Region:Middle East

Author(s):Dev

Product Code:KRAA8246

Pages:90

Published On:November 2025

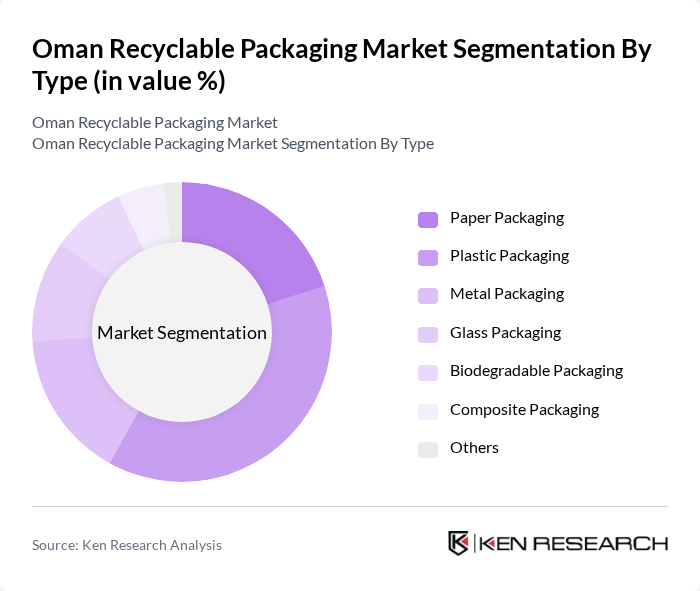

By Type:The recyclable packaging market is segmented into paper packaging, plastic packaging, metal packaging, glass packaging, biodegradable packaging, composite packaging, and others.Plastic packagingremains the leading sub-segment, driven by its versatility, lightweight properties, and cost-effectiveness. However, there is a marked shift towardbiodegradable and paper packagingas regulatory actions and consumer preferences increasingly favor eco-friendly materials. Innovation in material science and the introduction of extended producer responsibility schemes are accelerating the adoption of sustainable packaging solutions .

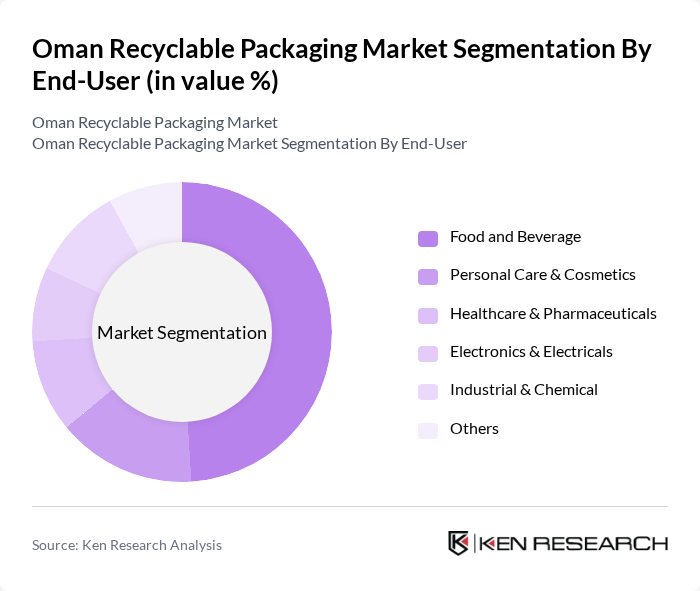

By End-User:The end-user segmentation includes food and beverage, personal care & cosmetics, healthcare & pharmaceuticals, electronics & electricals, industrial & chemical, and others. Thefood and beverage sectoris the largest consumer of recyclable packaging, propelled by consumer demand for safe, eco-friendly packaging and regulatory compliance in food safety. The personal care and healthcare sectors are also witnessing increased adoption of recyclable materials, reflecting broader sustainability commitments across industries .

The Oman Recyclable Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Environmental Services Holding Company (be’ah), Al Batinah Plastic Products SAOC, Oman Packaging Company SAOG, Gulf Plastic Industries Co. SAOC, National Aluminum Products Company SAOG, Modern Recycle Factory LLC, Al Jazeera Plastic Products Co. LLC, Muscat Packaging Company SAOG, Oman Recycling Company LLC, Al Harthy Group of Companies, Al Mufeedah Group, Al Fajr Plastic Industries LLC, Al Muna Plastic Industries LLC, Al Shanfari Group of Companies, and Oman Fibre Glass LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the recyclable packaging market in Oman appears promising, driven by increasing environmental awareness and supportive government policies. As consumer preferences shift towards sustainable products, companies are likely to invest in innovative packaging solutions. Additionally, the expansion of e-commerce is expected to further boost demand for recyclable packaging, creating new opportunities for growth. The market is poised for transformation as stakeholders collaborate to enhance recycling capabilities and develop eco-friendly alternatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Paper Packaging Plastic Packaging Metal Packaging Glass Packaging Biodegradable Packaging Composite Packaging Others |

| By End-User | Food and Beverage Personal Care & Cosmetics Healthcare & Pharmaceuticals Electronics & Electricals Industrial & Chemical Others |

| By Material | Recycled Paper & Paperboard Recycled Plastics (PET, HDPE, LDPE, etc.) Recycled Metal (Aluminum, Tinplate, etc.) Recycled Glass Biodegradable Materials Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Wholesale/Distributors Others |

| By Application | Food Packaging Beverage Packaging Industrial Packaging Consumer Goods Packaging E-commerce Packaging Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm Others |

| By Policy Support | Subsidies for Recycling Initiatives Tax Incentives for Eco-friendly Packaging Grants for Research and Development Extended Producer Responsibility (EPR) Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Sustainability Coordinators |

| Consumer Goods Sector | 80 | Product Managers, Supply Chain Analysts |

| E-commerce Packaging Solutions | 70 | Logistics Managers, E-commerce Operations Managers |

| Retail Sector Insights | 90 | Store Managers, Procurement Officers |

| Recycling Facilities Operations | 50 | Facility Managers, Environmental Compliance Officers |

The Oman Recyclable Packaging Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting sustainable packaging solutions.