Region:Asia

Author(s):Geetanshi

Product Code:KRAA3298

Pages:91

Published On:September 2025

By Type:The market is segmented into online courses, workshops and seminars, corporate training programs, coaching and mentoring, certification programs, blended learning solutions, immersive learning (AR/VR-enabled), leadership development programs, and others. Online courses and blended learning solutions are experiencing rapid growth due to increased digital adoption and flexibility. Immersive learning (AR/VR-enabled) is gaining traction in specialized fields, such as engineering and healthcare, offering practical simulations and experiential learning. Leadership development programs are increasingly personalized, leveraging AI and data analytics for targeted skill enhancement.

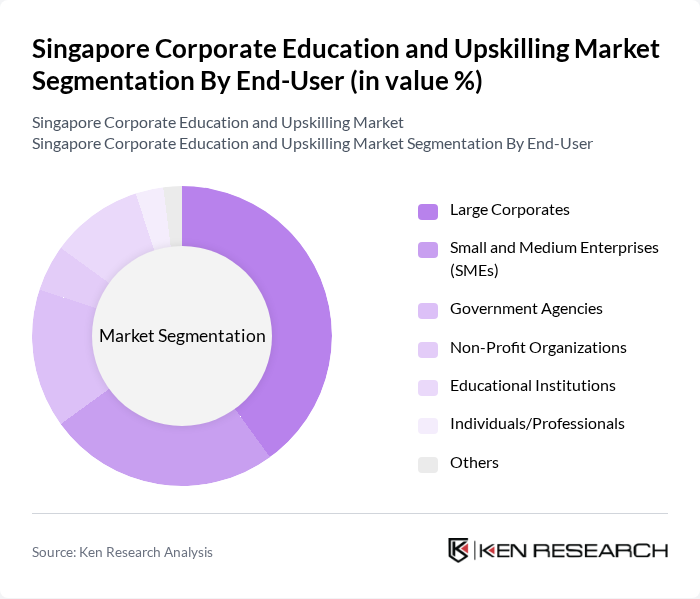

By End-User:The end-users of corporate education and upskilling services include large corporates, small and medium enterprises (SMEs), government agencies, non-profit organizations, educational institutions, individuals/professionals, and others. Large corporates and SMEs are the primary drivers of market demand, focusing on digital transformation and workforce reskilling. Government agencies and educational institutions are increasingly partnering with EdTech firms to deliver scalable training solutions. Individual professionals are leveraging online platforms for career advancement and certification.

The Singapore Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as NTUC LearningHub, PSB Academy, Kaplan Singapore, Singapore Management University (SMU), Nanyang Technological University (NTU), Temasek Polytechnic, Singapore Institute of Management (SIM), Coursera (Singapore operations), Udemy Business (Singapore), General Assembly Singapore, Skillsoft (Singapore), LinkedIn Learning (Singapore), Eduquest International Institute, Learning Tree International (Singapore), Emeritus Institute of Management, INSEAD Asia Campus, National University of Singapore (NUS) Business School, APM Group Singapore contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore corporate education and upskilling market is poised for significant evolution, driven by technological advancements and changing workforce needs. As organizations increasingly adopt hybrid work models, the demand for flexible, accessible training solutions will rise. Additionally, the integration of AI and data analytics in learning platforms will enhance personalization, making training more effective. Companies will likely focus on developing soft skills alongside technical training, ensuring a well-rounded workforce prepared for future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Workshops and Seminars Corporate Training Programs Coaching and Mentoring Certification Programs Blended Learning Solutions Immersive Learning (AR/VR-enabled) Leadership Development Programs Others |

| By End-User | Large Corporates Small and Medium Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions Individuals/Professionals Others |

| By Industry | Information Technology & Digital Services Finance and Banking Healthcare & Life Sciences Manufacturing & Engineering Retail & E-commerce Hospitality & Tourism Logistics & Supply Chain Others |

| By Delivery Mode | In-Person Training Virtual Instructor-Led Training (VILT) Hybrid/Blended Training Self-Paced E-Learning Mobile Learning Others |

| By Duration | Short Courses (1-3 days) Medium Courses (1-3 months) Long Courses (3 months and above) Modular/Microlearning Others |

| By Certification Type | Professional Certifications (e.g., PMP, CFA, AWS) Academic Certifications Skill-Based/Micro-Credentials Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Licensing/Enterprise Packages Freemium/Trial-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Providers | 80 | Training Managers, Business Development Executives |

| HR Departments in Large Enterprises | 120 | HR Directors, Learning and Development Managers |

| Employees Participating in Upskilling Programs | 100 | Mid-level Professionals, Entry-level Employees |

| Government Officials in Workforce Development | 40 | Policy Makers, Program Coordinators |

| Industry Experts and Consultants | 60 | Consultants, Industry Analysts |

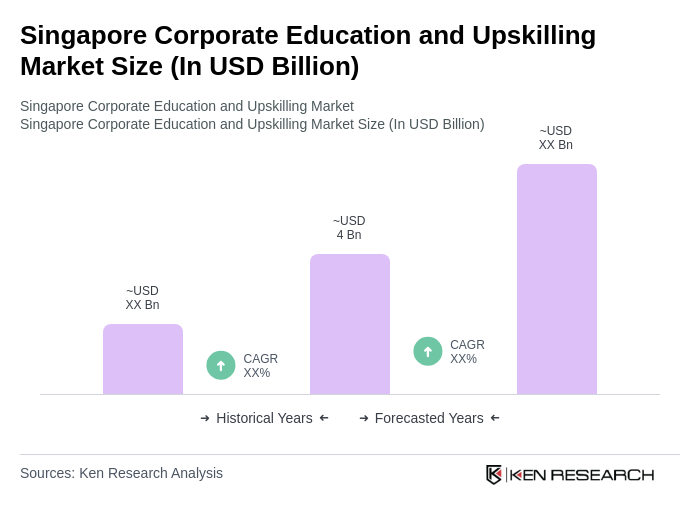

The Singapore Corporate Education and Upskilling Market is valued at approximately USD 4 billion, reflecting the demand for skilled labor and the need for continuous professional development among employees, driven by digital transformation and technology-enabled training programs.