Region:Asia

Author(s):Dev

Product Code:KRAB0315

Pages:99

Published On:August 2025

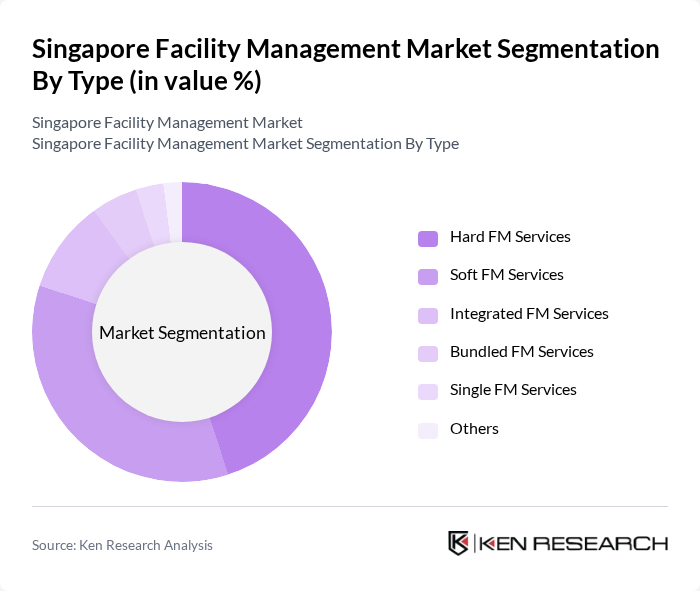

By Type:The facility management market is segmented into Hard FM Services and Soft FM Services. Hard FM Services encompass essential maintenance and operational functions such as HVAC, electrical, plumbing, and structural maintenance. Soft FM Services focus on support services that enhance the overall environment of facilities, including cleaning, security, landscaping, and catering. Integrated FM Services, Bundled FM Services, Single FM Services, and Others also play significant roles, with integrated and bundled offerings gaining traction due to the increasing preference for comprehensive solutions among commercial and government clients.

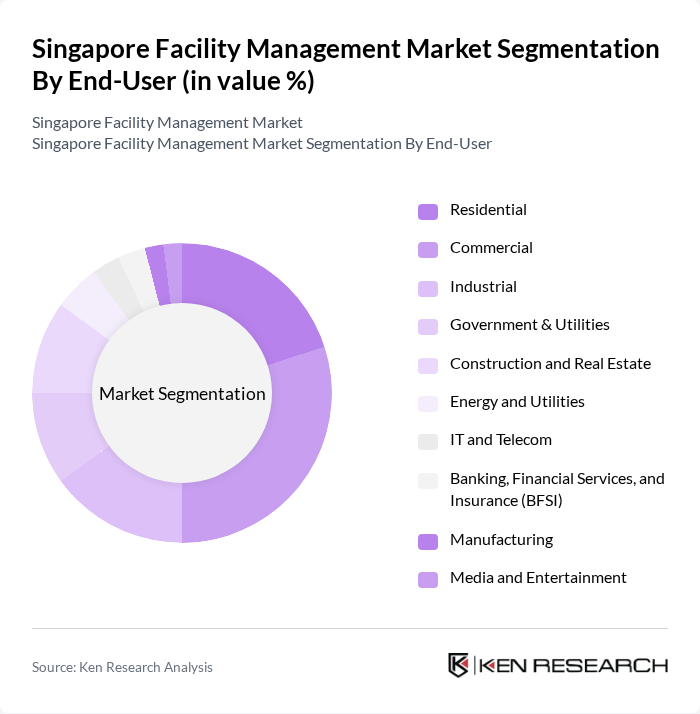

By End-User:The end-user segmentation of the facility management market includes Residential, Commercial, Industrial, Government & Utilities, Construction and Real Estate, Energy and Utilities, IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Manufacturing, and Media and Entertainment. Each sector has unique requirements and contributes to the overall demand for facility management services. Commercial and government sectors are leading adopters, driven by the need for compliance, safety, and sustainability, while BFSI and healthcare are rapidly increasing their share due to specialized facility needs.

The Singapore Facility Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services Pte Ltd, CBRE Group, Inc., JLL (Jones Lang LaSalle), SATS Ltd., CPG Facilities Management Pte Ltd, Knight Frank Property Asset Management Pte Ltd, Aetos Security Management Pte Ltd, Sembcorp Facilities Management Pte Ltd, Serco Group plc, OCS Group (Singapore) Pte Ltd, Veolia Environmental Services Singapore Pte Ltd, G4S Secure Solutions (Singapore) Pte Ltd, Cushman & Wakefield Singapore, ENGIE Services Singapore Pte Ltd, UEMS Solutions Pte Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore facility management market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As smart building technologies become more prevalent, FM companies will increasingly leverage data analytics and IoT to enhance service delivery. Additionally, the government's commitment to green initiatives will further propel the adoption of sustainable practices. The integration of these trends is expected to reshape the competitive landscape, encouraging innovation and collaboration among service providers to meet emerging client demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard FM Services Asset Management MEP (Mechanical, Electrical & Plumbing) and HVAC Services Fire Systems and Safety Other Hard FM Services Soft FM Services Office Support and Security Cleaning Services Catering Services Other Soft FM Services Integrated FM Services Bundled FM Services Single FM Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities Construction and Real Estate Energy and Utilities IT and Telecom Banking, Financial Services, and Insurance (BFSI) Manufacturing Media and Entertainment |

| By Application | Office Buildings Retail Spaces Healthcare Facilities Educational Institutions Hospitality Data Centers Others |

| By Service Model | Outsourced Services In-House Services |

| By Contract Type | Fixed-Price Contracts Time and Material Contracts |

| By Geographic Coverage | Central Region East Region West Region North Region |

| By Investment Source | Private Investment Public Funding Foreign Direct Investment Joint Ventures |

| By Facility Size | Small Facilities Medium Facilities Large Facilities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Space Management | 100 | Facility Managers, Building Owners |

| Residential Property Management | 60 | Property Managers, Homeowners Association Leaders |

| Industrial Facility Operations | 50 | Operations Managers, Safety Officers |

| Healthcare Facility Management | 40 | Healthcare Administrators, Facility Directors |

| Educational Institution Facilities | 40 | Campus Facility Managers, Administrative Staff |

The Singapore Facility Management Market is valued at approximately USD 3.6 billion, driven by the demand for efficient building management solutions, urbanization, smart technologies, and sustainability initiatives, as highlighted by government programs like the Smart Nation Plan and Green Plan 2030.