Region:Middle East

Author(s):Rebecca

Product Code:KRAD6151

Pages:91

Published On:December 2025

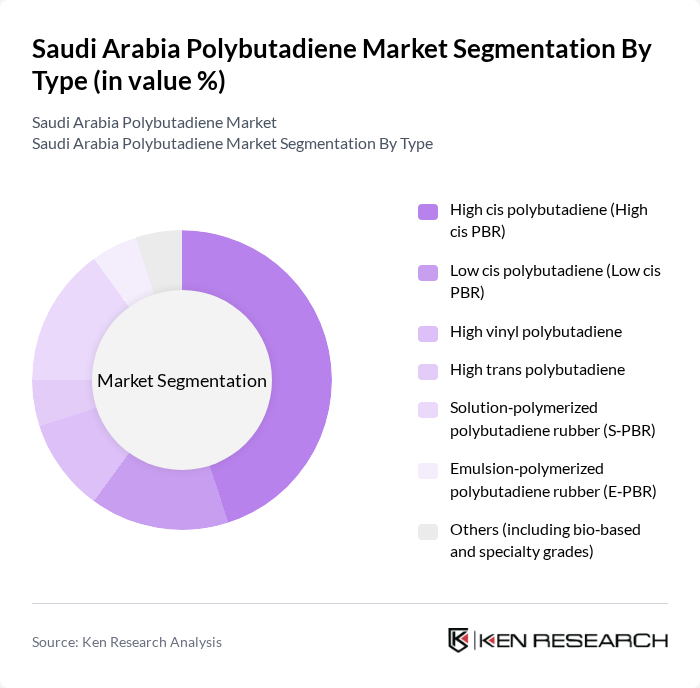

By Type:The polybutadiene market can be segmented into various types, including High cis polybutadiene (High cis PBR), Low cis polybutadiene (Low cis PBR), High vinyl polybutadiene, High trans polybutadiene, Solution?polymerized polybutadiene rubber (S?PBR), Emulsion?polymerized polybutadiene rubber (E?PBR), and Others (including bio?based and specialty grades). Among these, High cis PBR is the most dominant due to its superior properties, making it ideal for tire manufacturing and other applications requiring high resilience and durability.

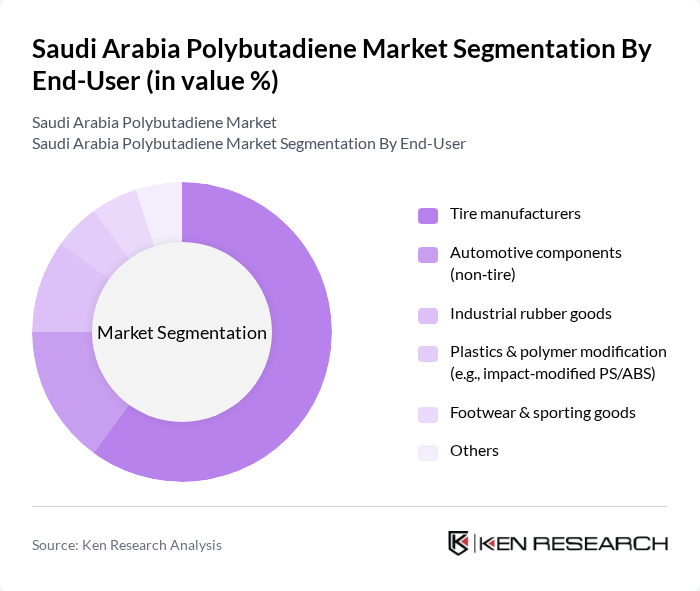

By End-User:The end-user segmentation includes Tire manufacturers, Automotive components (non?tire), Industrial rubber goods, Plastics & polymer modification (e.g., impact?modified PS/ABS), Footwear & sporting goods, and Others. Tire manufacturers dominate the market due to the increasing demand for high-performance tires, which require high-quality polybutadiene for enhanced durability and performance.

The Saudi Arabia Polybutadiene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Saudi Aramco – including Petro Rabigh & SATORP), Saudi International Petrochemical Company (Sipchem), Saudi Kayan Petrochemical Company, Petro Rabigh (Rabigh Refining and Petrochemical Company), Arlanxeo (synthetic rubber JV with footprint in the GCC), Kumho Petrochemical Co., Ltd., JSR Corporation, Asahi Kasei Corporation, LG Chem Ltd., Lanxess AG, ExxonMobil Chemical Company, LyondellBasell Industries N.V., China Petroleum & Chemical Corporation (Sinopec), Reliance Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia polybutadiene market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the automotive industry embraces electric vehicles, the demand for high-performance materials like polybutadiene will increase. Additionally, the construction sector's growth will further enhance polybutadiene applications. Companies that invest in eco-friendly production methods and innovative polymer blends will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | High cis polybutadiene (High cis PBR) Low cis polybutadiene (Low cis PBR) High vinyl polybutadiene High trans polybutadiene Solution?polymerized polybutadiene rubber (S?PBR) Emulsion?polymerized polybutadiene rubber (E?PBR) Others (including bio?based and specialty grades) |

| By End-User | Tire manufacturers Automotive components (non?tire) Industrial rubber goods Plastics & polymer modification (e.g., impact?modified PS/ABS) Footwear & sporting goods Others |

| By Application | Tire tread and sidewalls Tire carcass and bead applications Polymer modification (HIPS, ABS and engineering plastics) Industrial rubber products (belts, hoses, conveyor belts) Adhesives & sealants Footwear soles and golf balls Others |

| By Distribution Channel | Direct offtake contracts with tire and rubber manufacturers Direct sales to plastic & polymer processors Regional chemical distributors and traders Online / e?procurement platforms Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Jubail & Dammam industrial clusters) Western Region (including Jeddah & Makkah) Southern Region |

| By Production Process | Solution polymerization Emulsion polymerization High cis catalyst systems (e.g., Nd?based) Bio?based / renewable feedstock routes Others |

| By Pricing Strategy | Formula pricing linked to butadiene and crude benchmarks Long?term contract pricing with volume commitments Spot market / opportunistic pricing Value?added premium pricing for specialty and eco?grades Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Applications | 45 | Product Managers, Procurement Specialists |

| Rubber Manufacturing Sector | 40 | Operations Managers, Quality Control Analysts |

| Polymer Research and Development | 50 | R&D Directors, Technical Managers |

| Export Market Dynamics | 60 | Export Managers, Trade Analysts |

| End-user Feedback on Polybutadiene | 55 | Product Development Managers, Supply Chain Coordinators |

The Saudi Arabia Polybutadiene Market is valued at approximately USD 20 million, driven by increasing demand from the automotive sector, particularly in tire manufacturing, and the adoption of polybutadiene in various industrial applications.