Region:Africa

Author(s):Dev

Product Code:KRAB5432

Pages:100

Published On:October 2025

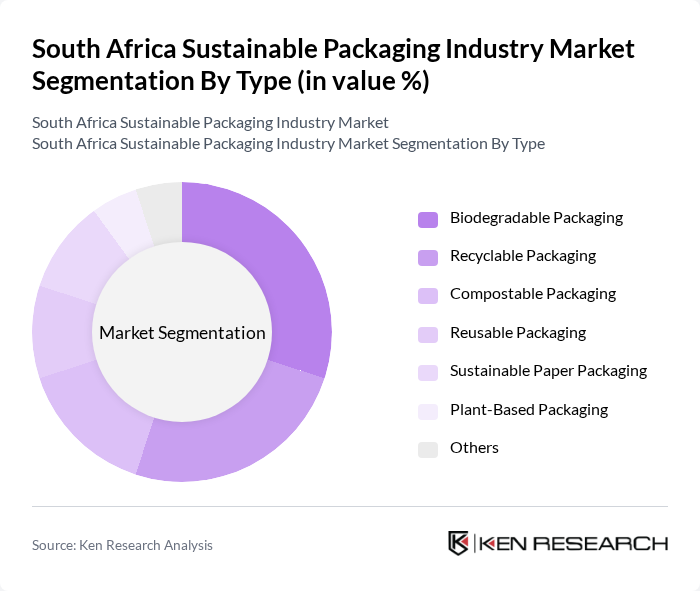

By Type:The sustainable packaging market can be segmented into various types, including biodegradable packaging, recyclable packaging, compostable packaging, reusable packaging, sustainable paper packaging, plant-based packaging, and others. Among these, biodegradable packaging is gaining significant traction due to its environmental benefits and consumer preference for eco-friendly products. Recyclable packaging also holds a substantial share as companies focus on reducing waste and promoting circular economy practices.

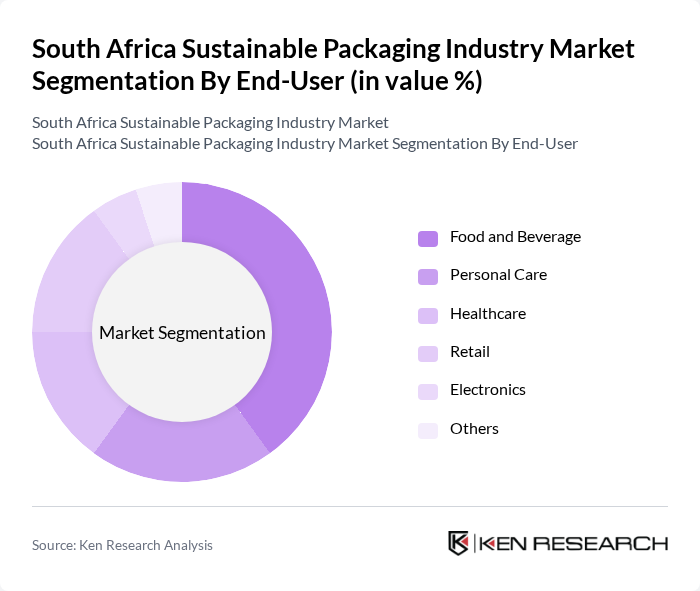

By End-User:The end-user segmentation includes food and beverage, personal care, healthcare, retail, electronics, and others. The food and beverage sector is the largest consumer of sustainable packaging, driven by increasing demand for eco-friendly packaging solutions among consumers and regulatory pressures to reduce plastic waste. The healthcare sector is also emerging as a significant user, focusing on sustainable packaging for medical supplies and pharmaceuticals.

The South Africa Sustainable Packaging Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mpact Limited, Nampak Limited, Astrapak Limited, Sappi Limited, Coca-Cola Beverages South Africa, Bidvest Group Limited, Tetra Pak South Africa, Amcor Flexibles South Africa, Smurfit Kappa Group, Polyoak Packaging, Plastics SA, Interpack, Constantia Flexibles, Huhtamaki South Africa, Denny Mushrooms contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African sustainable packaging industry appears promising, driven by increasing consumer awareness and government support for eco-friendly initiatives. As the market evolves, companies are expected to invest more in innovative materials and technologies that align with sustainability goals. The anticipated growth in e-commerce will further necessitate sustainable packaging solutions, as businesses seek to meet consumer expectations for environmentally responsible practices. Overall, the industry is poised for significant transformation, with sustainability at its core.

| Segment | Sub-Segments |

|---|---|

| By Type | Biodegradable Packaging Recyclable Packaging Compostable Packaging Reusable Packaging Sustainable Paper Packaging Plant-Based Packaging Others |

| By End-User | Food and Beverage Personal Care Healthcare Retail Electronics Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Supermarkets and Hypermarkets Specialty Stores Others |

| By Material | Paper Plastic Metal Glass Others |

| By Application | Food Packaging Beverage Packaging Industrial Packaging Consumer Goods Packaging Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Ownership | Private Label National Brands Regional Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 150 | Procurement Managers, Sustainability Coordinators |

| Consumer Goods Packaging | 100 | Product Development Managers, Marketing Directors |

| Retail Packaging Solutions | 80 | Supply Chain Managers, Retail Operations Heads |

| Recycling and Waste Management | 70 | Waste Management Directors, Environmental Compliance Officers |

| Innovative Packaging Startups | 60 | Founders, R&D Managers |

The South Africa Sustainable Packaging Industry Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by consumer awareness of environmental sustainability and government initiatives promoting eco-friendly packaging solutions.