Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA6665

Pages:83

Published On:September 2025

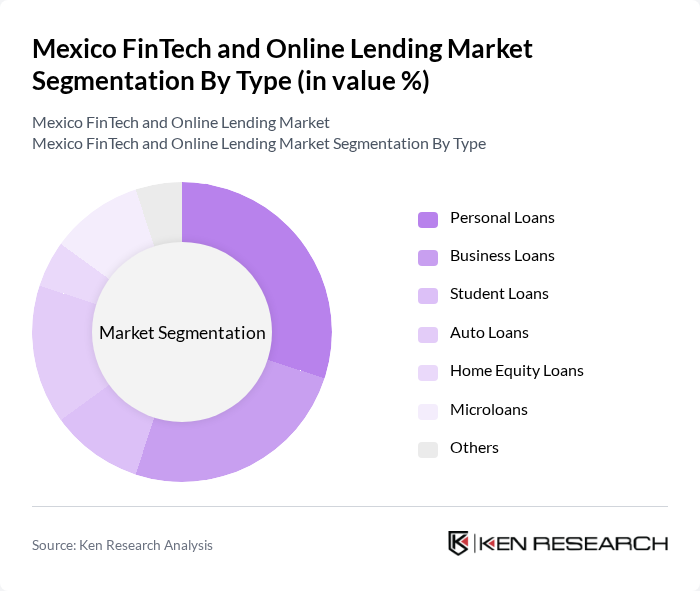

By Type:The market is segmented into various types of loans, including personal loans, business loans, student loans, auto loans, home equity loans, microloans, and others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse financial landscape in Mexico. Personal loans are particularly popular due to their flexibility and ease of access, while business loans are essential for SMEs looking to expand.

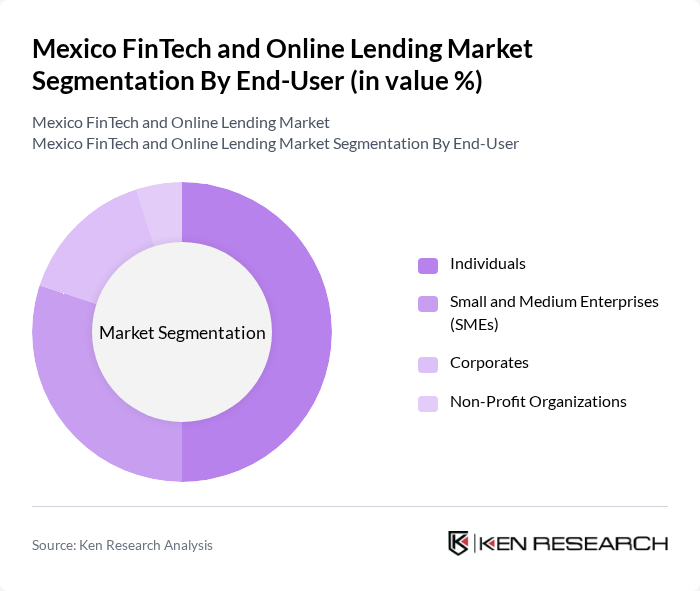

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and non-profit organizations. Each segment has unique financial needs, with individuals primarily seeking personal loans for various purposes, while SMEs often require business loans to support growth and operational costs. Corporates and non-profits also engage in the market, albeit to a lesser extent.

The Mexico FinTech and Online Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kueski, Creditea, Konfío, Fintech Mexico, Afluenta, CrediJusto, Banorte, Coppel, Banco Azteca, Kubo.financiero, Lendico, Zaveapp, Yotepresto, Dineromail contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico FinTech and online lending market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital literacy improves and more individuals gain access to smartphones, the adoption of online lending solutions is expected to accelerate. Furthermore, the integration of artificial intelligence in credit assessment processes will enhance risk management and customer experience. The market is likely to witness increased collaboration between FinTech firms and traditional banks, fostering innovation and expanding service offerings to underserved populations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Equity Loans Microloans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Loan Purpose | Debt Consolidation Home Improvement Business Expansion Education |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions |

| By Customer Segment | Millennials Gen Z Middle-aged Professionals Retirees |

| By Credit Score Range | Prime Borrowers Near-prime Borrowers Subprime Borrowers |

| By Loan Size | Small Loans (up to $5,000) Medium Loans ($5,001 - $50,000) Large Loans (over $50,000) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Users | 150 | Consumers aged 25-45, Middle-income bracket |

| Small Business Loan Applicants | 100 | Small business owners, Entrepreneurs |

| FinTech Service Providers | 80 | Product Managers, Business Development Executives |

| Regulatory Stakeholders | 50 | Policy Makers, Financial Regulators |

| Consumer Finance Advisors | 70 | Financial Advisors, Credit Counselors |

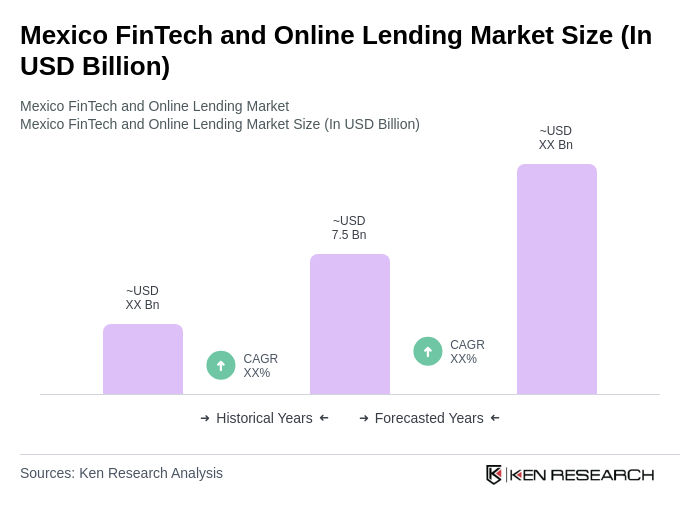

The Mexico FinTech and Online Lending Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising demand for accessible credit solutions among the unbanked population.