Region:Africa

Author(s):Dev

Product Code:KRAB0957

Pages:87

Published On:October 2025

By Type:The furniture market can be segmented into various types, including Residential Furniture, Office Furniture, Outdoor Furniture, Custom Furniture, Eco-Friendly Furniture, Luxury Furniture, Contract Furniture, and Others. Among these, Residential Furniture is the most dominant segment, driven by the increasing trend of home renovations and the growing real estate market. There is a notable consumer shift towards modular, space-efficient, and sustainable furniture, particularly in urban households. Eco-friendly and custom furniture are also gaining traction as consumers seek unique, environmentally responsible options .

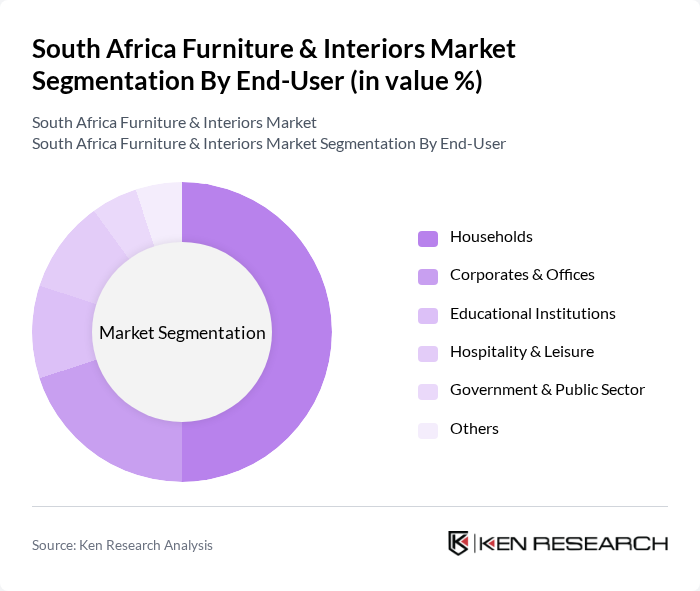

By End-User:The market can be segmented by end-users into Households (Residential), Commercial (Offices, Retail, Public Spaces), Hospitality Sector (Hotels, Restaurants, Lodges), Educational Institutions, Government & Public Sector, and Others. The Household segment is the largest, driven by the increasing number of homebuyers and renters looking to furnish their living spaces. The trend towards home improvement and interior design has led to a significant rise in consumer spending in this segment. Commercial and hospitality sectors are also expanding, supported by investments in office and tourism infrastructure .

The South Africa Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steinhoff International Holdings N.V., The Foschini Group (TFG), Cape Town Furniture, Coricraft, @Home (part of TFG), MRP Home, Homewood, Greenstone Hill Furniture, The Furniture Warehouse, Lifestyles Furniture, Furniture City, The Bed Shop, Urban Furniture, Rochester, Office Group contribute to innovation, geographic expansion, and service delivery in this space.

The South African furniture market is poised for transformation as urbanization and rising incomes continue to shape consumer preferences. In future, the emphasis on sustainable and ergonomic designs is expected to drive innovation within the industry. Additionally, the integration of technology in furniture manufacturing will enhance product offerings, catering to the growing demand for smart home solutions. As the market adapts to these trends, local manufacturers will need to focus on quality and sustainability to remain competitive in an evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Luxury Furniture Contract Furniture Others |

| By End-User | Households (Residential) Commercial (Offices, Retail, Public Spaces) Hospitality Sector (Hotels, Restaurants, Lodges) Educational Institutions Government & Public Sector Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Wood (including Pine, Eucalyptus, Hardwoods) Metal Plastic Fabric/Upholstery Composite Materials (Plywood, MDF, etc.) Others |

| By Style | Contemporary Traditional Industrial Rustic Modern Minimalist Others |

| By Functionality | Multi-Functional Furniture Space-Saving Furniture Modular Furniture Smart/Connected Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Retail | 100 | Store Managers, Sales Executives |

| Commercial Furniture Solutions | 60 | Facility Managers, Procurement Officers |

| Interior Design Trends | 50 | Interior Designers, Architects |

| Custom Furniture Manufacturing | 40 | Production Managers, Business Owners |

| Online Furniture Sales | 50 | E-commerce Managers, Digital Marketing Specialists |

The South Africa Furniture & Interiors Market is valued at approximately USD 5.1 billion, reflecting growth driven by urbanization, rising disposable incomes, and increased demand for home improvement and interior design services.