Region:Middle East

Author(s):Dev

Product Code:KRAD7604

Pages:99

Published On:December 2025

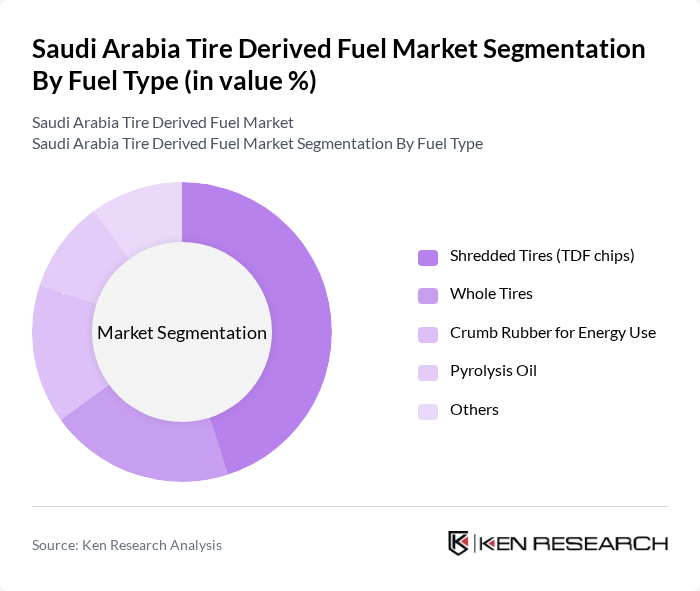

By Fuel Type:The fuel type segmentation includes various forms of tire-derived fuel, each with unique characteristics and applications. The subsegments are Shredded Tires (TDF chips), Whole Tires, Crumb Rubber for Energy Use, Pyrolysis Oil, and Others. Among these, Shredded Tires (TDF chips) are the most widely used due to their versatility and efficiency in combustion processes, particularly in cement kilns and industrial boilers, aligning with global trends where shredded TDF accounts for the majority of tire-derived fuel consumption. The increasing focus on sustainable energy sources and waste management practices, combined with the ease of handling, consistent particle size, and better combustion control of shredded tires, has further propelled the demand for this form of TDF, making it a dominant player in the market.

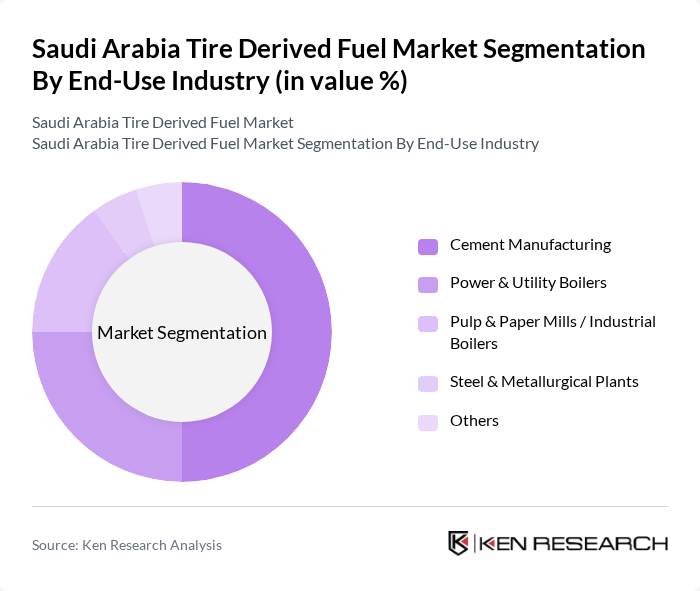

By End-Use Industry:The end-use industry segmentation encompasses various sectors utilizing tire-derived fuel, including Cement Manufacturing, Power & Utility Boilers, Pulp & Paper Mills / Industrial Boilers, Steel & Metallurgical Plants, and Others. Cement manufacturing is the leading sector, in line with global patterns where cement kilns account for the largest share of TDF consumption, driven by the industry's need for alternative fuels to reduce production costs and meet environmental regulations on emissions and clinker production. The high calorific value of tire-derived fuel, which is comparable to or higher than coal, makes it an attractive option for cement kilns and other energy-intensive processes, further solidifying its position as the dominant end-use industry.

The Saudi Arabia Tire Derived Fuel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Investment Recycling Company (SIRC) – Waste Tires & TDF Initiatives, EnviroServe Saudi Arabia LLC, Global Environmental Management Services (GEMS) – Waste-to-Energy Division, Tanmiah Industrial and Commercial Investment Co. – Recycling & Alternative Fuels, Batterjee Environmental Recycling Company – Tire Recycling & Alternative Fuels, Modern Tires Recycling Factory (Riyadh), Eastern Province Rubber Products Co. (EPRP), Al-Qaryan Group – Recycling & Industrial Services, Saudi Aramco – Industrial Fuel & Alternative Fuels Users (Cement & Utilities Interface), Saudi Cement Company – Co-processing of Tire Derived Fuel, Yanbu Cement Company – Alternative Fuels & Co-processing Program, Southern Province Cement Company – Use of Waste-derived Fuels, City Cement Company – Alternative Fuel Trials & Waste Tire Co-firing, Hail Cement Company – Regional Demand for TDF, Najran Cement Company – Potential Offtaker for Tire Derived Fuel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Tire Derived Fuel market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and a strong governmental push towards sustainable practices. As industries adapt to circular economy principles, TDF is likely to gain traction as a viable energy source. Furthermore, technological advancements in fuel processing are expected to enhance efficiency and reduce costs, making TDF more competitive against traditional fuels, thereby fostering broader adoption across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Fuel Type | Shredded Tires (TDF chips) Whole Tires Crumb Rubber for Energy Use Pyrolysis Oil Others |

| By End-Use Industry | Cement Manufacturing Power & Utility Boilers Pulp & Paper Mills / Industrial Boilers Steel & Metallurgical Plants Others |

| By Functional Application | Co-firing with Conventional Fossil Fuels Dedicated Tire-Derived Fuel Systems Waste-to-Energy Plants Pyrolysis & Gasification Others |

| By Source of Scrap Tires | Replacement Market (Passenger & Light Commercial Vehicles) Truck, Bus & OTR Tires Industrial & Off-Highway Tires Imported End-of-Life Tires Others |

| By Processing Technology | Mechanical Shredding & Size Reduction Pyrolysis Co-processing in Cement Kilns Gasification & Advanced Thermal Treatment Others |

| By Offtake / Sales Channel | Direct Supply to Cement Plants Supply to Power & Utility Operators Industrial Fuel Distributors Cross-border / Export Sales within GCC Others |

| By Regulatory & Environmental Compliance | Compliance with Saudi Waste Management Law & EPR Schemes Compliance with Saudi Environmental, Emission & Air Quality Standards International Certifications (e.g., ISO 14001, ISO 9001) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tire Recycling Facilities | 100 | Facility Managers, Operations Directors |

| Energy Companies Utilizing Alternative Fuels | 80 | Energy Analysts, Fuel Procurement Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| Automotive Manufacturers | 70 | Supply Chain Managers, Sustainability Coordinators |

| Research Institutions Focused on Renewable Energy | 60 | Research Scientists, Energy Policy Experts |

The Saudi Arabia Tire Derived Fuel Market is valued at approximately USD 65 million, reflecting a five-year historical analysis of tire-derived fuel's share within the national tire recycling market. This valuation highlights the market's growth driven by environmental regulations and energy demands.