Region:Middle East

Author(s):Shubham

Product Code:KRAD5335

Pages:89

Published On:December 2025

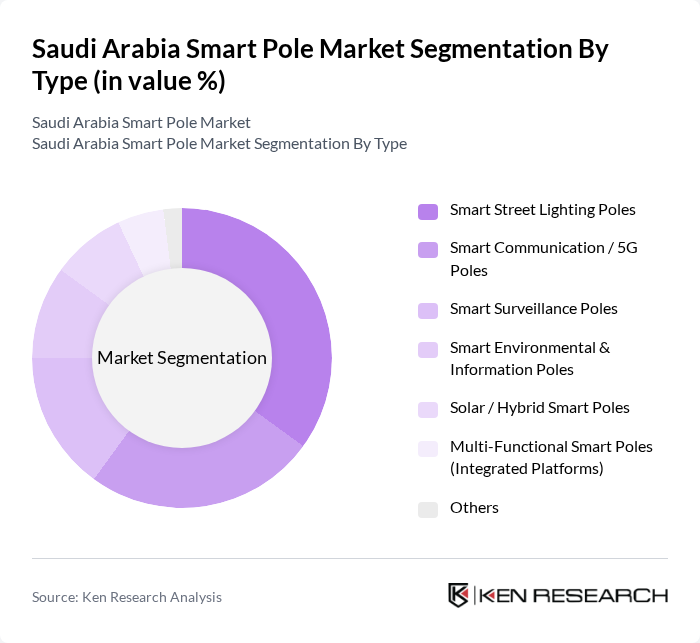

By Type:The market is segmented into various types of smart poles, each serving distinct functions and applications. The primary subsegments include Smart Street Lighting Poles, Smart Communication / 5G Poles, Smart Surveillance Poles, Smart Environmental & Information Poles, Solar / Hybrid Smart Poles, Multi-Functional Smart Poles (Integrated Platforms), and Others. Among these, Smart Street Lighting Poles are leading the market due to their widespread deployment in municipal street-lighting upgrades, where LED retrofits, adaptive dimming, and remote monitoring deliver significant energy savings and lower maintenance costs while supporting public safety and traffic management. Smart Communication / 5G Poles are gaining share as telecom operators embed small cells, Wi?Fi hotspots, and edge connectivity into poles to densify networks, especially in dense urban corridors and new smart districts. Solar / Hybrid Smart Poles, integrating photovoltaic panels and energy storage, are increasingly adopted in suburban, industrial, and remote areas to reduce grid dependence and support the Kingdom’s renewable energy and sustainability objectives.

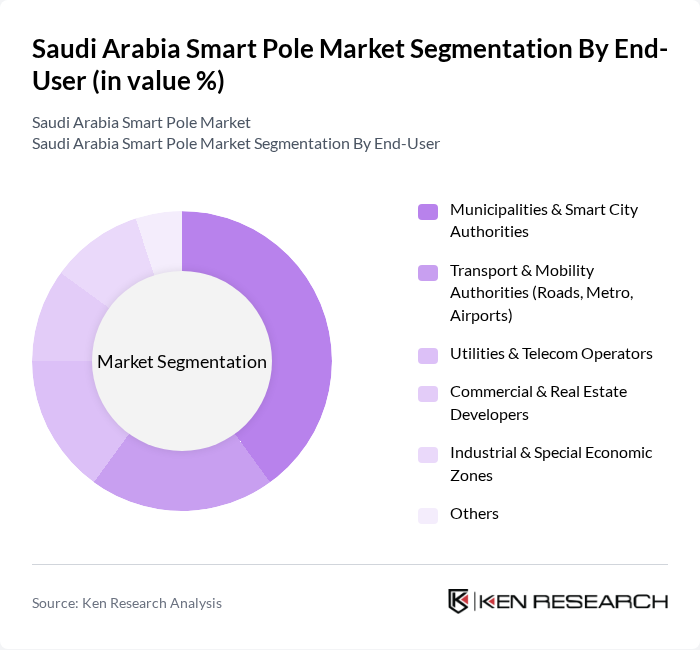

By End-User:The end-user segmentation includes Municipalities & Smart City Authorities, Transport & Mobility Authorities (Roads, Metro, Airports), Utilities & Telecom Operators, Commercial & Real Estate Developers, Industrial & Special Economic Zones, and Others. Municipalities & Smart City Authorities dominate the market as they are the primary decision-makers and budget holders for street lighting, urban safety, and streetscape modernization projects, and they are increasingly specifying smart-ready or fully connected poles in tenders for road expansions, urban regeneration, and new smart districts. Transport & Mobility Authorities are emerging as a significant user group as smart poles are deployed along highways, metro corridors, and around airports to host traffic monitoring cameras, variable message signs, and connectivity equipment. Utilities & Telecom Operators are leveraging smart poles to support grid digitalization, smart metering backhaul, and 5G network densification, while Commercial, Real Estate, and Industrial zone developers are adopting aesthetic multi-functional poles to offer integrated lighting, security, Wi?Fi, and wayfinding services in their developments.

The Saudi Arabia Smart Pole Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al?Babtain Power & Telecom Co., Saudi Lighting Company, Saudi Electricity Company (SEC), Zain KSA, Saudi Telecom Company (stc), NEOM Company, Huawei Technologies Co., Ltd., Nokia Corporation, Cisco Systems, Inc., Signify N.V. (Philips Lighting), Siemens AG, ABB Ltd., Eaton Corporation plc, Schréder Group, Fagerhult Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart pole market in Saudi Arabia appears promising, driven by ongoing urbanization and government initiatives aimed at enhancing public infrastructure. As cities evolve into smart environments, the integration of advanced technologies such as IoT and 5G will facilitate the deployment of smart poles, supported by the country’s rapid expansion of digital infrastructure and 5G coverage. Additionally, the increasing focus on sustainability and energy efficiency will further propel the adoption of these solutions, positioning Saudi Arabia as a leader in smart city development in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Street Lighting Poles Smart Communication / 5G Poles Smart Surveillance Poles Smart Environmental & Information Poles Solar / Hybrid Smart Poles Multi-Functional Smart Poles (Integrated Platforms) Others |

| By End-User | Municipalities & Smart City Authorities Transport & Mobility Authorities (Roads, Metro, Airports) Utilities & Telecom Operators Commercial & Real Estate Developers Industrial & Special Economic Zones Others |

| By Region | Riyadh Region Makkah & Jeddah Region Madinah & Tabuk / NEOM Corridor Eastern Province (Dammam, Dhahran, Al Khobar) Southern & Other Regions |

| By Technology | Smart Lighting & Dimming Control IoT Sensor & Edge Computing Integration Communication Technology (4G/5G, Wi?Fi, Fiber Backhaul) Renewable & Energy Storage Integration Software & Platform (CMS, Analytics, Digital Twin) Others |

| By Application | Street & Highway Lighting Traffic & Parking Management Public Safety & Video Surveillance Environmental & Asset Monitoring Public Wi?Fi & Digital Signage Others |

| By Investment Source | Central & Municipal Government Capex Utilities & Telecom Operator Investments Public?Private Partnerships (PPP / Concession Models) Developer?Led / Private Sector Investments Multilateral & Sovereign Funds Others |

| By Policy Support | Vision 2030 & National Transformation Program (NTP) Initiatives Smart City & Digital Infrastructure Programs Renewable Energy & Energy Efficiency Incentives Local Content & Saudization Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Smart City Projects | 100 | City Planners, Urban Development Officials |

| Smart Pole Technology Providers | 80 | Product Managers, Business Development Executives |

| End-User Feedback on Smart Poles | 75 | Local Business Owners, Community Leaders |

| Environmental Monitoring Applications | 60 | Environmental Scientists, Policy Makers |

| Public Safety and Surveillance Insights | 90 | Security Managers, Law Enforcement Officials |

The Saudi Arabia Smart Pole Market is valued at approximately USD 900 million, representing a significant segment of the broader utility poles market, which is valued at around USD 1.16 billion. This growth is driven by urbanization and smart city initiatives.