Region:Asia

Author(s):Rebecca

Product Code:KRAA4837

Pages:83

Published On:September 2025

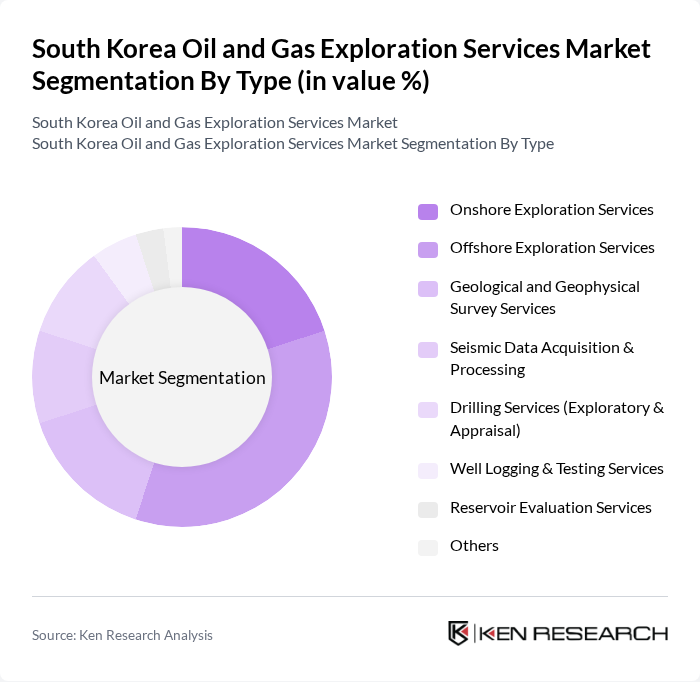

By Type:The segmentation of the market by type includes various services that cater to the exploration needs of oil and gas companies. The subsegments include Onshore Exploration Services, Offshore Exploration Services, Geological and Geophysical Survey Services, Seismic Data Acquisition & Processing, Drilling Services (Exploratory & Appraisal), Well Logging & Testing Services, Reservoir Evaluation Services, and Others. Each of these services plays a crucial role in the overall exploration process, contributing to the efficiency and effectiveness of resource extraction .

The Offshore Exploration Services subsegment is currently dominating the market due to the increasing focus on untapped offshore reserves and advancements in drilling technologies. Companies are investing heavily in offshore projects, driven by the need for energy security and the potential for higher yields compared to onshore operations. The trend towards deeper water exploration and the use of advanced seismic technologies are further propelling this subsegment's growth .

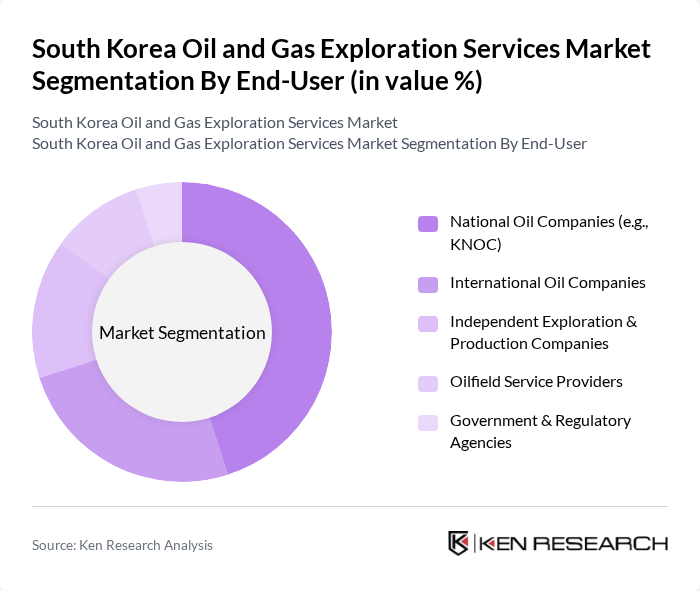

By End-User:The market segmentation by end-user includes National Oil Companies (e.g., KNOC), International Oil Companies, Independent Exploration & Production Companies, Oilfield Service Providers, and Government & Regulatory Agencies. Each of these end-users has distinct needs and requirements, influencing the types of exploration services they utilize. National Oil Companies, in particular, play a significant role in driving demand due to their large-scale operations and government backing .

National Oil Companies, particularly KNOC, dominate the market due to their extensive resources and government support. They are responsible for a significant portion of exploration activities, leveraging their financial strength to invest in advanced technologies and large-scale projects. This dominance is further reinforced by their strategic partnerships with international firms, enabling them to access global expertise and resources .

The South Korea Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Korea National Oil Corporation (KNOC), SK Innovation Co., Ltd., GS Energy Corporation, Daewoo Engineering & Construction Co., Ltd., Samsung Engineering Co., Ltd., Hyundai Engineering & Construction Co., Ltd., Hanwha Energy Corporation, LG International Corp., POSCO International Corporation, Hyundai Oilbank Co., Ltd., Korea Gas Corporation (KOGAS), Hanjin Heavy Industries & Construction Holdings Co., Ltd., SK E&C (SK ecoplant Co., Ltd.), DL E&C Co., Ltd., S-Oil Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The South Korea oil and gas exploration services market is poised for transformation, driven by a combination of technological advancements and government initiatives aimed at energy security. As the country seeks to balance its energy mix, the integration of renewable energy sources alongside traditional oil and gas exploration will become increasingly important. Additionally, the focus on sustainable practices and digital technologies will likely reshape operational strategies, enhancing efficiency and reducing environmental impact, thus attracting further investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Services Offshore Exploration Services Geological and Geophysical Survey Services Seismic Data Acquisition & Processing Drilling Services (Exploratory & Appraisal) Well Logging & Testing Services Reservoir Evaluation Services Others |

| By End-User | National Oil Companies (e.g., KNOC) International Oil Companies Independent Exploration & Production Companies Oilfield Service Providers Government & Regulatory Agencies |

| By Application | Hydrocarbon Exploration Appraisal & Development Production Optimization Decommissioning & Abandonment |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants & Subsidies |

| By Service Model | Contract-Based Services Turnkey Project Services Joint Ventures & Strategic Alliances |

| By Technology | Conventional Exploration Technologies Advanced Drilling & Completion Technologies Enhanced Oil Recovery (EOR) Techniques Digital Oilfield Solutions |

| By Policy Support | Exploration Subsidies Tax Incentives & Exemptions Regulatory Support Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Exploration Projects | 100 | Project Managers, Geoscientists |

| Onshore Drilling Operations | 90 | Operations Managers, Drilling Engineers |

| Environmental Impact Assessments | 50 | Environmental Consultants, Regulatory Affairs Specialists |

| Technology Providers for Exploration | 60 | Product Managers, R&D Directors |

| Investment and Financing in Exploration | 40 | Financial Analysts, Investment Managers |

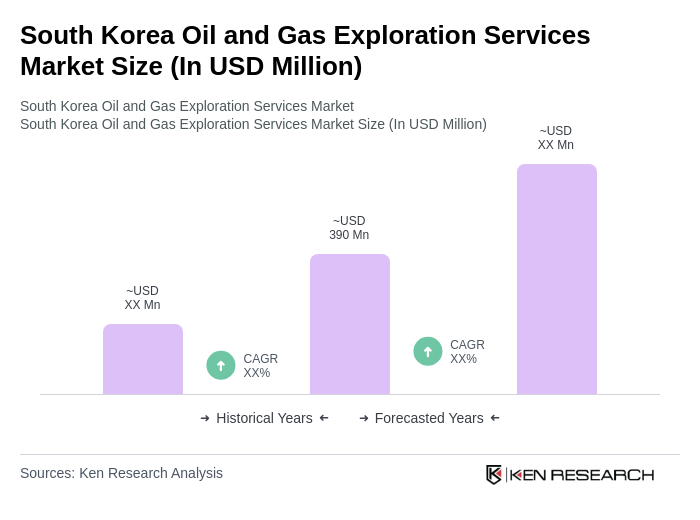

The South Korea Oil and Gas Exploration Services Market is valued at approximately USD 390 million, reflecting a steady growth driven by increasing energy demands, technological advancements, and government initiatives aimed at enhancing domestic production capabilities.