Region:Middle East

Author(s):Dev

Product Code:KRAD6415

Pages:96

Published On:December 2025

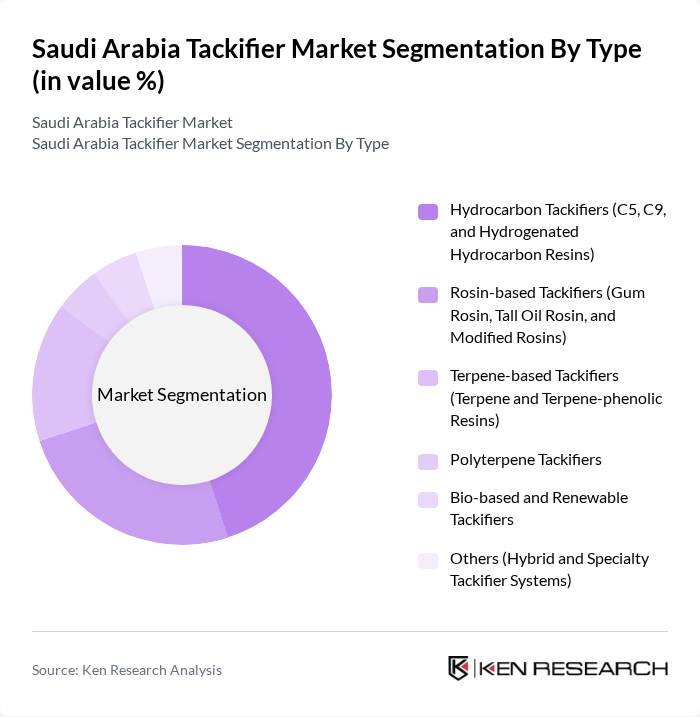

By Type:The market is segmented into various types of tackifiers, including Hydrocarbon Tackifiers, Rosin-based Tackifiers, Terpene-based Tackifiers, Polyterpene Tackifiers, Bio-based and Renewable Tackifiers, and Others. Each type serves different applications and industries, catering to specific adhesive needs.

The Hydrocarbon Tackifiers segment is currently dominating the market due to their versatility and strong adhesion properties, making them suitable for a wide range of applications, including packaging and construction. The increasing demand for high-performance adhesives in these sectors has led to a significant rise in the consumption of hydrocarbon-based products. Additionally, the cost-effectiveness and availability of raw materials further enhance their market position. As industries continue to evolve, the preference for hydrocarbon tackifiers is expected to remain strong, driven by their adaptability to various formulations and applications.

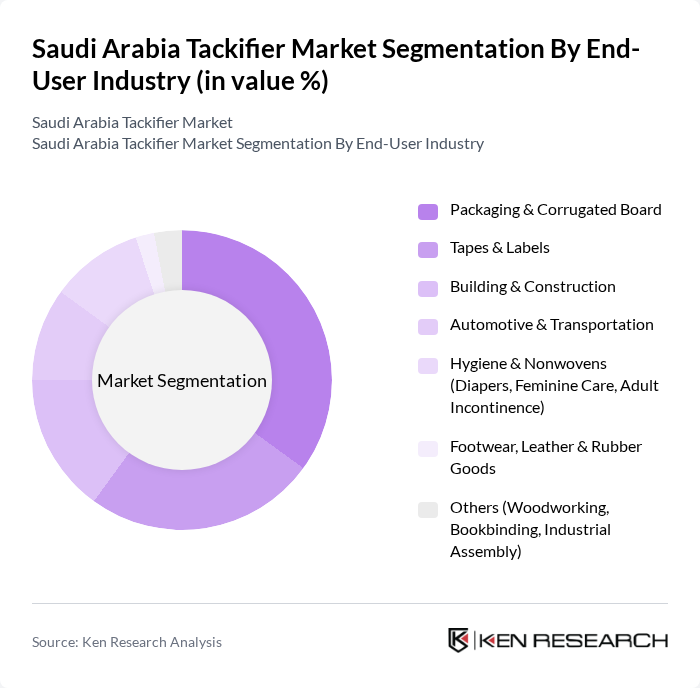

By End-User Industry:The tackifier market is segmented by end-user industries, including Packaging & Corrugated Board, Tapes & Labels, Building & Construction, Automotive & Transportation, Hygiene & Nonwovens, Footwear, Leather & Rubber Goods, and Others. Each industry has unique requirements that influence the demand for specific types of tackifiers.

The Packaging & Corrugated Board segment is the largest end-user industry for tackifiers, driven by the booming e-commerce sector and the increasing demand for sustainable packaging solutions. The need for efficient and reliable adhesives in packaging applications has led to a surge in the use of tackifiers that provide strong bonding and quick setting times. Additionally, the trend towards eco-friendly materials has prompted manufacturers to explore bio-based and renewable tackifiers, further enhancing the segment's growth. As consumer preferences shift towards sustainable packaging, the demand for tackifiers in this sector is expected to remain robust.

The Saudi Arabia Tackifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Oil Company (Saudi Aramco), Saudi Arabian Chevron Phillips Company (S-Chem), Tasnee – National Industrialization Company, Eastman Chemical Middle East FZE, ExxonMobil Chemical (Saudi Arabia & GCC Operations), Kraton Corporation (A DL Chemical Company), Arkema Bostik Middle East, Henkel Jebel Ali FZCO (Middle East & Saudi Operations), 3M Saudi Arabia, Dow Chemical Saudi Arabia, BASF Saudi Arabia Company Ltd., SI Group Middle East, Ingevity Corporation, Arak Petrochemical Company (Regional Exporter Serving Saudi Market) contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia tackifier market is poised for significant growth, driven by the ongoing expansion of the construction and automotive sectors. As the government continues to invest in infrastructure and local manufacturing, the demand for innovative and sustainable tackifier solutions will likely increase. Additionally, the shift towards eco-friendly products will encourage manufacturers to explore new formulations and technologies, enhancing their competitive edge in the market. Overall, the future appears promising, with ample opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocarbon Tackifiers (C5, C9, and Hydrogenated Hydrocarbon Resins) Rosin-based Tackifiers (Gum Rosin, Tall Oil Rosin, and Modified Rosins) Terpene-based Tackifiers (Terpene and Terpene-phenolic Resins) Polyterpene Tackifiers Bio-based and Renewable Tackifiers Others (Hybrid and Specialty Tackifier Systems) |

| By End-User Industry | Packaging & Corrugated Board Tapes & Labels Building & Construction Automotive & Transportation Hygiene & Nonwovens (Diapers, Feminine Care, Adult Incontinence) Footwear, Leather & Rubber Goods Others (Woodworking, Bookbinding, Industrial Assembly) |

| By Application | Pressure-Sensitive Adhesives (PSA) Hot-Melt Adhesives (HMA) Solvent-based & Waterborne Adhesives Sealants & Caulks Coatings & Inks Others (Compounding and Modifier Uses) |

| By Distribution Channel | Direct Sales to Adhesive & Sealant Manufacturers Regional Chemical Distributors Trading Houses & Importers Online B2B Platforms Others |

| By Region | Central Region (Riyadh and Surrounding Industrial Hubs) Eastern Region (Jubail, Dammam, and Petrochemical Cluster) Western Region (Jeddah, Makkah, Madinah) Southern Region Northern Region |

| By Product Form | Solids (Flakes, Pellets, Pastilles) Liquid Tackifiers Aqueous Dispersions & Emulsions Others (Masterbatches, Concentrates) |

| By Regulatory & Quality Compliance | SASO and Saudi Food & Drug Authority (SFDA) Requirements ISO 9001 and ISO 14001 Certification REACH and GHS-aligned Compliance for Imported Products Others (Customer-specific and OEM Specifications) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Adhesives | 100 | Project Managers, Procurement Officers |

| Automotive Adhesives | 80 | Manufacturing Engineers, Quality Control Managers |

| Packaging Adhesives | 90 | Product Development Managers, Supply Chain Analysts |

| Industrial Adhesives | 70 | Operations Managers, Technical Sales Representatives |

| Consumer Adhesives | 60 | Marketing Managers, Retail Buyers |

The Saudi Arabia Tackifier Market is valued at approximately USD 95 million, reflecting a five-year historical analysis. This growth is largely driven by increasing demand for adhesives across various sectors, including packaging, construction, and automotive industries.