Region:Africa

Author(s):Shubham

Product Code:KRAB3225

Pages:90

Published On:October 2025

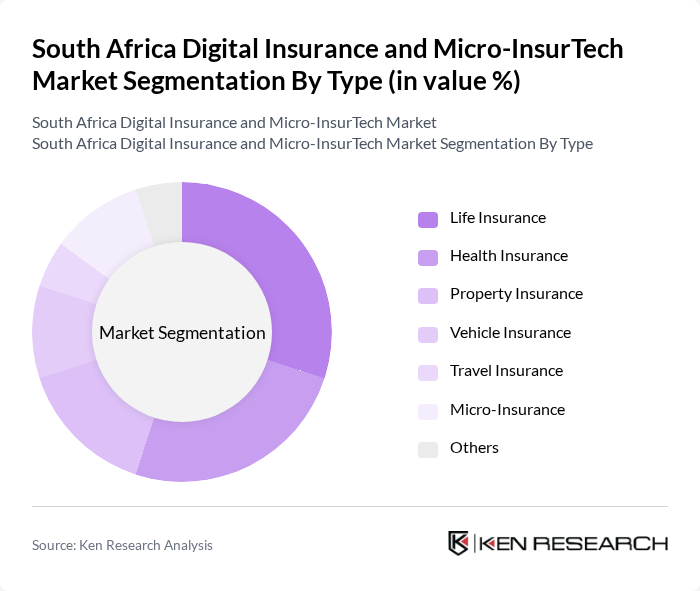

By Type:The market is segmented into various types of insurance products, including Life Insurance, Health Insurance, Property Insurance, Vehicle Insurance, Travel Insurance, Micro-Insurance, and Others. Among these, Life Insurance and Health Insurance are the most prominent segments, driven by increasing health awareness and the need for financial security among consumers.

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporates, and Non-Profit Organizations. Individuals and Small Businesses are the leading segments, as they increasingly seek affordable insurance solutions to mitigate risks and protect their assets.

The South Africa Digital Insurance and Micro-InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Discovery Limited, Old Mutual Limited, Santam Limited, Hollard Insurance, Momentum Metropolitan Holdings, Liberty Holdings Limited, OUTsurance, AIG South Africa, Zurich Insurance South Africa, Cigna Global Re, AXA South Africa, Allianz Global Corporate & Specialty, Guardrisk Insurance Company, Telesure Investment Holdings, MicroEnsure contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital insurance and micro-InsurTech market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning will enhance risk assessment and customer service, while the shift towards on-demand insurance models will cater to evolving consumer needs. As regulatory frameworks adapt to support innovation, the market is expected to attract new entrants, fostering competition and improving service delivery across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance Health Insurance Property Insurance Vehicle Insurance Travel Insurance Micro-Insurance Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Distribution Channel | Online Platforms Insurance Brokers Direct Sales Mobile Applications |

| By Product Offering | Standard Insurance Products Customized Insurance Solutions Bundled Insurance Packages |

| By Customer Segment | Low-Income Households Middle-Income Households High-Income Households |

| By Payment Method | Monthly Premiums Annual Premiums Pay-As-You-Go |

| By Policy Duration | Short-Term Policies Long-Term Policies Flexible Duration Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Insurance Providers | 100 | CEOs, Founders, Product Managers |

| Micro-Insurance Stakeholders | 80 | Business Development Managers, Underwriters |

| Insurance Brokers and Agents | 120 | Insurance Brokers, Sales Agents |

| Consumer Insights on Digital Insurance | 150 | Policyholders, Potential Customers |

| Regulatory Bodies and Industry Experts | 50 | Regulators, Industry Analysts |

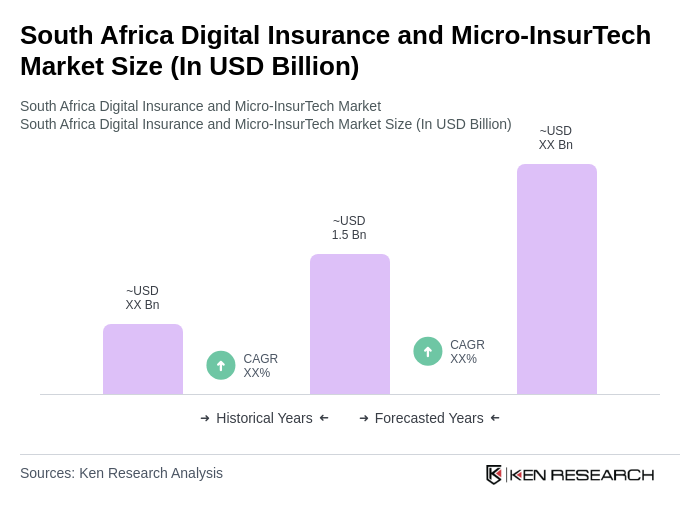

The South Africa Digital Insurance and Micro-InsurTech Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased digital technology adoption and consumer awareness of insurance products.