Region:Europe

Author(s):Shubham

Product Code:KRAB1194

Pages:97

Published On:October 2025

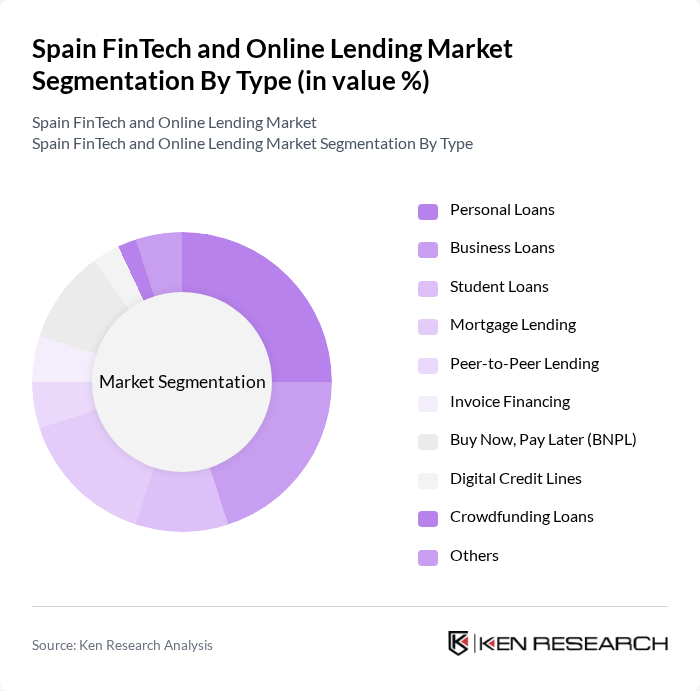

By Type:The market is segmented into various types of lending solutions, including Personal Loans, Business Loans, Student Loans, Mortgage Lending, Peer-to-Peer Lending, Invoice Financing, Buy Now, Pay Later (BNPL), Digital Credit Lines, Crowdfunding Loans, and Others. Each subsegment addresses distinct consumer and business needs, reflecting the diversity of Spain's financial services landscape. Personal loans and business loans remain the most prominent, driven by consumer demand for quick access to credit and SME requirements for working capital. Mortgage lending is supported by digital onboarding and automated risk assessment, while BNPL and peer-to-peer lending platforms are gaining traction among younger, digitally native users. Invoice financing and digital credit lines cater to SMEs and freelancers seeking flexible, short-term liquidity. Crowdfunding loans and other alternative finance models are increasingly used for startup and project funding, leveraging Spain’s active fintech ecosystem .

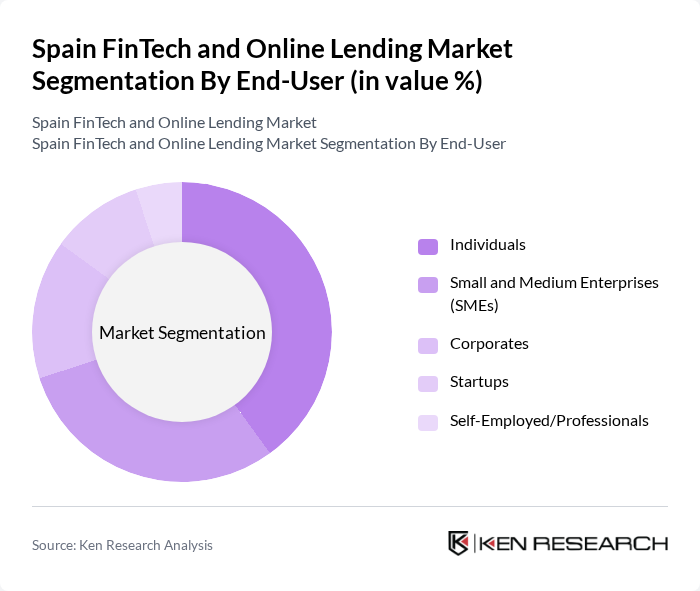

By End-User:The market is segmented by end-users, including Individuals, Small and Medium Enterprises (SMEs), Corporates, Startups, and Self-Employed/Professionals. Individuals primarily seek personal loans, BNPL, and mortgage solutions for everyday needs and home purchases. SMEs and startups are major users of business loans, invoice financing, and digital credit lines to support growth, innovation, and cash flow management. Corporates utilize tailored lending products for expansion and operational efficiency, while self-employed professionals leverage flexible credit options for project-based work and business development. The segmentation reflects the broad applicability of fintech and online lending across Spain’s diverse economic landscape .

The Spain FinTech and Online Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco Sabadell, BBVA, ING España, Creditea, Finizens, Zank, Lendico España, Spotcap, October España, MytripleA, Housers, Fellow Finance, Raisin, Aplazame, ID Finance (Plazo, Moneyman), Bondora, Belvo, Payflow, Indexa Capital, Bnext contribute to innovation, geographic expansion, and service delivery in this space.

The future of the FinTech and online lending market in Spain appears promising, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, the integration of artificial intelligence and machine learning in lending processes is expected to enhance efficiency and personalization. Furthermore, collaboration between FinTech firms and traditional banks is likely to create a more robust financial ecosystem, enabling innovative solutions that cater to diverse consumer needs while addressing regulatory challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Mortgage Lending Peer-to-Peer Lending Invoice Financing Buy Now, Pay Later (BNPL) Digital Credit Lines Crowdfunding Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Startups Self-Employed/Professionals |

| By Application | Consumer Financing Business Financing Educational Financing Real Estate Financing Working Capital |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Embedded Finance (via Partner Platforms) |

| By Customer Segment | Retail Customers Institutional Customers Unbanked/Underbanked |

| By Loan Size | Micro Loans (<€1,000) Small Loans (€1,000–€10,000) Medium Loans (€10,001–€100,000) Large Loans (>€100,000) |

| By Risk Profile | Low Risk Medium Risk High Risk |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Market | 100 | Consumers, Financial Advisors |

| Small Business Lending | 60 | Small Business Owners, Financial Managers |

| Peer-to-Peer Lending Platforms | 50 | Platform Operators, Investors |

| Regulatory Impact Assessment | 40 | Regulatory Officials, Compliance Officers |

| Consumer Behavior Analysis | 80 | End-users, Market Researchers |

The Spain FinTech and Online Lending Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by the adoption of digital financial services and alternative financing solutions among consumers and businesses.