Region:Middle East

Author(s):Dev

Product Code:KRAD5108

Pages:93

Published On:December 2025

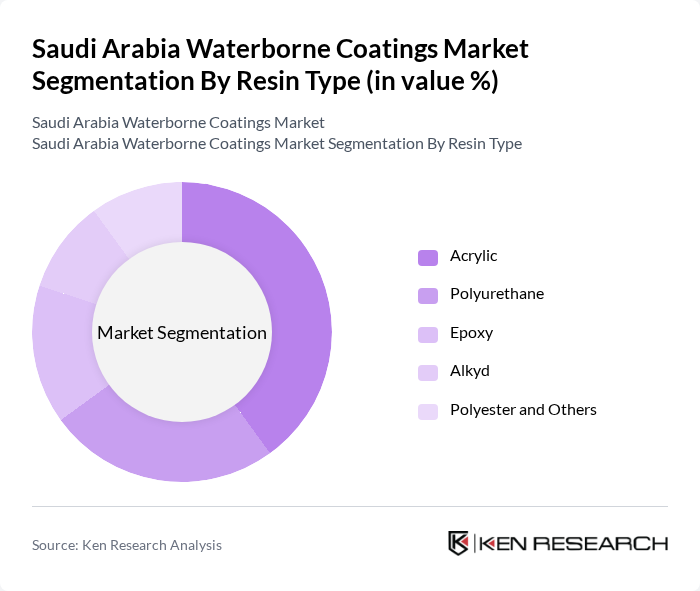

By Resin Type:The resin type segmentation includes various materials used in the formulation of waterborne coatings. The primary subsegments are Acrylic, Polyurethane, Epoxy, Alkyd, and Polyester and Others. Each of these resins offers unique properties that cater to different applications and performance requirements.

The Acrylic resin segment dominates the market due to its excellent adhesion, flexibility, and weather resistance, making it suitable for a wide range of applications, including architectural and industrial coatings, consistent with global waterborne coatings trends where acrylics hold the largest share. The growing trend towards sustainable and low-VOC products, supported by green building programs and consumer preference for low-odor coatings, has further propelled the demand for acrylic waterborne coatings in interior and exterior wall paints, metal primers, and façade systems. Polyurethane follows closely, favored for its durability, abrasion and chemical resistance, and high-gloss finishes, particularly in automotive OEM and refinish, flooring, and protective applications where enhanced mechanical performance is required. The increasing focus on eco-friendly solutions, including bio-based and hybrid waterborne systems, is expected to sustain the growth of these segments as end-users in construction, automotive, and industrial sectors continue to shift away from solvent-borne alternatives.

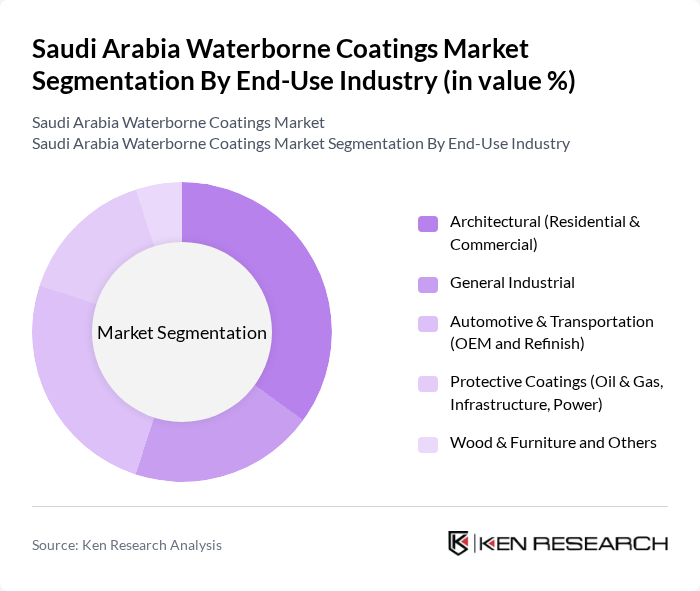

By End-Use Industry:The end-use industry segmentation encompasses various sectors utilizing waterborne coatings, including Architectural (Residential & Commercial), General Industrial, Automotive & Transportation (OEM and Refinish), Protective Coatings (Oil & Gas, Infrastructure, Power), and Wood & Furniture and Others.

The Architectural segment leads the market, driven by the booming construction industry, housing demand, and large commercial and infrastructure projects supported by government investment and Vision 2030 programs, where waterborne paints are increasingly preferred to meet indoor air quality and sustainability objectives. The automotive sector also plays a crucial role, with a significant demand for waterborne coatings in both OEM and refinish applications due to their superior appearance, lower VOC emissions, and compatibility with modern automotive manufacturing lines that emphasize environmental performance and worker safety. The protective coatings segment is growing steadily, particularly in oil and gas, petrochemical, marine, and infrastructure applications, where durability, corrosion resistance, and resistance to harsh climatic conditions are paramount and where waterborne epoxy and polyurethane technologies are increasingly adopted for specific applications such as tank linings, pipelines, and structural steel.

The Saudi Arabia Waterborne Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Saudi Arabia Co. Ltd., Al-Jazeera Paints Co., National Paints Factories Co. Ltd., Sigma Paints Saudi Arabia Ltd., Hempel Saudi Arabia Co. Ltd., Kansai Paint Middle East (Kansai Paint Co., Ltd.), Nippon Paint Saudi Arabia (Nippon Paint Holdings Co., Ltd.), PPG Industries, Inc., AkzoNobel N.V., BASF SE, The Sherwin-Williams Company, Asian Paints Berger (Saudi Arabia), Raghadan Paints Co. Ltd., Ghadir Paints & Chemical Industries Co., Berger Paints Emirates Co. LLC (Serving Saudi Market) contribute to innovation, geographic expansion, and service delivery in this space by broadening waterborne product portfolios, investing in local manufacturing, and tailoring solutions to Saudi climatic and regulatory requirements.

The future of the Saudi Arabia waterborne coatings market appears promising, driven by increasing environmental awareness and government support for sustainable practices. As the construction sector continues to expand, the demand for innovative, eco-friendly coatings is expected to rise. Additionally, advancements in coating technologies will likely enhance product performance, making waterborne options more appealing. The market is poised for growth as stakeholders adapt to evolving consumer preferences and regulatory requirements, fostering a more sustainable industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Resin Type | Acrylic Polyurethane Epoxy Alkyd Polyester and Others |

| By End-Use Industry | Architectural (Residential & Commercial) General Industrial Automotive & Transportation (OEM and Refinish) Protective Coatings (Oil & Gas, Infrastructure, Power) Wood & Furniture and Others |

| By Application | Interior Architectural Coatings Exterior Architectural Coatings Industrial Maintenance & Protective Coatings Automotive OEM & Refinish Coatings Wood, Coil, Packaging and Other Specialty Coatings |

| By Distribution Channel | Direct Sales to Projects and Industrial Customers Dealer & Distributor Network Modern Trade & Retail Stores E-commerce and Online B2B Platforms Others |

| By Region | Northern & Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Jubail) Southern Region |

| By Product Formulation | Waterborne Acrylics Waterborne Polyurethanes Waterborne Epoxies Hybrid and Other Waterborne Systems |

| By Performance Characteristics | Durability and Film Hardness Chemical and Stain Resistance Weathering and UV Resistance Low-VOC and Low-Odor Performance Corrosion Protection and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Coatings | 140 | Project Managers, Architects, Contractors |

| Automotive Coatings | 90 | Production Managers, Quality Control Engineers |

| Industrial Coatings | 70 | Facility Managers, Procurement Specialists |

| Architectural Coatings | 110 | Interior Designers, Building Inspectors |

| Marine Coatings | 60 | Marine Engineers, Fleet Managers |

The Saudi Arabia Waterborne Coatings Market is valued at approximately USD 540 million, reflecting a significant share of the national paints and coatings revenues, driven by the increasing demand for eco-friendly and low-VOC coatings.