization, and the adoption of advanced technologies like IoT and AI in asset management.