Region:Europe

Author(s):Geetanshi

Product Code:KRAB0086

Pages:88

Published On:August 2025

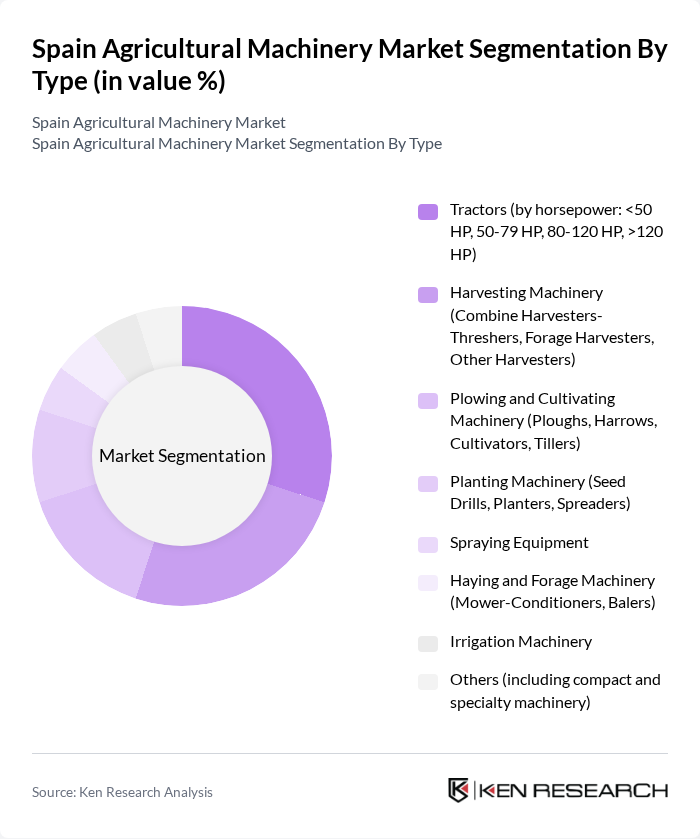

By Type:The agricultural machinery market is segmented into tractors, harvesting machinery, plowing and cultivating machinery, planting machinery, spraying equipment, haying and forage machinery, irrigation machinery, and others. Tractors remain the dominant segment, driven by their versatility and increasing adoption among small and medium-sized farms. Harvesting machinery, including combine and forage harvesters, is critical for efficient crop collection. Plowing and cultivating machinery, such as ploughs, harrows, and tillers, support soil preparation and crop management. Planting machinery (seed drills, planters, spreaders) and spraying equipment are increasingly integrated with precision agriculture technologies. Haying and forage machinery, irrigation machinery, and compact or specialty equipment address specific crop and farm needs, supporting both large-scale and niche agricultural operations .

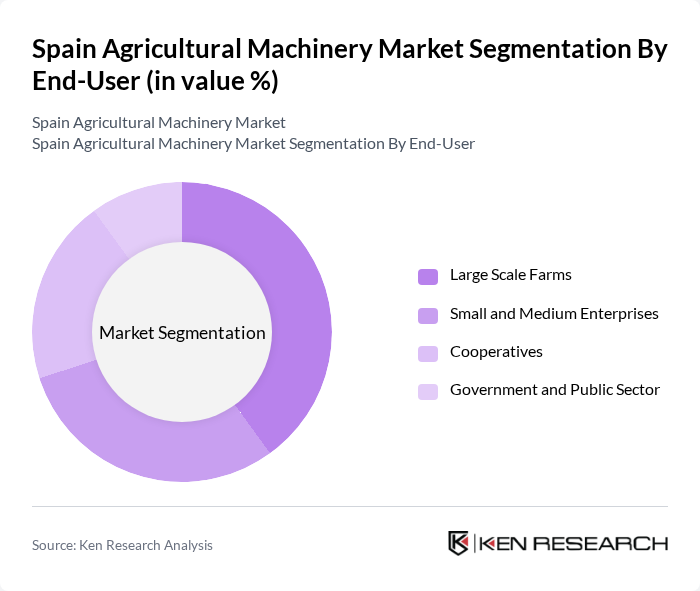

By End-User:The end-user segmentation includes large scale farms, small and medium enterprises, cooperatives, and government and public sector entities. Large scale farms are primary adopters of advanced machinery for maximizing yield and efficiency. Small and medium enterprises are increasingly investing in compact and multi-functional equipment to optimize costs and productivity. Cooperatives facilitate collective purchasing and shared use of machinery, while government and public sector entities focus on supporting mechanization through subsidies and demonstration projects .

The Spain Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial NV, Kubota Corporation, Claas KGaA mbH, SDF Group (Same Deutz-Fahr), Massey Ferguson, Fendt, Valtra, JCB, Kuhn Group, Landini, Iseki & Co., Ltd., Lamborghini Trattori, Trelleborg Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the agricultural machinery market in Spain appears promising, driven by technological advancements and a shift towards sustainable practices. As farmers increasingly adopt precision agriculture and smart farming technologies, the demand for innovative machinery is expected to rise. Additionally, the expansion of organic farming practices will create new opportunities for specialized equipment. With government support and a focus on sustainability, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors (by horsepower: <50 HP, 50-79 HP, 80-120 HP, >120 HP) Harvesting Machinery (Combine Harvesters-Threshers, Forage Harvesters, Other Harvesters) Plowing and Cultivating Machinery (Ploughs, Harrows, Cultivators, Tillers) Planting Machinery (Seed Drills, Planters, Spreaders) Spraying Equipment Haying and Forage Machinery (Mower-Conditioners, Balers) Irrigation Machinery Others (including compact and specialty machinery) |

| By End-User | Large Scale Farms Small and Medium Enterprises Cooperatives Government and Public Sector |

| By Application | Crop Production Livestock Farming Horticulture Forestry |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Outlets Wholesale Markets E-commerce Platforms |

| By Price Range | Low-End Machinery Mid-Range Machinery High-End Machinery |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Usage in Crop Production | 100 | Farm Owners, Agricultural Managers |

| Harvesting Equipment Adoption | 90 | Farm Operators, Equipment Dealers |

| Investment in Precision Agriculture Tools | 60 | Agricultural Technologists, Farm Consultants |

| Regional Variations in Machinery Preferences | 80 | Regional Agricultural Cooperatives, Local Farmers |

| Impact of Government Subsidies on Machinery Purchases | 50 | Policy Makers, Agricultural Economists |

The Spain Agricultural Machinery Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by advancements in automation, electric machinery, and sustainable farming practices.