Region:Asia

Author(s):Dev

Product Code:KRAB3121

Pages:89

Published On:October 2025

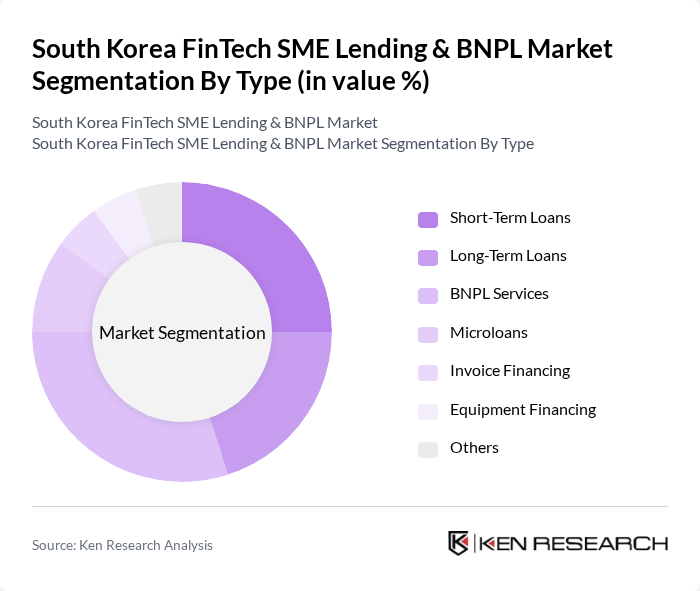

By Type:The market is segmented into various types of financial products, including Short-Term Loans, Long-Term Loans, BNPL Services, Microloans, Invoice Financing, Equipment Financing, and Others. Each of these segments caters to different financial needs of SMEs, with varying terms and conditions.

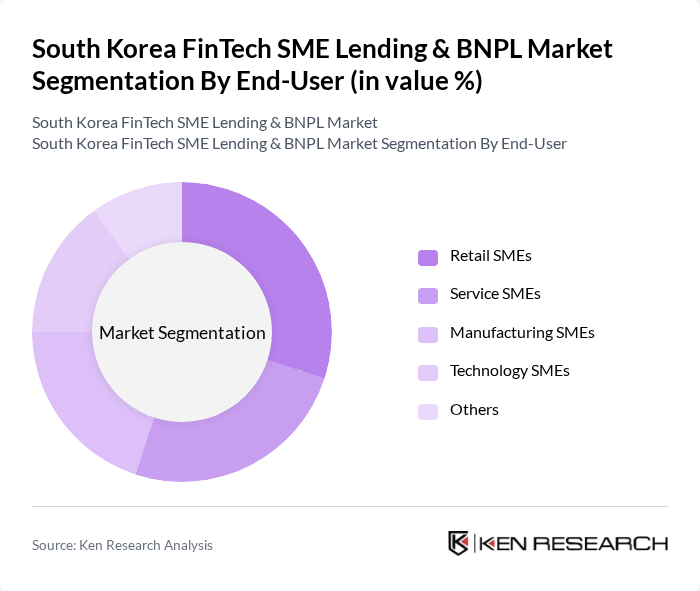

By End-User:The end-user segmentation includes Retail SMEs, Service SMEs, Manufacturing SMEs, Technology SMEs, and Others. Each segment represents different industries that utilize fintech solutions for their financial needs.

The South Korea FinTech SME Lending & BNPL Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kakao Bank, Toss Bank, Naver Financial, Kiva Korea, Lendit, Bank Salad, Viva Republica, Dabang, Kookmin Bank, Shinhan Bank, Woori Bank, Hana Bank, SC First Bank, NH Nonghyup Bank, Citibank Korea contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean FinTech SME lending and BNPL market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital solutions become more integrated into everyday business operations, SMEs are likely to increasingly rely on innovative lending platforms. Furthermore, the collaboration between FinTech firms and traditional banks is expected to enhance service offerings, providing SMEs with more tailored financial products that meet their unique needs in a rapidly changing economic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Loans Long-Term Loans BNPL Services Microloans Invoice Financing Equipment Financing Others |

| By End-User | Retail SMEs Service SMEs Manufacturing SMEs Technology SMEs Others |

| By Loan Size | Micro Loans (Up to $10,000) Small Loans ($10,001 - $50,000) Medium Loans ($50,001 - $200,000) Large Loans (Above $200,000) |

| By Application | Working Capital Equipment Purchase Expansion Financing Inventory Financing Others |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions Others |

| By Customer Segment | Startups Established SMEs Family-Owned Businesses Franchise Businesses Others |

| By Risk Profile | Low Risk Medium Risk High Risk Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Lending Practices | 150 | SME Owners, Financial Managers |

| BNPL Adoption Rates | 100 | Consumers, E-commerce Managers |

| FinTech Platform User Experience | 80 | End-users, Customer Service Representatives |

| Regulatory Impact on Lending | 60 | Compliance Officers, Legal Advisors |

| Market Trends in FinTech | 90 | Industry Analysts, Market Researchers |

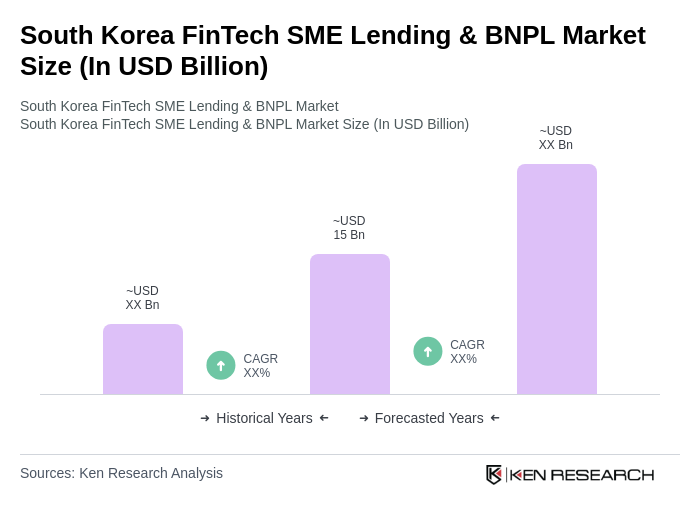

The South Korea FinTech SME Lending & BNPL Market is valued at approximately USD 15 billion, driven by the increasing adoption of digital financial services and the rising demand for flexible financing options among small and medium enterprises (SMEs).