South Africa Nutraceuticals & Herbal Products Market Overview

- The South Africa Nutraceuticals & Herbal Products Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rising trend towards preventive healthcare, and the growing popularity of natural and organic products. The market has seen a significant uptick in demand for dietary supplements and herbal remedies as consumers seek alternatives to conventional medicine.

- Key cities such as Johannesburg, Cape Town, and Durban dominate the market due to their large populations and higher disposable incomes. These urban centers are also hubs for health and wellness trends, with a growing number of health stores and online platforms catering to the increasing demand for nutraceuticals and herbal products. The concentration of health-conscious consumers in these areas further drives market growth.

- In 2023, the South African government implemented the Foodstuffs, Cosmetics and Disinfectants Act, which regulates the safety and labeling of nutraceuticals and herbal products. This regulation aims to ensure that all products meet safety standards and are accurately labeled, thereby protecting consumers and promoting fair trade practices within the industry.

South Africa Nutraceuticals & Herbal Products Market Segmentation

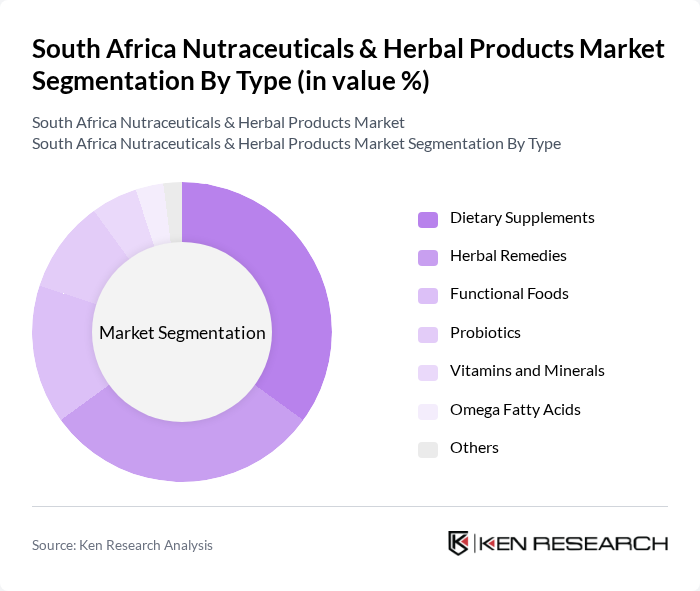

By Type:The market is segmented into various types, including Dietary Supplements, Herbal Remedies, Functional Foods, Probiotics, Vitamins and Minerals, Omega Fatty Acids, and Others. Among these, Dietary Supplements and Herbal Remedies are the most prominent segments, driven by consumer preferences for health maintenance and disease prevention. The increasing awareness of the benefits of these products has led to a surge in their consumption, particularly among health-conscious individuals.

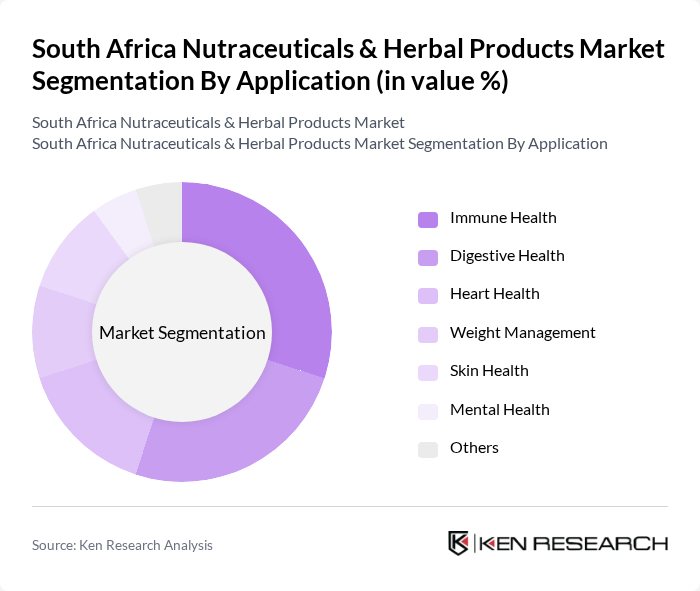

By Application:The applications of nutraceuticals and herbal products include Immune Health, Digestive Health, Heart Health, Weight Management, Skin Health, Mental Health, and Others. Immune Health and Digestive Health are leading applications, reflecting the growing consumer focus on enhancing immunity and gut health, especially in the wake of global health challenges. This trend is further supported by increasing research and development in these areas.

South Africa Nutraceuticals & Herbal Products Market Competitive Landscape

The South Africa Nutraceuticals & Herbal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway South Africa (Pty) Ltd., Nutrilite, Solal Technologies (Pty) Ltd., Nature's Way, Biogen (Pty) Ltd., Vital Health Foods (Pty) Ltd., USN (United States Nutrition), Omega Pharma South Africa, Herbalife South Africa, GNC (General Nutrition Corporation), Clicks Group Limited, Dischem Pharmacies, The Health Factory, Cape Herb & Spice (Pty) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Nutraceuticals & Herbal Products Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The South African population is becoming increasingly health-conscious, with a reported 60% of adults actively seeking healthier lifestyle choices. This trend is supported by the World Health Organization's findings that indicate a rise in non-communicable diseases, prompting consumers to turn to nutraceuticals and herbal products. The health and wellness market in South Africa is projected to reach ZAR 35 billion in future, reflecting a growing preference for preventive health measures and natural remedies.

- Rising Demand for Natural Products:The demand for natural and organic products in South Africa has surged, with the organic food market alone valued at ZAR 3 billion in future. This shift is driven by consumer preferences for products perceived as healthier and safer. According to the South African Organic Sector Report, over 45% of consumers are willing to pay a premium for organic nutraceuticals, indicating a robust market for herbal and natural supplements that align with these values.

- Growth in Preventive Healthcare:Preventive healthcare is gaining traction in South Africa, with the government investing ZAR 1.5 billion in health promotion initiatives in future. This investment is aimed at reducing the burden of chronic diseases, leading to increased consumption of nutraceuticals. The market for preventive health products is expected to grow significantly, as consumers increasingly prioritize supplements that enhance immunity and overall well-being, reflecting a shift towards proactive health management.

Market Challenges

- Regulatory Compliance Issues:The South African nutraceuticals market faces significant regulatory hurdles, with compliance costs estimated at ZAR 600 million annually for manufacturers. The stringent guidelines set by the South African Health Products Regulatory Authority (SAHPRA) can delay product launches and increase operational costs. This regulatory landscape poses challenges for new entrants and smaller companies, limiting their ability to compete effectively in the market.

- High Competition Among Players:The South African nutraceuticals market is characterized by intense competition, with over 250 registered companies vying for market share. This saturation leads to price wars and reduced profit margins, making it difficult for smaller brands to establish themselves. According to industry reports, the top five companies control approximately 45% of the market, creating barriers for new entrants and intensifying the competitive landscape.

South Africa Nutraceuticals & Herbal Products Market Future Outlook

The future of the South African nutraceuticals and herbal products market appears promising, driven by increasing consumer awareness and a shift towards preventive healthcare. As the market evolves, companies are likely to invest more in research and development to innovate and meet consumer demands. Additionally, the integration of technology in product offerings, such as personalized nutrition solutions, will further enhance market growth. The focus on sustainability and ethical sourcing will also shape the industry landscape, appealing to environmentally conscious consumers.

Market Opportunities

- Growth in Online Sales Channels:The rise of e-commerce in South Africa presents a significant opportunity for nutraceuticals, with online sales projected to reach ZAR 12 billion in future. This growth is driven by increased internet penetration and consumer preference for convenient shopping options, allowing brands to reach a broader audience and enhance their market presence.

- Development of Personalized Nutrition Products:The trend towards personalized nutrition is gaining momentum, with the market for customized supplements expected to grow significantly. Companies that invest in tailored products based on individual health needs and preferences can tap into a lucrative segment, as consumers increasingly seek solutions that cater to their unique health profiles.