Region:Africa

Author(s):Dev

Product Code:KRAA5128

Pages:84

Published On:September 2025

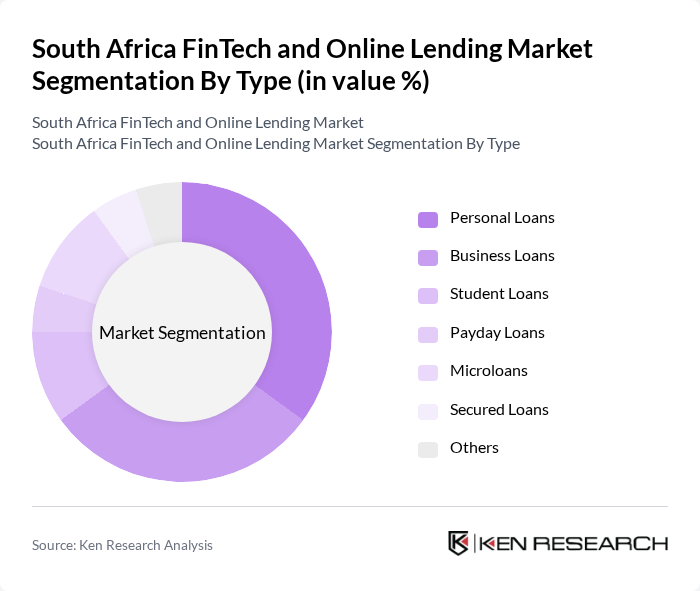

By Type:The market can be segmented into various types of loans, including personal loans, business loans, student loans, payday loans, microloans, secured loans, and others. Each type serves different consumer needs and preferences, with personal loans and business loans being particularly prominent due to their versatility and accessibility.

The personal loans segment is currently dominating the market due to the increasing financial needs of individuals for various purposes such as home improvement, debt consolidation, and emergency expenses. The ease of access to personal loans through online platforms has made them a preferred choice among consumers. Additionally, the growing trend of digital banking and the rise of alternative lending solutions have further fueled the demand for personal loans, making them a significant contributor to the overall market growth.

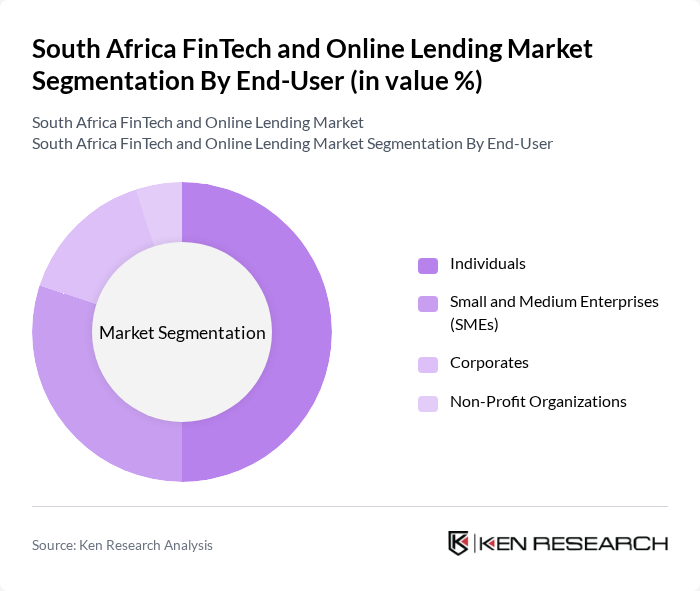

By End-User:The market can also be segmented based on end-users, which include individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Each segment has unique financial requirements and borrowing behaviors, influencing the types of loans they seek.

The individuals segment is the largest in the market, driven by the increasing need for personal financing options among consumers. Factors such as rising living costs, the need for immediate cash flow, and the convenience of online lending platforms have led to a surge in personal borrowing. Additionally, the growing trend of financial literacy among individuals has resulted in more informed borrowing decisions, further propelling the demand for loans in this segment.

The South Africa FinTech and Online Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Wonga, Lendico, RainFin, PayJustNow, GetBucks, Finbond, YAPILI, Fundi, Lendico, MyBucks, Kiva, Ubank, Zande contribute to innovation, geographic expansion, and service delivery in this space.

The South African FinTech and online lending market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more consumers will seek online financial solutions, fostering a competitive landscape. Additionally, the integration of artificial intelligence in credit scoring will enhance risk assessment, enabling lenders to offer tailored products. The focus on financial inclusion will further drive innovation, as companies develop solutions that cater to previously underserved populations, ensuring sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Payday Loans Microloans Secured Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Home Improvement Debt Consolidation Education Business Expansion |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers |

| By Loan Size | Small Loans (up to ZAR 10,000) Medium Loans (ZAR 10,001 - ZAR 50,000) Large Loans (over ZAR 50,000) |

| By Repayment Terms | Short-Term Loans Medium-Term Loans Long-Term Loans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Online Lending Usage | 150 | Individuals aged 18-65 who have used online lending services |

| FinTech Company Insights | 100 | CEOs, Founders, and Product Managers of FinTech firms |

| Regulatory Impact Assessment | 80 | Regulatory Officials and Compliance Officers |

| Market Trends and Innovations | 70 | Industry Analysts and Financial Consultants |

| Consumer Attitudes Towards FinTech | 120 | General consumers with varying financial backgrounds |

The South Africa FinTech and Online Lending Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rise in smartphone penetration among consumers and businesses.